Erick Knezek was absent.

Lafayette Parish School Board-Regular Board Meeting-REVISED (Wednesday, April 10, 2019). Meeting called to order at 5:30 p.m.

Members present

Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris, Mary Morrison

Members absent

Erick Knezek

1. MEETING OPENINGS

Procedural: 1.1 Pledge of Allegiance to the Flag of the United States of America and Presentation of Colors-Ovey Comeaux High NJROTC

Procedural: 1.2 Moment of Silence

Procedural: 1.3 Opening Comments-Superintendent

Superintendent, Dr. Donald Aguillard, announced to the Board that Ms. Michelle Lewis, a first grade teacher at Green T. Lindon, was selected as the Louisiana Farm Bureau and LSU Agriculture Center “Classroom Teacher of the Year.” Dr. Aguillard recognized the winners of the 22nd Annual Superintendent’s Golf Scholarship Tournament. Acadiana High School’s Administrative Team was the school system’s winner. Corporate sponsor winners were, first place, Sound and Communication, second place, Poche, Prouet, and Associates, and third place was Bernhard Mechanical. The event raised $40,000 that will go toward scholarships for LPSS graduating seniors; the deadline to apply is Friday, April 12, 2019.

Dr. Aguillard also presented Mr. Richard Craig with a plaque honoring his 30 years of outstanding service and dedication to the students, staff, and community of Lafayette Parish. He wished him well on his retirement and thanked him for his years of hard work.

2. RECOGNITIONS/PRESENTATIONS

Appearances: 2.1 RECOGNITION: LPSS Outstanding School Support Employee Award-Vead/Thibodeaux

Superintendent Aguillard and the Board recognized the Outstanding School Support Employees of 2019 and presented each honoree with a certificate.

Katherine Anselmo, David Thibodaux Stem Magnet Academy, Elizabeth Arnold, Judice Middle, Debra Baras, Charles Burke Elementary, Cindy Beaugh, Broadmoor Elementary, Crescenda Broussard, Live Oak Elementary, Mitzi Broussard, Milton Elem/Middle, Lystra Butler, S.J. Montgomery Elementary, Thomas Carmouche, Comeaux High, Sandy Colomb, Acadian Middle, Donna Comeaux, Carencro Middle, Carolyn Danton, Woodvale Elementary, Norma Davis, Northside High, Karen Demette, Prairie Elementary, Elizabeth Farnsworth, Broussard Middle, Nicole Foret, L. Leo Judice Elementary, Sonia Francois, CPL Middlebrook Elementary, Pam Gardner, Ernest Gallet Elementary, Sharelle Gboro, Early College Academy, Nicole Guidry, Ossun Elementary, Ella Handy, Duson Elementary, William Hargroder, Myrtle Place Elementary, Tabitha Hebert, Lafayette Middle, Carl King, L.J. Alleman Middle, Susan Kinkade, Carencro High, Mary Labbie, E.J. Sam Accelerated, Julia Lebleu, Ridge Elementary, Ryan Martin, Westside Elementary, Christina Papillion, J.W. Faulk Elementary, Jerry Parker, Alice Boucher Elementary, Jolene Prejean, J. Wallace James Elementary, Jennifer Robinson, Scott Middle, Karen Romero, Southside High, Angela Sellen, Green T. Lindon Elementary, Minnie Simien, Truman Early Childhood, Jamie Spears, Edgar Martin Middle, Theresa Stein, Katharine Drexel Elementary, Meta Stoven, Youngsville Middle, Nancy Vallejo, Carencro Heights Elementary, Nicole Verret, Evangeline Elementary, Ayana Washington, Lafayette High, Denise Weber, Acadiana High, Verna Williams, Lerson Preparatory, Tiffany Word, Milton Elem/Middle, Nelson Zeno, Paul Breaux Middle

Appearances: 2.2 Love Our Schools-Chassion

Dr. Tehmi Chassion introduced Ryan Domengeaux with the William C. Schumacher Family Foundation and Cindy Dilena with Love Acadiana, who gave the Board information on the upcoming Love our Schools event. The event will be held on July 13, 2019, where volunteers will revitalize eight schools. They hope to raise enough funds to provide 5,000 students with backpacks filled with school supplies and 600 faculty and staff with necessary supplies in the upcoming 2019-2020 school year.

