Lafayette Parish School Board - Regular Board Meeting (Wednesday, October 14, 2020)

Meeting called to order at 5:30 PM

Members present

Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Members absent

Kate Labue

1. MEETING OPENINGS

Procedural: 1.1 Pledge of Allegiance to the Flag of the United States of America

Mary Morrison, Vice President, led the Board in the Pledge of Allegiance.

Procedural: 1.2 Moment of Silence

Procedural: 1.3 Opening Comments – Superintendent

Superintendent Trosclair gave the Board information and updates on the following:

SCHOOLS REOPEN AFTER HURRICANE DELTA: I am pleased to inform you that all but two of our schools were in session today after last week’s hurricane with one of those schools, Ernest Gallet, opening tomorrow. Duson Elementary is the only school closed at this time due to power outages. Thank you to our maintenance, district, and school level staff who worked tirelessly to deliver sandbags and prepare our campuses for the storm and return of students.

ACT TESTING: On October 6, 2020, LPSS Seniors and graduating juniors took the ACT test at no charge. The ACT is an important assessment to aid in education and career planning for life after high school. Thank you to Raising Cane’s and Love Our Schools for providing fuel to students at Northside High School as they took their ACT test.

PROGRESS REPORTS: Last week progress reports were sent home; marking the halfway point of the first 9-week grading period. We know this year has been an adjustment and we encourage all parents and students to reach out to your teachers and counselors if you have concerns, as there is still time to recover and improve grades before the end of the nine week grading period. Parents may also access their student’s grades online via the Parent Portal System.

NATIONAL PRINCIPAL’S MONTH: October is National Principals Month. I would like to take a moment to thank all of our school principals for their hard work, especially this year, as they have overcome many obstacles to ensure their campuses are safe and learning is ongoing. If you follow our LPSS Facebook page you will see our daily “Meet your Principal” posts and learn more about our amazing administrators.

ASBO CERTIFICATE AND GFOA AWARD: We are pleased to share the latest accomplishment of the Business Services Department. For the 27th year in a row, The Government Finance Officers Association of the United States and Canada (GFOA) has awarded the Certificate of Achievement for Excellence in Financial Reporting to Lafayette Parish School System for its comprehensive annual financial report (CAFR) for the fiscal year ended June 30, 2019. The CAFR has been judged by an impartial panel to meet the high standards of the program, which includes demonstrating a constructive "spirit of full disclosure" to clearly communicate its financial story and motivate potential users and user groups to read the CAFR. Thank you to the Business Services Department team for your ongoing commitment and dedication to excellence in financial reporting.

SCHOOL COUNSELOR OF THE YEAR AWARD: Milton Elementary School’s Amy Arceneaux has been named the Elementary School Counselor of the Year by the Louisiana School Counseling Association. The School Counselor of the Year Awards were created to recognize the state’s most outstanding school counselors for their top-notch, comprehensive school counseling programs that contribute to student success. Ms. Arceneaux was nominated for the award by the Lafayette Professional School Counseling Organization and was chosen from among nominees across the state for this award. Winners of the state School Counselor of the Year Awards are also submitted to the American School Counseling Association for consideration in the national School Counselor of the Year Awards. Congratulations Ms. Arceneaux on receiving this well-deserved award.

USDA WAIVER: Due to the ongoing COVID-19 pandemic, the U.S. Department of Agriculture (USDA) has issued a nationwide waiver that will allow public school systems across the country to continue to offer all students, regardless of income eligibility, daily breakfast and lunch meals at no charge effective immediately. This waiver will be valid through May 2021 or until available funds are depleted (whichever comes first). Under this extension, all LPSS students can receive daily breakfast and lunch meals at no cost, including both on-campus meals and Meals-to-Go. Snack meals for after-school care programs will also be provided at no charge.

Appearances: 1.4 BOARD: Recognition of Yvonne Moore-Service Retirement-Broussard

Elroy Broussard, Board Member-District 3, recognized Yvonne Moore, who recently retired from the Lafayette Parish School System after 54 years of service. Mrs. Moore worked as a Special Education Physical Education teacher at schools such as Acadian Middle, Evangeline Elementary School, and Carencro High School.

Appearances: 1.5 BOARD: Introduction of Amanda Martin-Candidate for District Judge, 15th JDC-Division D-Broussard

Appearances: 1.6 BOARD: Introduction of Judge Jules Edwards III-Candidate for City Court Judge-Broussard

Appearances: 1.7 BOARD: Introduction of Daniel "Danny" Landry-Candidate for 15th Judicial District Attorney-Mason

Appearances: 1.8 BOARD: Introduction of Glynn Shelly Maturin II-Candidate for 15th Judicial District Court Judge Division K-Mason

Appearances: 1.9 BOARD: Introduction of Kaye Karre Gautreaux - Candidate for District Judge, 15th JDC Division K-Mason

Appearances: 1.10 BOARD: Introduction of Michelle Odinet-Candidate for City Court Judge

Additional Appearance: BOARD: Introduction of Dona Renegar – Candidate for Family Court Judge.

Additional Appearance: BOARD: Introduction of Royal Colbert - Candidate for District Judge, 15th JDC-Division D

Action: 1.11 Add to the Agenda

That the Board add to the agenda an information item regarding the Lafayette High School Gas Leak. (*Motion Fails)

*Board Policy requires unanimous approval of members present in order to add an item that is not on the agenda.

Motion by Justin Centanni, second by Mary Morrison.

Final Resolution: Motion Fails

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

No: Tehmi Chassion

Absent: Kate Labue

2. INFORMATION ITEMS

Information: 2.1 BOARD: Presentation of UL Lacrosse Programs-Labue - PULLED FROM AGENDA

Information: 2.2 EMPLOYEE SERVICES: Personnel Changes - October 14, 2020 –

Gardner/J. Mouton

New Employees

|

Name of Employee |

Current Location |

Current Classification |

Effective Date |

Fund |

Reason |

Requisition Number |

| Abshire, Cody | L. J. Alleman MS | Teacher - SS | 8/31/2020 | 01 | Replacing Valerie Courville | |

| Alexander, Lakisha | Baranco ES | Custodian Part-Time | 9/1/2020 | 01 | Open Position | 4330 |

| Arabie, Jessica | Health Services | Registered Nurse | 9/14/2020 | 01 | Appeal | |

| Arceneaux, Donna | Transportation Dept | Bus Attendant | 7/30/2020 | 01 | Replacing Anna Dixon | |

| Barrios, Stephanie | Lafayette MS | Secretary I | 8/31/2020 | 01 | Replacing Paige Broussard | 2315 |

| Bartie, Michele | Alice Boucher ES | Teacher- 4th | 8/5/2020 | 01 | Replacing Gabrielle Smith | 2814 |

| Bearb, Tiffany | Ossun ES | Para - SPED | 9/21/2020 | 01 | Replacing Lindsey Thibodeaux | 3413 |

| Bellard, Tangela | Transportation Dept. | Bus Attendant | 7/30/2020 | 01 | Replacing Tralynn Kinchen | |

| Bengel, Laura | Cpl. Middlebrook ES | Teacher - 5th | 8/5/2020 | 01 | Replacing Taura Williamson | |

| Boudreaux, Brent | Acadiana HS | Athletic Trainer | 8/31/2020 | 01 | Replacing Kyle Lancon | |

| Burns, Lauren | Carencro MS | Teacher - ELA | 9/8/2020 | 01 | Replacing Valerie Bayone-Bandy | |

| Buron, Adrianne | Acadian MS | Teacher - Math | 9/3/2020 | 01 | Replacing Brandon Lejuene | 4115 |

| Coles, Corey | Comeaux HS | Teacher-Physical Science | 8/5/2020 | 01 | Replacing Jonathan Kennison | |

| Cormier, Kelly | Comeaux HS | Teacher - Art | 9/1/2020 | 01 | Replacing Sarah Ruiz | 4198 |

| Decker, Hannah | Carencro MS | Teacher-ELA | 9/14/2020 | 01 | Replacing Velma Leonard | |

|

Denofrio, Philip |

Lafayette HS | Teacher - Physical Science | 9/14/2020 | 01 | Replacing Lindsey Ramsey | |

| Derise, Lauren | Lafayette MS | Teacher - Math | 9/28/2020 | 01 | Replacing Jane Riviere | |

| Dodd, Ashley | Health Services | Registered Nurse | 9/14/2020 | 01 | Appeal | 4999 |

| Farr, Jennifer | Scott MS | Teacher - Science | 9/30/2020 | 01 | Replacing Jacob Rogers | |

| Foreman, Jared | L. J. Alleman MS | Teacher - SS | 9/8/2020 | 01 | Replacing Maureen Bonvillain | |

| Foti, Alexandra | Lafayette HS | Para - SPED | 9/28/2020 | 01 | Replacing Lisa Barr | 2485 |

| Gallet, Callie | Lafayette HS | Secretary II | 9/4/2020 | 01 | Replacing Tamara Reeves | 564 |

| Gauthier, Aimee | Youngsville MS | ISS Facilitator | 9/22/2020 | 01 | Replacing Anthony Boswell | 3980 |

| Granger, Cindy | Broussard MS | Clerical Assistant | 8/31/2020 | 01 | Replacing Anna Hunt | 3773 |

| Guidry, Haili | Edgar Martin Middle School | Para - SPED Child Specific | 9/10/2020 | 40 | Replacing Mary Viguere | 4603 |

| Guilbeau, Shane | L. J. Alleman MS | Teacher - Theatre | 9/29/2020 | 01 | Replacing Joan Green | |

| Hankenhof, Julia | Lafayette HS | Teacher - EMR | 9/14/2020 | 01 | Reallocation | |