Appearances: 2.3 Teche-Vermilion Freshwater District Presentation-D. Stanley

Dee Stanley of Sides and Associates gave a brief presentation on behalf of the Teche-Vermilion Freshwater District regarding their May 4 tax renewal.

3. INFORMATION ITEMS

Information: 3.1 HUMAN RESOURCES: Personnel Changes-April 10, 2019-Aguillard/Craig/Thibodeaux/Vead

Suzanne Thibodeaux, Director of Human Resources, introduced to the Board, Anne-Marie Tassin, newly appointed assistant principal of Woodvale Elementary.

New Employee

|

Name of Employee |

Current Location |

Current Classification |

Effective Date |

Fund |

Reason |

Requisition Number |

| Landry, Amanda | Acadian MS | Teacher-Math | 3/18/2019 | 01 | Replacing Bree Galewski | 6400 |

| Lewis, Monica | David Thibodaux | STEM Custodian | 4/1/2019 | 01 | Replacing Jonathon Rideau | 6510 |

| Moreau, Hannah | David Thibodaux | STEM Teacher-HS ELA | 3/12/2019 | 01 | Replacing Haley Barbier | 6347 |

| Taylor, Farrow | Child Nutrition | Warehouse Coordinator | 3/7/2019 | 70 | Replacing Scott Romero | 6319 |

| Ward, William | Maintenance Dept | Carpenter 1 | 3/19/2019 | 01 | Replacing Jody Terro | 6309 |

Employee Transfers

|

Name of Employee

|

Current Location |

Current Classification |

New Location |

New Classification |

Effective Date |

Fund |

Reason |

Requisition Number |

| Francis, Walter | Northside HS | Custodian | Lafayette HS | Custodian | 3/27/2019 | 01 | Replacing Caffery Levine | 6512 |

|

Lemaire, John |

Warehouse | Warehouse Worker I | Warehouse | Warehouse Worker II | 3/18/2019 | 01 | Replacing James Groh | 6397 |

| Mudd, Nicole | Carencro HS | Custodian | Lafayette HS | Custodian |

3/27/2019 |

01 | Replacing Sylvia Richard | 6513 |

| Smith, Shayla | J. W. Faulk ES | Teacher-M/M | J. W. Faulk ES | Teacher- Combo | 1/7/2019 | 01 | Replacing Dexter Brown | 6414 |

| Villery-Gobert, Alysia | Purchasing | Purchasing Clerk I | Federal Programs | Receiving and Inventory Coordinator | 4/1/2019 | 50 | Replacing Pamela Leblanc | 6393 |

| Zehner, Pauline | Alice Boucher ES | ISS Facilitator | Baranco ES | Secretary I | 4/1/2019 | 01 | New Position | 6349 |

Exiting Employee

|

Name of Employee |

|

Current Location |

Current Classification |

Effective Date |

Fund |

Reason |

| Airault | Stephen | P. Breaux MS | Teacher-Math-French Immersion, | 5/24/2019 | 01 | Resignation |

| Alfred | Albert | J. W. James ES | Custodian | 4/23/2019 | 01 | Resignation |

| Andrus | Tara | Transportation Dept. | Bus Attendant | 3/22/2019 | 01 | Resignation |

| Angelle | Janelle | Evangeline ES | Para-PE | 4/5/2019 | 01 | Resignation |

| Angers | Cynthia | Charles Burke ES | Teacher - 3rd | 5/24/2019 | 01 | Service Retirement |

| Benoit | Mitzi | Scott MS | Teacher -Science | 5/24/2019 | 01 | Service Retirement |