| Johnson, Rosalynn | Federal Programs | Social Worker | 9/8/2020 | 65 | New Position | |

| King, Nicole | EA Martin | Classroom Interpreter | 9/15/2020 | 40 | Replacing Nancy Nicholson | 4563 |

| Laborde, Jerry | Lafayette HS | Custodian | 9/1/2020 | 01 | Replacing Jessica Kost | 4533 |

| Landry-Trahan, Elizabeth | Lafayette HS | Para - SPED | 9/4/2020 | 01 | Replacing Vanessa Magnon | 19 |

| Langley, Lacie | Mrytle Place ES | Teacher - Kindergarten French Immersion | 9/4/2020 | 01 | Replacing Aimee Hamilton | 2745 |

| Leblanc, Katelyn | Ossun ES | Teacher-5th Grade | 9/1/2020 | 01 | Replacing Adrianne Yost | |

| LeGrand, Alexandria | Ernest Gallet ES | Para - PE | 9/28/2020 | 01 | Replacing Shayne Hebert | 4284 |

| McFaul, Tiffanie | Health Services | Registered Nurse | 9/8/2020 | 01 | Appeal | 4999 |

| McGowen, Anna | Acadian MS | Teacher-Science | 9/30/2020 | 01 | Replacing Harold Williams | |

| Mouton, Jamie | Ossun ES | Clerical Assistant | 9/1/2020 | 01 | Replacing Jamie Mouton | 4062 |

| Mustafa, Manahil | Southside HS | Para - SPED | 9/15/2020 | 01 | New Position | 4677 |

| Patin, Keith | Maintenance | Mechanic II | 9/8/2020 | 01 | Replacing Timothy Reed | 3785 |

| Plat, Fabrice | Westside ES | Teacher - Pre-K French Immersion | 9/1/2020 | 01 | Replacing Jodi Galasso | 2649 |

| Prentiss, David | Lafayette HS | Teacher - Math | 9/21/2020 | 01 | Replacing Katelyn Belsom | |

| Prevost, Renee | Health Services | Registered Nurse | 9/21/2020 | 01 | Appeal | |

| Richard, Brandon | Northside HS | Teacher - ED | 9/29/2020 | 01 | Replacing Karla Nelson | |

| Rousse, Carley | Edgar Martin MS | Para - SPED | 9/21/2020 | 01 | Replacing Tina Menard | 2073 |

| Sam, Dorielle | Truman ECEC | Clerical Assistant | 9/28/2020 | 01 | Replacing Devon Espree | 3772 |

| Scimio, Maryam | Health Services | Nurse Practitioner | 9/9/2020 | 01 | New Position | |

| Shiloh, Jordan-Michael | Maintenance | Exterminator II | 9/18/2020 | 01 | Replacing Kenneth Cole | 117 |

| Smith, Alicia | Evangeline ES | Teacher - French Immersion 1st/4th | 9/11/2020 | 01 | Replacing Katrina Sekhani | |

| Smith, Drakarra | Evangeline ES | Para-PE | 9/28/2020 | 01 | Replacing Andree Cressy | 4315 |

| Stelly, Jennife | Paul Breaux MS | Teacher - Alt. Math | 9/4/2020 | 15 | Replacing Neil Armstead | 2824 |

| Stevens, Holly | Cpl. Middlebrook ES | Teacher-Kdgn | 9/9/2020 | 01 | Replacing Jodi Savoy | |

| Theriot, Krystal | David Thibodaux STEM | Teacher - ELA | 9/24/2020 | 01 | Replacing Aaron Esters | |

| Truesdell, Denise | Southside HS | Clerical Assistant | 9/23/2020 | 01 | Replacing Madonna Mata | 2149 |

| Vice, Kayla | GT Lindon/Billeaud ES | Para - PE | 9/8/2020 | 01 | Replacing Alicia Hayes | 4493;4277 |

| Wilkinson, Sean | LeRosen Prep | Teacher-ED | 9/29/2020 | 01 | Replacing Julie Malveaux |

Employee Transfers

|

Name of Employee |

Current Location |

Current Classification |

New Location |

New Classification |

Effective Date |

Fund |

Reason |

Requistion Number |

| Alleman, Jonathan | Comeaux HS | Teacher - Social Studies | LeRosen Prep | Data Analyst | 9/24/2020 | 01 | Replacing Tiara Wiles | |

| Batiste, Sonya | LeRosen Prep | SFS Technician | LeRosen Prep | SFS Manager II | 9/1/2020 | 70 | Replacing Jo Ann Laxey | |

| Belsom, Katelyn | Lafayette HS | Teacher - Math | Lafayette HS | Teacher - Gifted/Math | 9/1/2020 | 01 | Replacing Dustin Domangue | |

| Bess, John | Career Center | Teacher - Exiting Pathways | LeRosen Prep | Teacher - Resource | 8/5/2020 | 01 | Replacing Jarina Sullivan | |

| Bobb, Desmond | Carencro HS | Teacher - Resource | Carencro HS | Teacher - ED | 8/5/2020 | 01 | New Position | |

| Boutte, Shantell | J Wallace James ES | Para - SPED Pre-K | JW Faulk ES | Para - SPED Pre-K | 8/5/2020 | 40 | Position Location Change | 4999 |

| Boutte, Shantell | JW Faulk ES | Para - SPED Pre-K | Lafayette HS | Para - SPED | 9/21/2020 | 01 | Replacing Kristina Billot | 3692 |

| Brandie Parker | Evangeline Elementary | Para - PE | Acadian Middle | Para-ISS | 9/22/2020 | 01 | Replacing Jonathon Francis | |

| Breaux, Camille | Lafayette MS | Teacher - TIPPS | Lafayette MS | Teacher - Alternative | 8/5/2020 | 15 | Replacing Jenny Antilla | |

| Carroll, Theresa | Lerosen Prep | Para - Reg Ed | Billeaud ES | Para - SPED | 9/23/2020 | 01 | Replacing Delane Blanchard | 4225 |

| Chang-Fong,Jean | P. Breaux MS | Teacher - Science French Immersion | P. Breaux MS | Teacher - Math French Immersion | 8/5/2020 | 01 | Replacing Tony Lampure | 4216 |

| Cormier, Bennie | Duson ES | SFS Technician | Duson ES | SFS Manager I | 9/1/2020 | 70 | Replacing Vianna Miller | |

| Courville, Racque | Ossun ES | Teacher - 1st | Woodvale ES | Teacher - 1st | 8/5/2020 | 01 | Replacing Lauren Pontiff | |

| Dickerson, Nicole | E. A. Martin MS | Teacher - 5th | E. A . Martin MS | Teacher - Math | 8/5/2020 | 01 | Replacing Kiley Leonard | |

| Esters, Aaron | David Thibodaux STEM | Teacher - ELA | Acadiana HS | Gear-Up College and Career Coach | 9/24/2020 | 57 | Replacing Megan Breaux | |

| Fabacher, Tonya | Milton ES/MS | Teacher - Inclusion | Milton ES/MS | Teacher - Low Incidence | 8/5/2020 | 01 | New Position | 4628 |

| Fall, Serigne | Evangeline ES | Teacher - 1st French Immersion | Evangeline ES | Teacher - Kdgn. French Immersion | 8/5/2020 | 01 | Replacing Cecilia Dupuis | |

| Farmer, Enola | Woodvale ES | Teacher - 3rd | Woodvale ES | Teacher - Gifted | 8/5/2020 | 01 | Replacing Eva LeJeune | 946 |

| Gedward, Pauletta | Truman EC | Para - Pre-K | Acadiana HS | Para - SPED | 8/5/2020 | 01 | Replacing Anita Sams | 40 |

| Hamilton, Aimee | Myrtle Place ES | Teacher - Kindergarten French Immersion | Woodvale ES | Teacher - 3rd Grade Gifted | 8/5/2020 | 01 | Replacing Samantha Webre | 359 |

| Hamilton, Aimee | Myrtle Place ES | Teacher - Kdgn. French Immersion | Woodvale ES | Teacher - Gifted | 8/5/2020 | 01 | Replacing Samantha Webre | 359 |

| Hebert, Sarah | Ossun ES | Teacher - 5th Grade | Ossun ES | Teacher - 1st Grade | 8/10/2020 | 01 | Replacing Kayla Andrus | 667 |

| Jackson, April | Evangeline ES | Teacher - ELA Immersion | Evangeline ES | Teacher - 4th Grade | 8/5/2020 | 01 | Replacing Arlevia Bell | 3378 |

| Kidder, Bonnie | Woodvale ES | Teacher - Combo | Woodvale ES | Teacher - Resource | 8/5/2020 | 01 | New Position | |

| Leblanc, Jacqueline | Evangeline/Acadian MS | Para - PE | Evangeline ES | Para - PE | 8/5/2020 | 01 | New Position | 4670 |

| Leblanc, Sharelly | Acadiana HS | Custodian | J Wallace James ES | Custodian | 9/16/2020 | 01 | Replacing Monique Thomas | 2790 |

| Maron, Connie | J. W. Faulk ES | Teacher - SS/Science | Broadmoor ES | Teacher - 3rd | 8/5/2020 | 01 | New Position | |

| Metcalf, Reanna | Ridge ES | Teacher - 3rd | Ridge ES | Teacher - 5th | 8/5/2020 | 01 | Replacing Lela Clowers | |

| Moreau, Amanda | Youngsville MS | Para - SPED | Youngsville MS | Clerical Assistant | 8/5/2020 | 01 | Replacing Wendy Geary | 28 |