| Bordelon | Tracie | Lafayette HS | Counselor | 6/10/2019 | 01 | Resignation |

| Bourque | Eva | Ernest Gallet ES | Para- SPED | 3/12/2019 | 01 | Termination |

| Breaux | Elizabeth | Cpl. Middlebrook ES | Para-SPED | 3/29/2019 | 01 | Resignation |

| Broussard | Belinda | G. T. Lindon ES | Librarian | 5/24/2019 | 01 | Service Retirement |

| Butter | Roger | Milton ES/MS | Teacher-M/M | 5/24/2019 | 01 | Service Retirement |

| Calo, IV | Salvadore N. | Prairie ES | Para-SPED | 3/22/2019 | 01 | Resignation |

| Courounadin-Mouny | Marie | Evangeline ES | Teacher-French Immersion- Pre- Kdgn | 5/24/2019 | 01 | Resignation |

| Craig | Richard | Office of Administration | Assistant Superintendent- Administration | 4/12/2019 | 01 | Service Retirement |

| Credeur | Jennifer | Evangeline ES | Teacher-PE | 5/24/2019 | 01 | Service Retirement |

| Cruice | Gary | Lafayette HS | Teacher-Math | 5/24/2019 | 01 | Resignation |

| Domingue | Karen | Alice Boucher ES | Teacher-1st | 5/24/2019 | 01 | Service Retirement |

| Dricot | Chloe | Prairie ES | Teacher-French Immersion-Pre-Kdgn. | 2/5/2019 | 01 | Resignation |

| Edmond | Ebony | Scott MS | Custodian | 3/25/2019 | 01 | Resignation |

| Fall | Serigne | Evangeline ES | Teacher-1st-French Immersion | 5/24/2019 | 01 | Resignation |

| Fernandez-Arias | Ana | Alice Boucher ES | Teacher-Kdgn/Spanish Immersion | 5/24/2019 | 01 | Resignation |

| Francoeur-Labrie | Christine | Prairie ES | Teacher-Third Grade French Immersion | 5/24/2019 | 01 | Resignation |

| Frederick | Paula | Alice Boucher ES | Secretary I | 4/12/2019 | 01 | Resignation |

| Gaddison | Linda | G. T. Lindon ES | Custodian | 3/15/2019 | 01 | Resignation |

| Guidry | Carol | Westside ES | Head Custodian | 3/7/2019 | 01 | Resignation |

| Hebert | Selina | Scott MS | Teacher-Science | 3/29/2019 | 01 | Resignation |

| Ingraham | Reinette | J. W. Faulk ES | Head Custodian | 3/13/2019 | 01 | Resignation |

| Kirgan | Mary Jo | Acadiana HS | Teacher-Science | 5/24/2019 | 01 | Service Retirement |

| Labrie | Christian | Paul Breaux MS | Teacher-Math French Immersion | 5/24/2019 | 01 | Resignation |

| LaBry | Randall | Talented Education Office | Teacher-Talented Music | 5/24/2019 | 01 | Service Retirement |

| Lamy | Emilie | Westside ES | Teacher-Kdgn.-French Immersion | 5/24/2019 | 01 | Resignation |

| Landry | Rebecca | Carencro HS | Teacher-Math | 3/15/2019 | 01 | Resignation |

| LeBlanc | Carolyn | Carencro HS | Teacher-ELA | 3/1/2019 | 01 | Resignation |

| LeBlanc-Abuhijeh | Trisha | Prairie ES | Para-SPED | 3/22/2019 | 01 | Resignation |

| LeBouef | Brandy | Lafayette MS | Teacher-Alternative | 5/24/2019 | 15 | Resignation |

| LeJeune | Debra | Alice Boucher ES | Teacher-Sev. Profound | 5/24/2019 | 01 | Service Retirement |

| Levine | Caffery J | Lafayette HS | Custodian | 3/12/2019 | 01 | Resignation |

| Louis | Natalie | Northside HS | Para-SPED | 11/22/2018 | 01 | Resignation |

| Louis-Marie | Angele | Evangeline ES | Teacher-5th/French Immersion | 5/24/2019 | 01 | Resignation |

| Louis-Marie | Jimmy | Myrtle Place ES | Teacher-French/Music | 5/24/2019 | 01 | Resignation |

| McGinty | Christopher | L. J. Alleman Middle | Teacher-PE | 3/27/2019 | 01 | Resignation |

| Moody | Kandice | Acadiana HS | Account Clerk | 4/1/2019 | 01 | Resignation |

| Moore | Megan | L. J. Alleman MS | SFS Technician | 3/22/2019 | 70 | Resignation |

| Morgan | Bettie | Carencro MS | SFS Manager | 8/30/2019 | 70 | Service Retirement |

| Morgan | Susan | Charles Burke ES | Teacher-2nd | 5/24/2019 | 01 | Service Retirement |

| Moroux | Lynn | VCC/Early Childhood | Teacher-SPED Pre-Kdgn | 5/24/2019 | 01 | Service Retirement |

| Mouton | Heidi | L. Leo Judice ES | Para-Reg. Ed. | 4/1/2019 | 01 | Resignation |

| Picard | Cynthia | S. J. Montgomery ES | Educational Interpreter | 5/24/2019 | 40 | Service Retirement |

| Portalis | Mikula | Lafayette HS | Custodian | 3/15/2019 | 01 | Resignation |

| Prejean | Glenda | Acadiana HS | SS Technician | 3/13/2019 | 70 | Service Retirement |

| Sharon | Pierre | Northside High | Teacher-ELA | 5/24/2019 | 01 | Service Retirement |

| Simon | Tracy | Carencro MS | Custodian | 3/21/2019 | 01 | Resignation |

| Stevens | Cristen | J. W. Faulk ES | Teacher 3rd | 5/24/2019 | 01 | Resignation |

| Syrie, Jr | Neville | Myrtle Place ES | Custodian (Part-Time) | 3/22/2019 | 01 | Resignation |

| Thornton, Jr | Donald | Lafayette HS | Principal | 5/31/2019 | 01 | Resignation |

| Trichel | Donald | Acadiana HS | Teacher-Computer Science | 3/15/2019 | 01 | Resignation |

| Verre | Armelle | Evangeline ES | Teacher-5th-French Immersion | 5/24/2019 | 01 | Resignation |

| Welch | Cathleen | Gearup | Gearup Partnership and Data Management | 7/31/2019 | 57 | Service Retirement |

Other Action

|

Name of Employee |

Current Location |

Current Classification |

Effective Date |

Fund |

Reason |

| Moore, Marva | Ernest Gallet ES | SFS Technician | 4/1/2019 | 70 | Termination |

| Tharpe, Cindy | Comeaux HS | Teacher - ELA | 5/24/2019 | 01 | Service Retirement, Not 03/29/2019 |

|

Number of Full-Time, Active Employees by Funding Source as of: |

|

Last Month |

One Year Ago |

|

|

4/4/2019 |

March 2019 |

April 2018 |

|

General Fund (01) |

3,545.50 |

3,606.50 |

3,606.75 |

|

2002 Sales Tax (15) |

62.00 |

67.00 |

66.00 |

|

Special Revenues (20) |

9.25 |

9.25 |

6.25 |

|

Other Grants (25) |

0.00 |

0.00 |

0.00 |

|

Consolidated Adult Education (30) |

2.00 |

2.00 |

2.00 |

|

Consolidated Other Federal Programs (35) |

6.00 |

6.00 |

8.00 |

|

Special Education (40) |

86.50 |

87.50 |

86.50 |

|

Self-Funded Construction (45) |

2.50 |

2.50 |

2.50 |

|

IASA Title I (50) |

89.75 |

88.75 |

85.75 |

|

Consolidated Other State (55) |

4.50 |

4.50 |

4.50 |

|

GEARUP/Magnet Grant (57) |

8.00 |

8.00 |

8.00 |

|

Child Development & Head Start (60) |

70.00 |

70.00 |

71.75 |

|

IASA Titles II/III/IV/VI (65) |

15.00 |

15.00 |

14.00 |

|

Child Nutrition (70) |

223.00 |

224.00 |

227.00 |

|

Group Insurance Fund (85) |

4.50 |

4.50 |

4.50 |

|

Sales Tax Dept (88) |

16.00 |

16.00 |

17.00 |

|

TOTAL |

4,144.50 |

4,211.50 |

4,210.50 |

Information: 3.2 FINANCE: List of Bids Approved to be advertised by the Superintendent-Aguillard/Guidry/Francis