| Morgan, Nicole | Early Childhood | Resource Coordinator | Early Childhood | Resource Coordinator | 9/21/2020 | 01 | Replacing Kathaline Crowley | 2888 |

| Morgan-Dozier, Shelita | P. Breaux MS | SFS Technician | P. Breaux MS | SFS Manager II | 9/1/2020 | 70 | Replacing Amy Bob | |

| Mouton, Ashton | Acadian MS | Teacher - Combo | Woodvale ES | Teacher - Combo | 8/5/2020 | 01 | Replacing Ginger Boudreaux | |

| Newman, Brenda | Edgar Martin MS | Classroom Interpreter | Lafayette HS | Classroom Interpreter | 9/18/2020 | 40 | Position Location Change | 4999 |

| Palombo, Cynthia | Scott/Alleman MS | Para - PE | Middlebrook/Alleman MS | Para - PE | 8/5/2020 | 01 | New Position | 4409;4654 |

| Parker, Brandie | Lafayette MS | Para - SPED | Evangeline ES | Para - PE | 8/5/2020 | 01 | Replacing Andrea Cressy | 4315 |

| Pitre, Jolynn | Scott/Alleman MS | Teacher - PE | Middlebrook/Alleman MS | Teacher - PE | 8/5/2020 | 01 | New Position | 4626;252 |

| Pontiff, Lauren | Woodvale ES | Teacher - 1st | Woodvale ES | Reacher - 3rd | 8/5/2020 | 01 | Replacing Enola Farmer | 3108 |

| Prejean, LaRhonda | Acadian MS | Teacher - M/M | Acadian MS | Teacher - Low Incidence | 8/5/2020 | 01 | New Position | |

| Sam, Linda | Live Oak ES | Teacher - 1st | Live Oak ES | Teacher - 2nd | 8/5/2020 | 01 | New Position | |

| Sinegal, Sylvia | Scott MS | SFS Technician | Scott MS | SFS Manager II | 9/1/2020 | 70 | Replacing Debbie Cormier | |

| Smith, Shayla | J. W. Faulk ES | Teacher - Combo | L. Leo Judice ES | Teacher - Combo | 8/5/2020 | 01 | Replacing Jeanne Romero | |

| Sonnier, Dwyona | Ridge ES | SFS Technician | Ridge ES | SFS Manager II | 9/1/2020 | 70 | Replacing Debbie Broussard | |

| Stokley, Shawn | Curriculum | Middle School /Aids Teacher | L.J. Alleman MS | Teacher - 6th/Social Studies | 8/5/2020 | 01 | Replacing Angela Brasher | |

| Thibodeaux, Matthew | Comeaux HS | Teacher - ELA | Comeaux HS | Teacher - Low Incidence | 8/5/2020 | 01 | Replacing Britney Baylor | |

| Thomas, Monique | J Wallace James ES | Custodian | Evangeline ES | Custodian | 9/1/2020 | 01 | New Position | 4669 |

| Thomas, Shakondia | Youngsville MS | Teacher - Combo | Youngsville MS | Teacher - Resource | 8/5/2020 | 01 | New Position | |

| Touchet, Roxann | Alice Boucher ES | Teacher - 1st | Alice Boucher ES | Teacher - 5th | 9/15/2020 | 01 | Replacing Arianna James | 3732 |

| Watts, Hannah | Cpl. Middlebrook ES | Teacher - 4th | Cpl. Middlebrook ES | Teacher - Gifted | 8/5/2020 | 01 | Replacing Sally Hebert | |

| Wiles, Tiara | Lerosen Prep | Data Analyst | Comeaux HS | High School At Risk Intervention Teacher | 9/24/2020 | 01 | Replacing Kristine Dronet |

Exiting Employee

|

Name of Employee |

Current Location |

Current Classification |

Effective Date |

Fund |

Reason |

| Armstrong, Colette | Health Services | RN | 9/30/2020 | 01 | Resignation |

| Barrett, Jr., Stephen | Carencro HS | Para - SPED | 9/30/2020 | 01 | Resignation |

| Billiot, Kristina | Lafayette HS | Para - SPED | 9/15/2020 | 01 | Resignation |

| Blanchard, Delane | Billeaud ES | Para - SPED | 8/28/2020 | 01 | Resignation |

| Bonvillain, Hunter | Lafayette HS | Teacher - PE | 9/3/2020 | 01 | Resignation |

| Boswell, Anthony | Youngsville MS | ISS Facilitator | 9/2/2020 | 01 | Resignation |

| Briscoe, April | Live Oak ES | Para - PE | 9/22/2020 | 01 | Resignation |

| Carrier, Ana | S. J. Montgomery ES | Para - ESL | 9/30/2020 | 01 | Resignation |

| Celestine, Myrtle | Transportation Dept | Bus Driver - Board Owned | 9/11/2020 | 01 | Resignation |

| Cressy, Andree | Evangeline ES | Para - PE | 8/6/2020 | 01 | Resignation |

| Dixon, Melaka | Westside ES | Counselor | 9/29/2020 | 01 | Resignation |

| Domangue, Dustin | Lafayette HS | Teacher - Gifted/Math | 9/1/2020 | 01 | Resignation |

| Duffy, Darrell | Billeaud ES | Head Custodian | 9/30/2020 | 01 | Resignation |

| Dupuis, Jessica | Lafayette HS | Teacher - Gifted/ Math | 9/4/2020 | 01 | Resignation |

| Fontenot, Delana | Health Services | LPN | 9/4/2020 | 01 | Resignation |

| Godrey, Debra | Transportation Dept | Bus Attendant | 9/25/2020 | 01 | Resignation |

| Guy, Maggie | Carencro HS | SFS Technician | 9/17/2020 | 70 | Resignation |

| Harmon, Amy | Special Education Dept | Program Specialist | 9/25/2020 | 40 | Service Retirement |

| Harrison, Jay | Alice Boucher ES | Teacher - M/M | 9/2/2020 | 01 | Resignation |

| Johnson, Kandice | Youngsville MS | Teacher - Science | 5/29/2020 | 01 | Resignation |

| Jolivette, Katherine | L. Leo Judice ES | Para-Reg. Ed | 9/3/2020 | 01 | Service Retirement |

| Klein, Opal | G. T. Lindon ES | Teacher - APE | 9/30/2020 | 01 | Service Retirement |

| LeBlanc, Jennifer | Duson ES | Para - SPED | 9/22/2020 | 01 | Resignation |

| Leger, Rose | L. Leo Judice ES | SFS Technician | 9/30/2020 | 70 | Service Retirement |

| Marcantel, Stephanie | Alice Boucher ES | Teacher-4th/5th | 9/14/2020 | 01 | Resignation |

| Orand, Janet | Judice MS | Teacher - APE | 9/18/2020 | 01 | Service Retirement |

| Phillips, Melanie | J. W. Faulk ES | Para - SPED | 9/30/2020 | 01 | Resignation |

| Prejean, Dorthea | Baranco ES | Para - PE | 9/1/2020 | 01 | Resignation |

| Racette, Martin | Prairie ES | Teacher-3rd Grade French Immersion | 9/2/2020 | 01 | Resignatio |

| Richard, Dee | Charles Burke ES | SFS Technician | 9/17/2020 | 70 | Service Retirement |

| Robichaux, Adele | Health Services | RN | 9/30/2020 | 40 | Resignation |

| Rogers, Jacob | Scott MS | Teacher - Science | 9/18/2020 | 01 | Resignation |

| Sonnier, Julia | Charles Burke ES | SFS Technician | 5/29/2020 | 70 | Service Retirement |

| Spencer, Rita | Cpl. Middlebrook ES | Head Custodian | 9/22/2020 | 01 | Resignation |

| Stone, Peggy | E. A. Martin MS | Interpreter | 9/4/2020 | 40 | Service Retirement |

| Thibodeaux, Lindsay | Ossun ES | Para - SPED | 9/8/2020 | 01 | Resignation |

| Toups, Heath | Maintenance Dept | Grounds Maintenance | 9/25/2020 | 01 | Resignation |

| Trahan, Tammy | Carencro MS | SFS Technician | 9/21/2020 | 70 | Resignation |

| Troyanowski, Larry | Homebound | Homebound, Teacher | 9/15/2020 | 01 | Resignation |

| Weathersby, Byrda | Planning and Facilities Dept | Secretary II | 9/30/2020 | 45 | Service Retirement |

Other Action

|

Name of Employee |

Current Location |

Current Classification |

Effective Date |

Fund |

Reason |

| Hebert, Sarah | Ossun ES | Teacher - 5th | 8/5/2020 | 01 | Replacing Kayla Andrus |

| LaFleur, Samantha | Transformation Zone | Master Teacher | 9/1/2020 | 65 | Fund and Start Date correction |

| Laperouse, Elizabeth | G. T. Lindon ES | Speech Therapist | 8/31/2020 | 01 | Not 8/24/2020 |

| LeBlanc, Jordan | S. J. Montgomery ES | Teacher - 5th | 8/5/2020 | 15 | Not Fund 01 |

| Vance, Caitlin | Lafayette MS | Teacher - Alternative | 8/11/2020 | 15 | Not Fund 01 |

| Wallace, Trinity | Acadian MS | Teacher - Vocal | 8/5/2020 | 01 | Full-time not Part-time, |

| Zaunbrecher, Austin | Broadmoor ES | Teacher-Pre-K ESL | 8/5/2020 | 01 | Not Teacher-Pre-K |

|

Number of Full-Time, Active Employees by Funding Source as of: |

|

Last Month |

One Year Ago |

|

|

|

|

6/8/2020 |

May 2020 |

June 2019 |

|

General Fund (01) |

|

3,531.50 |

3,598.00 |

3,435.00 |

|

2002 Sales Tax (15) |

|

57.00 |

59.00 |

61.00 |

|

Special Revenues (20) |

|

9.25 |

8.75 |

9.25 |

|

Other Grants (25) |

|

0.00 |

0.00 |

0.00 |

|

Consolidated Adult Education (30) |

|

2.00 |

2.00 |

2.00 |

|

Consolidated Other Federal Programs (35) |

|

7.00 |

7.00 |

6.00 |

|

Special Education (40) |

|

98.50 |

98.00 |

83.50 |

|

Self-Funded Construction (45) |

|

2.50 |

2.50 |

2.50 |

|

IASA Title I (50) |

|

87.25 |

87.75 |

88.75 |

|

Consolidated Other State (55) |

|

4.00 |

4.00 |

4.50 |

|

GEARUP/Magnet Grant (57) |

|

7.00 |

7.00 |

8.00 |

|

Child Development & Head Start (60) |

|

68.00 |

69.00 |

68.00 |

|

IASA Titles II/III/IV/VI (65) |

|

16.00 |

15.50 |

15.00 |

|

Child Nutrition (70) |

|

218.00 |

221.00 |

219.00 |

|

Group Insurance Fund (85) |

|

4.00 |

4.00 |

4.50 |

|

Sales Tax Dept. (88) |

|

16.00 |

16.00 |

15.00 |

|

TOTAL |

|

4,128.00 |

4,199.50 |

4,022.00 |

|

|

Information: 2.3 FACILITIES: Information regarding playground fence replacement at G.T. Lindon Elementary-Bordelon/Guidry

Kyle Bordelon, Director of Planning and Facilities, gave the Board information on the playground fence replacement at G.T. Lindon Elementary.

Information: 2.4 FINANCE: List of Bids Approved to be Advertised by the Superintendent-Guidry/Bordelon/Francis

As per Administrative Guidelines for Board Meetings effective January 12, 2017, Mrs. Trosclair approved advertisement of the following bids during the time frame of August 7 - October 9, 2020: Two JROTC Buildings [Rebid; Bid# not issued yet].

Information: 2.5 FINANCE: List of Purchases Made Pursuant to Federal & State Emergency Declaration Provisions-Guidry/Francis

Notification of purchases was provided for the Board as information. This information included as list of recent procurements over $30,000.00 made utilizing federal & state emergency declaration procurement guidelines.

Information: 2.6 FINANCE: ASBO Certificate of Excellence and GFOA Award of Financial Reporting Achievement for the FY 2018-2019 Comprehensive Annual Financial Report-Guidry/Dugas

Billy Guidry, Associate Superintendent–Business Services, informed the Board of the Recognition of Lafayette Parish School System for receiving the Association of School Business Officials International (ASBO) Certificate of Excellence and Government Finance Officers Association (GFOA) Award of Financial Reporting Achievement for the FY 2018-2019 Comprehensive Annual Financial Report. As described by GFOA, the award "represents a significant achievement and reflects your commitment to the highest standards of school system financial reporting".

Action: 2.7 Reconsideration to Add to the Agenda

That the Board reconsider the vote to add to the agenda an information item regarding the Lafayette High School Gas Leak.

Motion by Tehmi Chassion, second by Justin Centanni.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action: 2.8 Add to the Agenda

That the Board add to the agenda an information item regarding the Lafayette High School Gas Leak.

Motion by Tehmi Chassion, second by Mary Morrison

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Information: 2.9 FACILITIES: Information regarding Lafayette High School Gas Leak

Kyle Bordelon, Director of Planning and Facility, gave Board an update on the Lafayette High School Gas Leak.

3. CONSENT AGENDA

Action (Consent): 3.1 ADMINISTRATION: Discussion and/or action concerning revisions to Policy CG, Administrative Records-Trosclair/Touchet/Gardner

Resolution: That the Board approves the proposed revisions to Policy CG, Administrative Records as attached in the public content section of this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action: 3.2 BOARD: Discussion and/or action concerning Resolution 10-20-1990 National Domestic Violence Awareness Month-Latiolais

That the Board approves Resolution 10-20-1990 National Domestic Violence Awareness Month as attached in the public content section of this agenda item.

RESOLUTION 10-20-1990

NATIONAL DOMESTIC VIOLENCE AWARENESS MONTH

WHEREAS, The Lafayette Parish School Board supports National Domestic Violence Awareness Month to bring attention to and advocate for victims of domestic violence;

WHEREAS, The Lafayette Parish School Board wants to take a stand and remind our local communities that between 3.3 million and 10 million children are exposed to domestic violence each year;

WHEREAS, The Lafayette Parish School Board and our communities shall not stop until society has zero-tolerance for domestic violence and until all victims and survivors can be heard;

THEREFORE, BE IT DULY RESOLVED that the Lafayette Parish School Board does hereby designate the month of October as:

“National Domestic Violence Awareness Month”

CERTIFICATE

I, the undersigned Secretary-Treasurer of the Lafayette Parish School Board, do hereby certify that the above and foregoing is a true copy of a resolution adopted at its Regular Board Meeting of October 14, 2020, at which time a quorum was present and that same is in full force and effect.

Dated at Lafayette, Louisiana

this 14th day of October, 2020

/s/ Irma D. Trosclair

___________________________________

Irma D. Trosclair - Secretary-Treasurer

LAFAYETTE PARISH SCHOOL BOARD

Motion by Mary Morrison, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.3 EMPLOYEE SERVICES: Discussion and/or action concerning the new Assistant Supervisor of Nursing Health Services job description and related budget revisions-Guidry/Gardner/J. Mouton

Resolution: That the Board approves the proposed new job description/position of Assistant Supervisor of Nursing Health Services, as shown in the attachment to this agenda item, as well as the following budget revisions to the General Fund: (1) $66,583.35 for Salary and Benefits for the new Assistant Supervisor of Nursing Health Services, and (2) decrease of $63,115.83 (Salary and Benefits) by the removal/elimination of one vacant Registered Nurse position.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.4 EMPLOYEE SERVICES: Discussion and/or action concerning the Audiologist job description-Gardner/J. Mouton

Resolution: That the board approves the revision to the Audiologist job description as shown in the attachment to this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.5 EMPLOYEE SERVICES: Discussion and/or action concerning the revised Technology Facilitator job description-Gardner/J. Mouton

Resolution: That the board approves the revised Technology Facilitator job description.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.6 EMPLOYEE SERVICES: Discussion and/or action concerning Physical Therapist/Occupational Therapist Job Description-Rabalais/Ortego/J. Mouton

Resolution: That the board approves the elimination of the existing combined Physical Therapist/Occupational Therapist job description and approves two new, separate job descriptions in its place, one for Physical Therapist and one for Occupational Therapist, as shown in the two attachments to this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.7 EMPLOYEE SERVICES: Discussion and/or action concerning the new LOA Curriculum Coordinator job description-Gardner/Rabalais/J. Mouton

Resolution: That the Board approves the proposed new job description/position of LOA Curriculum Coordinator as shown in the attachment to this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action: 3.8 EMPLOYEE SERVICES: Discussion and/or action concerning Policy File EGA, Staff Insurance Coverages-Angelle

That the Board approves a one-time waiver from the three month limitation for refunds due to a change in coverage and direct staff to issue the refund check for the month following the death of the dependent to current date.

Motion by Tommy Angelle, second by Justin Centanni.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.9 EMPLOYEE SERVICES: Discussion and/or action concerning the Curriculum Coordinator/Facilitator job description J. Gardner/J.Mouton

Resolution: That the Board approves the proposed revision to the Curriculum Coordinator/ Facilitator job description as shown in the attachment to this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action: 3.10 EMPLOYEE SERVICES: Discussion and/or action concerning EGWP/SilverScript Retiree Prescription Plan-Gardner/Mouton/LeBouef

That the Board rescind the EGWP/SilverScript retiree prescription plan.

Motion by Justin Centanni, second by Elroy Broussard.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Britt Latiolais, Mary Morrison,

Hannah Mason

No: Tehmi Chassion, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.11 EMPLOYEE SERVICES: Discussion and/or action concerning a Reorganization in the Office of the Superintendent-Gardner/Mouton

Resolution: That the Board approves the newly created Executive Assistant to the Superintendent and Board of Education job description as attached in the public content section of this agenda item and eliminates the Administrative Office Coordinator position in the Office of the Superintendent and adds the position of the Executive Assistant to the Superintendent and Board of Education and approves the related budget revision in the amount of $12,481.00 to the general fund from the contingency budget line item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.12 FACILITIES: Discussion and/or action concerning approval of quotes for Live Oak Elementary Boiler Replacement-Bordelon/Francis

Resolution: That the Board authorize staff to award the low quote to Air Plus for $56,000 for the Live Oak Elementary Boiler Replacement in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.13 FACILITIES: Discussion and/or action concerning a budget revision to the 2016 Bond Construction Fund for Middlebrook Wing Addition-Camera system-Bordelon/Guidry

Resolution: That the Board approves a budget revision increase in the amount of $34,000 to the Middlebrook Wing Addition project line item to fund a camera system with an offsetting decrease in the Contingency line item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.14 FACILITIES: Discussion and/or action concerning Quotes for Stadium Fence Replacement-Latiolais/Francis/Bordelon

Resolution: That the Board rejects the low quote from Dailey's Fence since they cannot commit to a start date for the work and accept the next lowest bid for $27,936.56 from Nextgen Sports in accordance with purchasing procedures and guidelines. Also, that the Board approves budget revisions to the Self-Funded Construction Fund for the transfer of the related funding from the Committed for Next School Year Projects budget line item to AHS-Stadium Fence Replacement Project.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.15 FACILITIES: Discussion and/or action concerning rejection of quotes for Carencro High Weight Room Addition-Bordelon/Francis