Bid# 71-19 Dish Machine-Carencro Middle, Bid# 73-19 Comeaux High Re-Roof, Bid# 75-19 Acadiana High Fire Line Installation, Bid# 76-19 Paul Breaux Re-Roof, Bid# 77-19 Dish Machine-Lafayette Middle, Bid# 78-19 Southside High School Portable Bldg. Classroom FF&E, Calculators Bid# 01-20, Duplicator Ink & Masters Bid# 02-20, Sports Medical Supplies Bid# 03-20, Nursing Supplies (Latex Free) Bid# 04-20, Band Instruments Bid# 05-20, Band Uniforms Bid# 06-20, Lubricants - Engine Oil Bid# 07-20, Pea Gravel Bid# 08-20, Ready Mix Concrete Bid# 09-20, #610 Limestone Bid# 10-20, Red Mulch Bid# 11-20, Landscape Timbers Bid# 12-20, Cold Mix Asphalt Bid# 13-20, Early Childhood Educational Supplies Bid# 14-20, Homeless Department School Uniforms Bid# 15-20, Homeless Department Mesh Backpacks Bid# 16-20, Homeless Department School Supply Kits Bid# 17-20, Chromebook Cases Bid# 18-20, Large Kitchen Equipment Bid# 19-20, Milk & Milk Products Bid# 19-1925, Bread & Bread Products Bid# 19-1926, Paper & Janitorial Supplies Bid# 19-1929, Small Kitchen Equipment & Supplies Bid# 19-1930, Dry & Frozen Food Items Bid# 19-1928

4. CONSENT AGENDA

Action (Consent): 4.1 ADMINISTRATION: Revision of the 2019-2020 School Calendar-Aguillard/Trosclair/Craig

Resolution: That the Board approve the revised school calendar for 2019-2020 which includes three (3) days of professional development for teachers.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.2 ADMINISTRATION: 5th Grade Spot Re-zone, Faulk to Baranco-Craig/Trosclair/Aguillard

Resolution: That the Board approve a 5th grade spot re-zone of students from J. W. Faulk to Raphael Baranco Elementary for the 2019-2020 school year.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.3 BOARD: Resolution 04-19-1955 Increase in the 2019-2020 MFP-Aguillard/Centanni

Resolution: That the Board approve Resolution 04-19-1955 Increase in the 2019-2020 MFP.

The following resolution was offered by Britt Latiolais and seconded by Tommy Angelle:

RESOLUTION 04-19-1955

INCREASE IN THE 2019-2020 MFP

WHEREAS, the Minimum Foundation Program (MFP) establishes the state funding component of the K12 public education system in Louisiana, and the Legislature is required to fully fund the formula;

WHEREAS, there was no increase in the base per-pupil allocation for the school years of 2009-10, 2010-11, 2011-12, 2012-13 and 2013-14;

WHEREAS, in the 2014 Regular Session the MFP base per-pupil allocation increased from $3,855 to $3,961 for the 2014-15 school year;

WHEREAS, had the MFP base per-pupil allocation been increased each year by the anticipated 2.75%, the 2019-2020 MFP would be $5,056;

WHEREAS, BESE has unanimously recommended a 1.375% increase in the base per-pupil allocation for 2019-2020, raising the base per-pupil allocation from $3,961 to $4,015;

WHEREAS, BESE’s recommendation also includes additional funding in Level 3 of the MFP dedicated to an increase in salary for teachers and support workers in the amount of $1,000 and $500, respectively;