Resolution: That the Board reject all quotes received for the Carencro High Weight Room Addition since all quotes received exceed the available funds, in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.16 FACILITIES: Discussion and/or action concerning Ratification of Approval to Repair Live Oak Elementary Intercom System-Bordelon/Francis

Resolution: That the Board ratifies the Board President's and Superintendent's approval of an emergency procurement pursuant to DJED for repairs to the Live Oak Elementary Intercom System for $44,396.90 by Sound & Communication Systems, Inc. and a corresponding budget revision in the Self-Funded Construction Fund (Fund 45) in the amount of $44,396.90 to reflect a transfer from the Administrative Contingency budget line item into the Live Oak Elementary Intercom System Repairs project.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action: 3.17 FACILITIES: Discussion and/or action concerning USDA Funding Available for Capital Projects at Southside High School to address anticipated safety and student enrollment increases-Aguillard

That the Board authorize use of USDA funds in the amount of $563,144 earmarked for Southside High School to complete various capital projects recommended to address safety and increased student enrollment as follows: Concrete outdoor covered area along with outdoor furniture to accommodate increased student population at lunch: $183,000; Additional Chromebooks (400) to address increased student enrollment: $172,388; Additional laptops (20) for increase number of teachers: $19,780; Additional TI graphing calculators (20 sets of 10) to address increased student enrollment: $65,640; Electrical panel box to replace temporary service powering irrigation system and include athletic fields: $74,000; Contingency: $48,336.

Motion by Donald Aguillard, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

No: Elroy Broussard, Justin Centanni, Tehmi Chassion

Absent: Kate Labue

Substitute Motion: That the Board authorize use of USDA funds earmarked for Southside High School to complete various capital projects recommended to address safety and increased student enrollment with the exception of Concrete outdoor covered area along with outdoor furniture to accommodate increased student population at lunch: $183,000

Motion by Justin Centanni, second by Elroy Broussard.

Final Resolution: Motion Fails

Yes: Elroy Broussard, Justin Centanni, Britt Latiolais

No: Tommy Angelle, Mary Morrison, Hannah Mason, Donald Aguillard

Abstain: Tehmi Chassion

Absent: Kate Labue

Action (Consent): 3.18 FACILITIES: Discussion and/or action concerning Ratification of Approval of quotes for Burke Elementary Roofing Replacement-Bordelon/Francis

Resolution: That the Board ratifies the approval of an emergency procurement pursuant to Policy DJED by the Superintendent and the Board President and the award of the lowest quote to Grizzly Roofing, LLC for $190,720 for the Burke Elementary Roofing Replacement caused by Hurricane Delta and a budget revision to the Self-Funded Construction Fund to reflect a transfer from the "Committed for Next Year Projects" budget line item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.19 FINANCE: Discussion and/or action concerning Bid Award - Bathroom Paper Bid# 25-21-Guidry/Francis

Resolution: That the Board awards Bid# 25-21 to the apparent low bidder Cajun Chemical for Roll Hand Towels and Dispensers for LPSS restroom facilities.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.20 FINANCE: Discussion and/or action concerning the 2020-2021 First Quarter Budget Revisions for Applicable Funds-Guidry/Richard

Resolution: That the Board approves the First Quarter Budget Revisions for fiscal year 2020-2021 for all applicable funds recommended by Administration as attached in the public content section of this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.21 FINANCE: Discussion and /or action concerning the Sales Tax Collection Reports for August 2020 and September 2020-Guidry/Ashy

Resolution: That the Board approves the Sales Tax Collection reports for the months of August 2020 and September 2020 as attached in the public content section of this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.22 FINANCE: Discussion and/or action concerning the Grant Fund Summary for September 2020-Guidry/Richard

Resolution: That the Board approves the Summary of Grant Funding and Activity for September 2020 as attached in the public content section of this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

Action (Consent): 3.23 FINANCE: Discussion and/or action concerning Budget to Actual Reports for September 2020-Guidry/Richard

Resolution: That the Board approves the Budget-to-Actual reports for September 2020 as attached in the public content section of this agenda item.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

Absent: Kate Labue

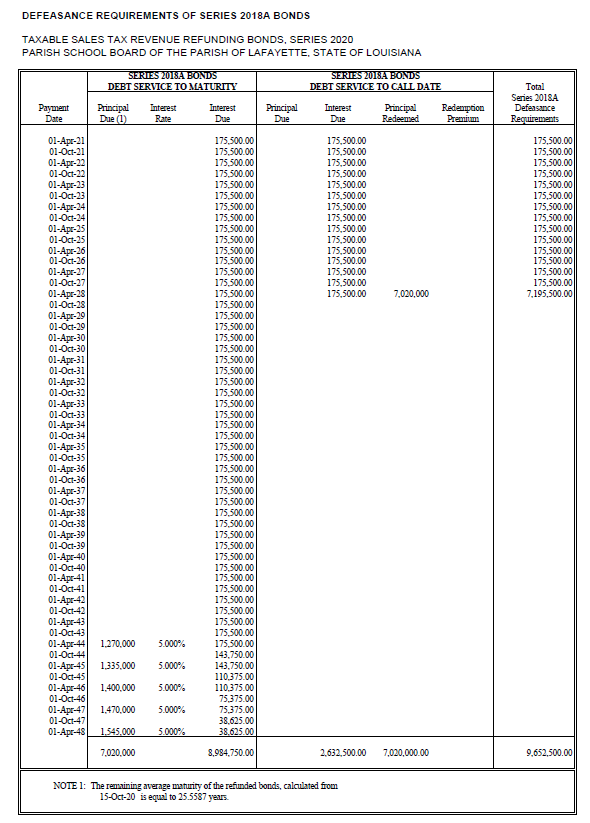

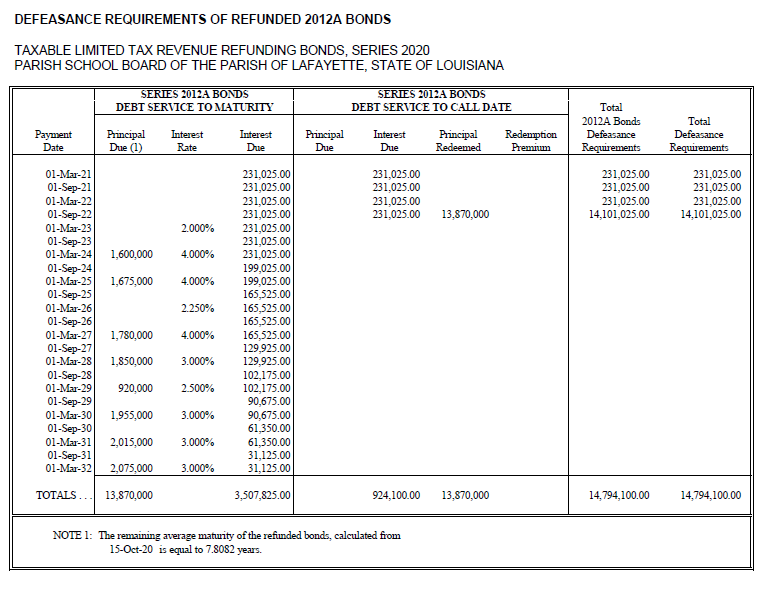

Action (Consent): 3.24 FINANCE: Discussion and/or action concerning Resolution 10-20-1988: Ratification of Taxable Sales Tax Revenue Refunding Bonds, Series 2020-Guidry/Dugas

Resolution: That the Board approves Resolution 10-20-1988 ratifying the Taxable Sales Tax Revenue Refunding Bonds, Series 2020 that occurred on Thursday, September 24, 2020.

The following resolution was offered by Centanni and seconded by Angelle:

RESOLUTION 10-20-1988

A resolution recognizing the final form and execution of the Bond Purchase Agreement in connection with the issuance and sale of $31,925,000 of Taxable Sales Tax Revenue Refunding Bonds, Series 2020,of the Parish School Board of the Parish of Lafayette, State of Louisiana, and providing for other matters in connection therewith.

WHEREAS, the Parish School Board of the Parish of Lafayette, State of Louisiana (the "Issuer"), adopted a resolution on April 15, 2020 (the "Bond Resolution"), authorizing the issuance of not exceeding Sixty-Five Million Dollars ($65,000,000) of Taxable Sales Tax Revenue Refunding Bonds, Series 2020 of the Issuer; and

WHEREAS, pursuant to the terms of the Bond Resolution, the Secretary of the Issuerhas agreed to the sale of $31,925,000 of Taxable Sales Tax Revenue Refunding Bonds, Series 2020 of the Issuer (the "Bonds") and has executed the Bond Purchase Agreement as authorized by the Bond Resolution; and

WHEREAS, a copy of the executed Bond Purchase Agreement is attached hereto as Exhibit A; and

WHEREAS, the Issuer hereby finds and determines that the terms of the Bonds are within the parameters permitted by the Bond Resolution;

NOW, THEREFORE, BE IT RESOLVED by the Parish School Board of the Parish of Lafayette, State of Louisiana, acting as the governing authority of the Parish of Lafayette, State of Louisiana, for school purposes, that:

SECTION 1. Confirmation of Bond Purchase Agreement. The sale of the Bonds has met the parameters set forth in the Bond Resolution, and accordingly the issuance and delivery of the Bonds are hereby approved, the terms of the Bonds contained in the Bond Purchase Agreement are incorporated herein, and the Bond Purchase Agreement is hereby recognized and accepted as executed and attached as Exhibit A hereto.

Capitalized terms used but not defined herein shall have the meaning given such terms in the Bond Resolution.

SECTION 2. Official Statement. The Issuer hereby approves the form and content of the Preliminary Official Statement dated as of September 9, 2020, pertaining to the Bonds, which has been submitted to the Issuer, and hereby ratifies its prior use by the Purchaser in connection with the sale of the Bonds. The Issuer further approves the form and content of the final Official Statement pertaining to the Bonds, which has been submitted to the Issuer, and hereby ratifies its execution by the Executive Officers and the delivery of such final Official Statement to the Purchaser for use in connection with the public offering of the Bonds.

SECTION 3. Repealing Clause. All resolutions and/or ordinances, or parts thereof, in conflict herewith are hereby repealed to the extent of such conflict.

SECTION 4. Execution of Documents. The Executive Officers are hereby empowered, authorized and directed to take any and all action and to execute and deliver any instrument, document or certificate necessary to effectuate the purposes of this resolution.

SECTION 5. Effective Date. This resolution shall become effective immediately upon its adoption.

This resolution having been submitted to a vote, the vote thereon was as follows:

YEAS: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion,

Britt Latiolais, Mary Morrison, Hannah Mason, Donald Aguillard

NAYS: None

ABSENT: Kate Labue

And the resolution was declared adopted on this 14th day of October, 2020.

/s/ Irma D. Trosclair /s/ Britt Latiolais

Secretary President

EXHIBIT A

BOND PURCHASE AGREEMENT

$31,925,000

TAXABLE SALES TAX REVENUE REFUNDING BONDS, SERIES 2020

OF THE

PARISH SCHOOL BOARD OF THE

PARISH OF LAFAYETTE, STATE OF LOUISIANA

September 17, 2020

Hon. Parish School Board

Parish of Lafayette

113 Chaplin Drive

Lafayette, La 70502

The undersigned, Raymond James & Associates, Inc., of New Orleans, Louisiana (the "Underwriter"), offers to enter into this agreement with Parish School Board of the Parish of Lafayette, State of Louisiana (the "Issuer"), which, upon your acceptance of this offer, will be binding upon you and upon us.

This offer is made subject to your acceptance of this agreement on or before 11:59 p.m., New Orleans Time, on this date, which acceptance shall be evidenced by your execution of this Bond Purchase Agreement on behalf of the Issuer as a duly authorized official thereof.

Capitalized terms used, but not defined, herein shall have the meanings ascribed to them in the Bond Resolution (as defined below).

1. The Bonds. Upon the terms and conditions and the basis of the respective representations and covenants set forth herein, the Underwriter hereby agrees to purchase from the Issuer, and the Issuer hereby agrees to sell and deliver to the Underwriter, all (but not less than all) of the above‑captioned bonds of the Issuer (the "Bonds"). The purchase price of the Bonds is set forth in Schedule I hereto (the "Purchase Price"). Such Purchase Price shall be paid at the Closing (hereinafter defined) in accordance with Section 7 hereof. The Bonds are to be issued by the Issuer, under and pursuant to, and are to be secured, on a complete parity with the Outstanding Parity Bonds, and payable as set forth in a resolution adopted by the Governing Authority on April 15, 2020 (the "Bond Resolution"). The Bonds are issued pursuant to Part II of Chapter 4 of Subtitle II of Title 39 of the Louisiana Revised Statutes of 1950, as amended, and other constitutional and statutory authority (the "Act"). The Bonds shall mature on the dates and shall bear interest at the fixed rates, all as described in Schedule II attached hereto. Furthermore, the Bonds and the Outstanding Parity Bonds are entitled to the benefit of a common debt service reserve fund in accordance with the terms of the Bond Resolution, which common reserve fund is being initially funded with cash.

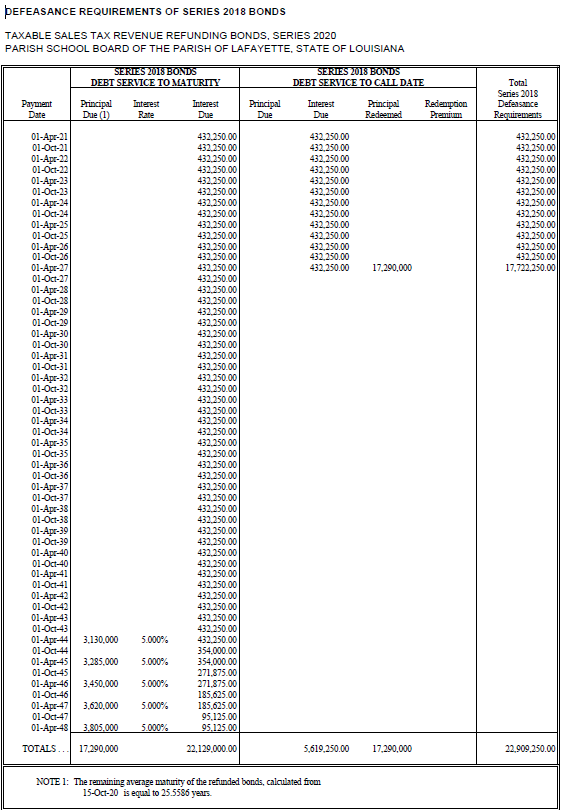

A portion of the proceeds of the Bonds will be deposited with Argent Trust Company (the "Escrow Agent"), and invested pursuant to the Defeasance and Escrow Deposit Agreement dated as of October 1, 2020, between the Issuer and the Escrow Agent (the "Escrow Agreement") and applied to the payment of principal and interest on the Issuer’s outstanding Sales Tax Revenue Bonds, Series 2018, (the "Series 2018 Refunded Bonds") and the Issuer's outstanding Sales Tax Revenue Bonds, Series 2018A, (the "Series 2018A Refunded Bonds" and together with the Series 2018 Refunded Bonds, the "Refunded Bonds") set forth in Schedule III attached hereto.

Representations of Underwriter. The Underwriter confirms that it has offered the Bonds to the public on or before the date of this Bond Purchase Agreement. The Underwriter agrees to execute and deliver to the Issuer at Closing a certificate substantially in the form attached hereto as Exhibit A.

2. Representative. The individual signing on behalf of the Underwriter below is duly authorized to execute this Bond Purchase Agreement on behalf of the Underwriter.

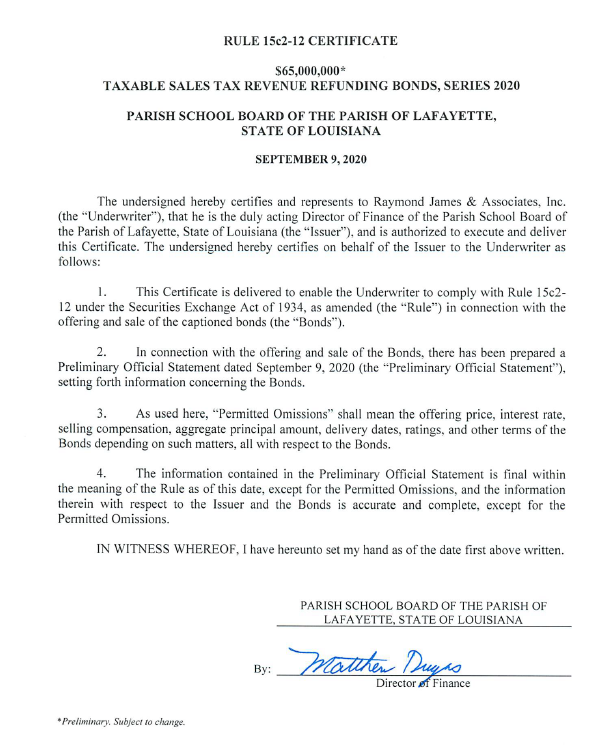

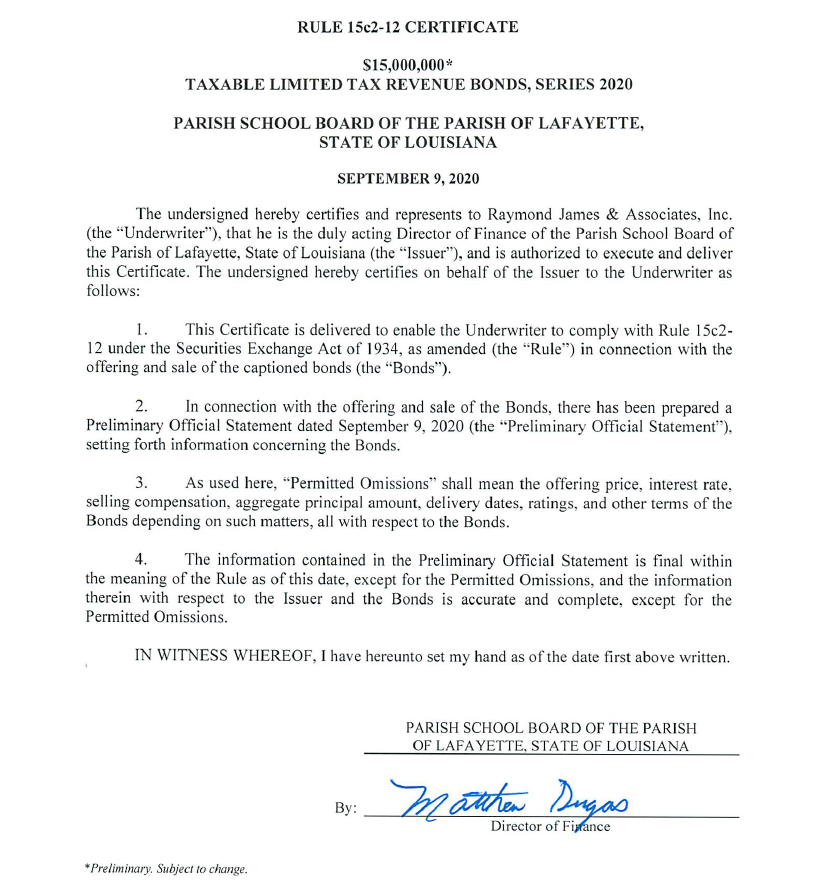

Preliminary Official Statement and Official Statement. The Issuer hereby ratifies and approves the lawful use of the Preliminary Official Statement, dated September 9, 2020, relating to the Bonds (the "Preliminary Official Statement") by the Underwriter prior to the date hereof and authorizes and approves the Official Statement and other pertinent documents referred to in Section 8 hereof to be lawfully used in connection with the offering and sale of the Bonds. The Issuer has previously provided the Underwriter with a copy of the Preliminary Official Statement. As of its date, the Preliminary Official Statement has been deemed final by the Issuer for purposes of SEC Rule 15c2-12 (the "Rule") under the Securities Exchange Act of 1934, as amended.