WHEREAS, the Lafayette Parish School Board has been absorbing ever-increasing operational costs, from health insurance, technology, the security of students, curriculum aligned with the state standards, and the increasing demands of the state accountability system, without increased state funding;

WHEREAS, BESE’s unanimously recommended MFP will benefit local school districts in every parish, as well as every public charter school in the state;

WHERAS, the Lafayette Parish School Board appreciates that BESE’s recommended MFP divides the increased funding between a dedicated teacher and support worker pay raise and an increase in per-pupil funding, the recommended increase will still help meet the ever-increasing costs of providing a public education;

NOW THEREFORE, BE IT RESOLVED that the Lafayette Parish School Board supports the unanimously approved MFP adopted by BESE to increase the MFP Level 1 per-pupil allocation by 1.375% and to provide funding for a dedicated teacher and support worker pay raise in Level 3 of the MFP;

BE IT FURTHER RESOLVED, that the Lafayette Parish School Board urges the Legislature to approve the unanimously approved MFP by BESE for the 2019-20 school year;

FINALLY, BE IT FURTHER RESOLVED, that the Lafayette Parish School Board directs the Superintendent to forward a copy of this Resolution to each member of the Lafayette Parish Legislative delegation and to Governor John Bel Edwards.

This resolution having been submitted to a vote, thereon was as follows:

YEAS: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolias, and Dawn Morris.

NAYS: None

ABSENT: Erick Knezek and Mary Morrison

CERTIFICATE

I, the undersigned Secretary-Treasurer of the Lafayette Parish School Board, do hereby certify that the above and foregoing is a true copy of a resolution adopted at its Regular Board Meeting of April 10, 2019, at which time a quorum was present and that same is in full force and effect.

Dated at Lafayette, Louisiana,

this 10th day of April 2019.

/s/ Donald Aguillard

Dr. Donald Aguillard, Secretary-Treasurer

LAFAYETTE PARISH SCHOOL BOARD

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action: 4.4 BOARD: Interim Superintendent Interviews-Centanni

That the Board limit the number to 2 candidates to interview.

Motion by Britt Latiolais, second by Jeremy Hidalgo.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris, Mary Morrison

Absent: Erick Knezek

That the Board select April 24, 2019 to interview the two candidates at 5:30 p.m.

Motion by Britt Latiolais, second by Mary Morrison.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris, Mary Morrison