The Issuer has delivered a certificate to the Underwriter, dated September 9, 2020, to evidence compliance with the Rule to the date hereof, a copy of which is attached hereto as Exhibit B.

The Issuer, within seven (7) business days of the date hereof, shall deliver to the Underwriter sufficient copies of the Official Statement dated the date hereof relating to the Bonds, executed on behalf of the Issuer by the duly authorized officer(s) of the Governing Authority (the "Official Statement"), as the Underwriter may reasonably request as necessary to comply with paragraph (b)(4) of the Rule, with Rule G-32 and with all other applicable rules of the Municipal Securities Rulemaking Board (the "MSRB").

The Issuer hereby covenants that, if during the period ending on the 25th day after the "End of the Underwriting Period" (as defined in the Rule), or such other period as may be agreed to by the Issuer and the Underwriter, any event occurs of which the Issuer has actual knowledge and which would cause the Official Statement to contain an untrue statement of material fact or to omit to state a material fact necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading, the Issuer shall notify the Underwriter in writing, and if, in the reasonable opinion of the Underwriter, such event requires an amendment or supplement to the Official Statement, the Issuer promptly will amend or supplement, or cause to be amended or supplemented, the Official Statement in a form and in a manner approved by the Underwriter and consented to by the Issuer so that the Official Statement, under such caption, will not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in light of the circumstances existing at the time the Official Statement is delivered to a purchaser, not misleading. If such notification shall be given subsequent to the date of Closing, the Issuer also shall furnish, or cause to be furnished, such additional legal opinions, certificates, instruments and other documents as the Underwriter may reasonably deem necessary to evidence the truth and accuracy of any such supplement or amendment to the Official Statement.

Additional Requirements of the Issuer and Underwriter. The Underwriter agrees to promptly file a copy of the final Official Statement, including any supplements prepared by the Issuer as required herein, with the MSRB through the operation of the Electronic Municipal Market Access repository within one (1) business day after receipt from the Issuer, but by no later than the date of Closing, in such manner and accompanied by such forms as are required by the MSRB, in accordance with the applicable MSRB Rules, and shall maintain such books and records as required by MSRB Rules with respect to filing of the Official Statement. If an amended Official Statement is prepared in accordance with Section 4 during the "new issue disclosure period" (as defined in the Rule), and if required by applicable SEC or MSRB Rule, the Underwriter also shall make the required filings of the amended Official Statement.

The Issuer covenants and agrees to enter into a Continuing Disclosure Certificate to be dated the date of Closing (the "Continuing Disclosure Certificate") constituting an undertaking (an "Undertaking") to provide ongoing disclosure about the Issuer for the benefit of Bondholders as required by the Rule, in the form as set forth in the Preliminary Official Statement, with such changes as may be agreed to by the Underwriter.

Representations of the Issuer. The Issuer hereby represents to the Underwriter as follows:

The Issuer has duly authorized, or prior to the delivery of the Bonds the Issuer will duly authorize, all necessary action to be taken by it for (i) the sale of the Bonds upon the terms set forth herein and in the Official Statement; (ii) the approval and signing of the Official Statement by a duly authorized officer of the Issuer; and (iii) the execution, delivery and receipt of this Bond Purchase Agreement, the Escrow Agreement, and any and all such other agreements and documents as may be required to be executed, delivered and received by the Issuer in order to carry out, give effect to, and consummate the transactions contemplated hereby, by the Bonds, the Official Statement, and the Bond Resolution;

a. The information contained in the Preliminary Official Statement does not contain any untrue statement of material fact and does not omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they were made, not misleading; and the information to be contained in the Official Statement, as of its date and the date of Closing, will not contain any untrue statement of material fact and will not omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they are made, not misleading;

b. To the knowledge of the Issuer there is no action, suit, proceeding, inquiry or investigation at law or in equity or before or by any court, public board or body pending against or affecting the Issuer or the Governing Authority or threatened against or affecting the Issuer or the Governing Authority (or, to the knowledge of the Issuer, any basis therefor) contesting the due organization and valid existence of the Issuer or the Governing Authority or the validity of the Act or wherein an unfavorable decision, ruling or finding would adversely affect the transactions contemplated hereby or by the Official Statement or the validity or due adoption of the Bond Resolution or the validity, due authorization and execution of the Bonds, this Bond Purchase Agreement, the Escrow Agreement, or any agreement or instrument to which the Issuer is a party and which is used or contemplated for use in the consummation of the transaction contemplated hereby or by the Official Statement, except as disclosed in the Official Statement;

c. The authorization, execution and delivery by the Issuer of the Official Statement, this Bond Purchase Agreement, the Escrow Agreement, and the other documents contemplated hereby and by the Official Statement, and compliance by the Issuer with the provisions of such instruments, do not and will not conflict with or constitute on the part of the Issuer a breach of or a default under any (i) statute, indenture, ordinance, resolution, mortgage or other agreement by which the Issuer is bound; (ii) provisions of the Louisiana Constitution of 1974, as amended; or (iii) existing law, court or administrative regulation, decree or order by which the Issuer or its properties are or, on the date of Closing, will be bound;

d. All consents of and notices to or filings with governmental authorities necessary for the consummation by the Issuer of the transactions described in the Official Statement, the Bond Resolution, the Escrow Agreement, and this Bond Purchase Agreement (other than such consents, notices and filings, if any, as may be required under the securities or blue sky laws of any federal or state jurisdiction) required to be obtained or made have been obtained or made or will be obtained or made prior to delivery of the Bonds;

The Issuer agrees to cooperate with the Underwriter and its counsel in any endeavor to qualify the Bonds for offering and sale under the securities or blue sky laws of such jurisdictions of the United States as the Underwriter may reasonably request; provided, however, that the Issuer shall not be required to register as a dealer or a broker in any such state or jurisdiction, qualify as a foreign corporation or file any general or specific consents to service of process under the laws of any state, or submit to the general jurisdiction of any state. The Issuer consents to the lawful use of the Preliminary Official Statement and the Official Statement by the Underwriter in obtaining such qualifications. No member of the Governing Authority, or any officer, employee or agent of the Issuer shall be individually liable for the breach of any representation or covenant made by the Issuer; and

The Issuer acknowledges and agrees that (i) the purchase and sale of the Bonds pursuant to this Bond Purchase Agreement is an arm's-length commercial transaction between the Issuer and the Underwriter; (ii) in connection with such transaction, including the process leading thereto, the Underwriter’s primary role, as an underwriter, is to purchase the Bonds for resale to investors, and the Underwriter is acting solely as a principal and not as an agent, municipal advisor, financial advisor or as a fiduciary of or to the Issuer; (iii) the Underwriter has neither assumed an advisory or fiduciary responsibility in favor of the Issuer with respect to the offering of the Bonds or the process leading thereto (whether or not the Underwriter, or any affiliate of the Underwriter, has advised or is currently advising the Issuer on other matters) nor has it assumed any other obligation to the Issuer except the obligations expressly set forth in this Bond Purchase Agreement; (iv) the Underwriter has financial and other interests that differ from those of the Issuer; and (v) the Issuer has consulted with its own legal, accounting, tax, financial and other advisors, as applicable, to the extent it has deemed appropriate in connection with the offering of the Bonds.

3. Delivery of, and Payment for, the Bonds. At 10:00 a.m., New Orleans Time, on or about October 15, 2020, or at such other time or date as shall have been mutually agreed upon by the Issuer and the Underwriter, the Issuer will deliver, or cause to be delivered, to the Underwriter, the Bonds, in definitive form as fully registered bonds bearing CUSIP numbers (provided neither the printing of a wrong CUSIP number on any Bond nor the failure to print a CUSIP number thereon shall constitute cause to refuse delivery of any Bond) registered in the name of Cede & Co., as nominee for The Depository Trust Company ("DTC"), duly executed and registered by Argent Trust Company, Ruston, Louisiana (the "Paying Agent"), together with the other documents hereinafter mentioned and the other moneys required by the Bond Resolution to be provided by the Issuer to refund the Refunded Bonds and, subject to the conditions contained herein, the Underwriter will accept such delivery and pay the purchase price of the Bonds in Federal Funds to the Escrow Agent for the account of the Issuer.

Delivery of the Bonds as aforesaid shall be made at the offices of Foley & Judell, L.L.P., in New Orleans, Louisiana ("Bond Counsel"), or such other place as may be agreed upon by the Underwriter and the Issuer. Such delivery against payment of the Purchase Price therefor at the time listed above is herein called the "Closing". The Bonds will be delivered initially as fully registered bonds, one bond representing each CUSIP number of the Bonds, and registered in such names as the Underwriter may request not less than three business days prior to the Closing (or if no such instructions are received by the Paying Agent, in the name of the Underwriter).

4. Certain Conditions To Underwriter's Obligations. The obligations of the Underwriter hereunder shall be subject to the performance by the Issuer of its obligations to be performed hereunder, and to the following conditions:

a. At the time of Closing, (i) the Bond Resolution shall have been adopted and the Escrow Agreement shall have been executed and delivered in the form approved by the Underwriter, each shall be in full force and effect, and neither shall have been amended, modified or supplemented except as may have been agreed to by the Underwriter, (ii) the Bonds shall have been approved by the State Bond Commission and shall have been duly authorized, executed, authenticated and delivered, (iii) the Issuer shall perform or have performed all of its obligations under or specified in any instruments or documents related to the Bonds (collectively, the "Bond Documents") to be performed by it at or prior to the Closing and the Underwriter shall have received evidence thereof, and (iv) there shall have been duly adopted and there shall be in full force and effect such ordinances or resolutions as, in the opinion of Bond Counsel, shall be necessary in connection with the transactions contemplated hereby; and

b. At or prior to the Closing, (i) the Underwriter shall have received each of the following:

(1) the approving opinion of Bond Counsel, dated the date of the Closing, in the form attached to the Official Statement;

(2) a supplemental opinion of Bond Counsel in substantially the form attached as Exhibit C hereto, dated the date of the Closing, addressed to the Issuer and the Underwriter;

(3) certificates of the Issuer dated the date of the Closing, executed by authorized officers in form and substance reasonably satisfactory to the Underwriter, to the effect that (a) the representations of the Issuer herein and in the other Bond Documents are true and correct in all material respects as of the date of the Closing, (b) all obligations required under or specified in this Bond Purchase Agreement or in the other Bond Documents to be performed by the Issuer on or prior to the date of the Closing have been performed or waived, (c) the Issuer is in compliance in all respects with all the covenants, agreements, provisions and conditions contained in the Bond Documents to which the Issuer is a party which are to have been performed and complied with by the Issuer by the date of the Closing, and (d) the Issuer's execution of and compliance with the provisions of the Bond Documents will not conflict or constitute on the part of the Issuer a breach of or a default under any existing law, court or administrative regulation, decree or order or any other agreement, indenture, mortgage, loan or other instrument to which the Issuer is subject or by which it is bound;

(4) the Official Statement, together with any supplements or amendments thereto in the event it has been supplemented or amended, executed on behalf of the Issuer by the duly authorized officer(s) thereof;

(5) a specimen of the Bonds;

(6) certified copies of the Bond Resolution and all other actions of the Issuer and the State Bond Commission relating to the issuance and/or sale of the Bonds, as applicable;

(7) a certificate of a duly authorized officer of the Issuer, reasonably satisfactory to the Underwriter, dated the date of Closing, stating that such officer is charged, either alone or with others, with the responsibility for issuing the Bonds; setting forth, in the manner required by Bond Counsel, the reasonable expectations of the Issuer as of such date as to the use of proceeds of the Bonds and of any other funds of the Issuer expected to be used to pay principal or interest on the Bonds and the facts and estimates on which such expectations are based; and stating that, to the best of the knowledge and belief of the certifying officer, the Issuer's expectations are reasonable;

(8) a certificate of the Paying Agent as to its corporate capacity to act as such, the incumbency and signatures of authorized officers, and its due registration of the Bonds delivered at the Closing by an authorized officer;

(9) a letter with respect to the Bonds, dated the date of Closing, of Bingham Arbitrage Rebate Services, Inc., to the effect that it has verified the accuracy of the mathematical computations of the adequacy of the maturing principal amounts of the obligations to be deposited in the Escrow Fund, together with the interest earned and to be earned thereon and uninvested cash, if any, to be held by the Escrow Agent to pay when due the principal and interest on the Refunded Bonds on the dates and in the amounts provided in the Escrow Agreement;

(10) a rating letter from S&P Global Ratings, acting through Standard & Poor’s Financial Services LLC, providing for the following rating(s) on the Bonds:

· Underlying: "AA+"/Stable outlook;

(11) other certificates of the Issuer required in order for Bond Counsel to deliver the opinions referred to in Sections 8(b)(i)(1) and 8(b)(i)(2) of this Bond Purchase Agreement and such additional legal opinions, certificates, proceedings, instruments and other documents as Bond Counsel may reasonably request to evidence compliance by the Issuer with applicable legal requirements, the truth and accuracy, as of the time of Closing, of their respective representations contained herein, and the due performance or satisfaction by them at or prior to such time of all agreements then to be performed and all conditions then to be satisfied by each; and

(12) executed copies of each of the Bond Documents not listed above in this Section 8(b)(i).

(ii) All such opinions, certificates, letters, agreements and documents under Section 8(b)(i) will be in compliance with the provisions hereof only if they are reasonably satisfactory in form and substance to the Underwriter. The Issuer will furnish the Underwriter with such conformed copies or photocopies of such opinions, certificates, letters, agreements and documents relating to the Bonds as the Underwriter may reasonably request.

5. Effect of Termination. If the Issuer shall be unable to satisfy one or more of the conditions to the obligations of the Underwriter contained in this Bond Purchase Agreement and any such condition is not waived by the Underwriter, or if this Bond Purchase Agreement shall otherwise be terminated pursuant to Section 10 below, then the respective obligations hereunder of the Issuer and the Underwriter shall be cancelled and neither the Underwriter nor the Issuer shall be under further obligation hereunder, except that the Issuer and the Underwriter shall pay their respective expenses as provided in Section 12 hereof. Notwithstanding the foregoing, in order for either party to terminate or cancel its obligation to purchase or sell the Bonds as set forth herein, it must notify the other party in writing of its election to do so not less than 48 hours before the time for the Closing set forth in Section 7 hereof.

6. Termination by Underwriter. The Underwriter shall have the right to cancel its obligation to purchase the Bonds and terminate this Bond Purchase Agreement by written notice to the Issuer in accordance with Section 9 hereof, if, between the date hereof and the Closing, any of the following events shall occur: (i) there shall exist any event which in the Underwriter's reasonable judgment either (a) makes untrue or incorrect in any material respect any statement or information contained in the Official Statement or (b) is not reflected in the Official Statement but should be reflected therein in order to make the statements and information contained therein not misleading in any material respect, (ii) there shall have occurred any outbreak of hostilities or any national or international calamity or crisis including financial crisis, or a default with respect to the debt obligations of, or the institution of proceedings under federal or state bankruptcy laws by or against the Issuer, the effect of which on the financial markets of the United States being such as, in the reasonable judgment of the Underwriter, would make it impracticable for the Underwriter to market the Bonds or to enforce contracts for the sale of the Bonds, (iii) there shall be in force a general suspension of trading on the New York Stock Exchange, (iv) a general banking moratorium shall have been declared by either federal, Louisiana or New York state authorities, (v) there shall have occurred since the date of this Bond Purchase Agreement any material adverse change in the affairs of the Issuer, except for changes which the Official Statement discloses have occurred or may occur, (vi) any rating on the Bonds or on any of the Outstanding Parity Bonds is reduced or withdrawn or placed on credit watch with negative outlook by any major credit rating agency, (vii) legislation shall be enacted or any action shall be taken by the Securities and Exchange Commission which, in the opinion of Bond Counsel, has the effect of requiring the contemplated distribution of the Bonds to be registered under the Securities Act of 1933, as amended, or the Bond Resolution, or any other document executed in connection with the transactions contemplated hereof to be qualified under the Trust Indenture Act of 1939, as amended, (viii) a stop order, ruling, regulation or official statement by or on behalf of the Securities and Exchange Commission shall be issued or made to the effect that the issuance, offering or sale of the Bonds, or of obligations of the general character of the Bonds as contemplated hereby, or the offering of any other obligation which may be represented by the Bonds is in violation of any provision of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, or the Trust Indenture Act of 1939, as amended, or (ix) any state blue sky or securities commission shall have withheld registration, exemption or clearance of the offering, and in the reasonable judgment of the Underwriter the market for the Bonds is materially affected thereby.

7. Survival of Representations. All representations and agreements of the Issuer and the Underwriter hereunder shall remain operative and in full force and effect, and shall survive the delivery of the Bonds and any termination of this Bond Purchase Agreement by the Underwriter pursuant to the terms hereof.

8. Payment of Expenses. (a) If the Bonds are sold to the Underwriter by the Issuer, the Issuer shall pay, from the proceeds of the Bonds, any reasonable expenses incidental to the performance of its obligations hereunder, including but not limited to: (i) State Bond Commission fees; (ii) the cost of the preparation, printing and distribution of the Preliminary Official Statement and the Official Statement; (iii) the cost of the preparation of the printed Bonds; (iv) any rating agency fees; and (v) the fees and expenses of Bond Counsel, the Escrow Agent, the Paying Agent, the Municipal Advisor and any other experts or consultants retained by the Issuer.

(b) The Underwriter shall pay (i) all advertising expenses in connection with the public offering of the Bonds; (ii) the cost of preparing and printing the blue sky and legal investment memoranda, if any; (iii) filing fees in connection with the aforesaid blue sky and legal investment memoranda; (iv) the cost of obtaining CUSIP numbers for the bonds; and (v) all other expenses incurred by the Underwriter (including the cost of any Federal Funds necessary to pay the purchase price of the Bonds) in connection with its public offering.