Absent: Erick Knezek

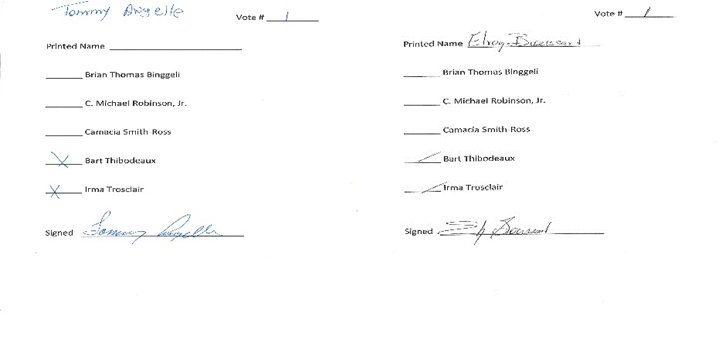

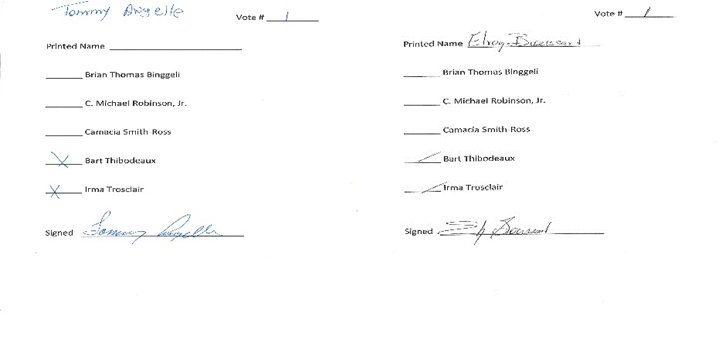

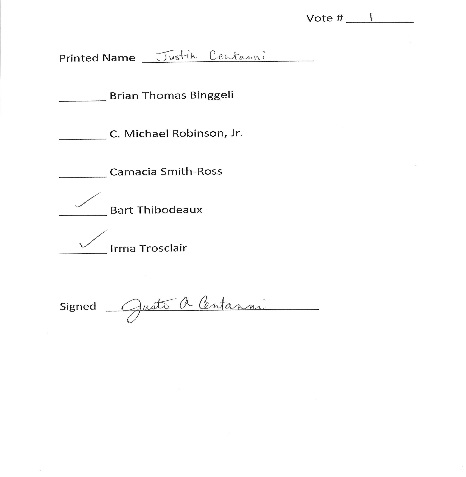

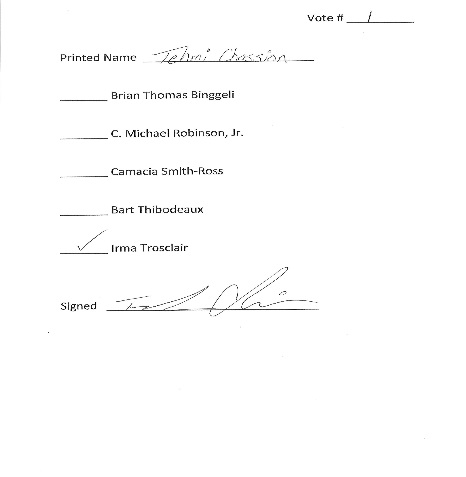

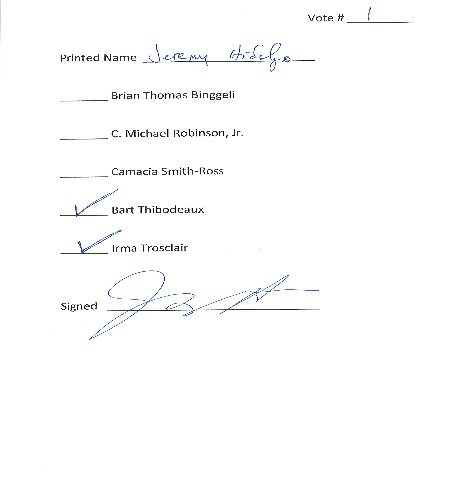

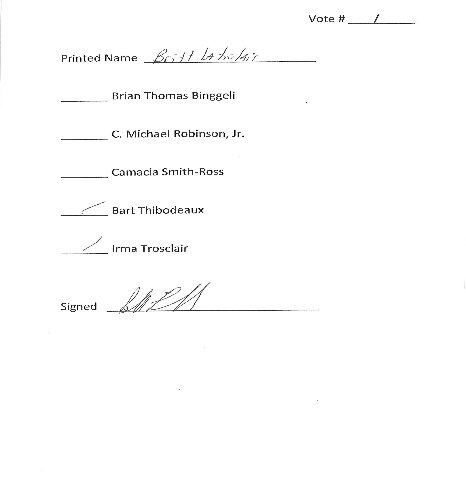

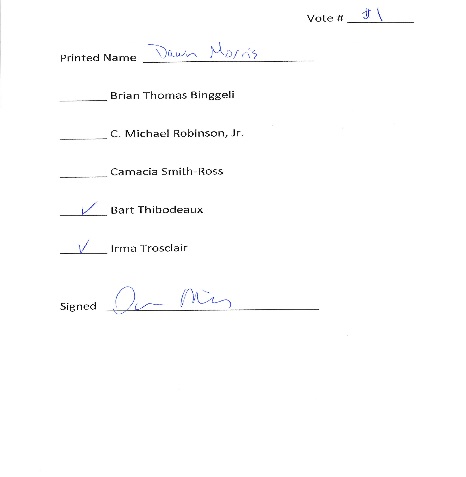

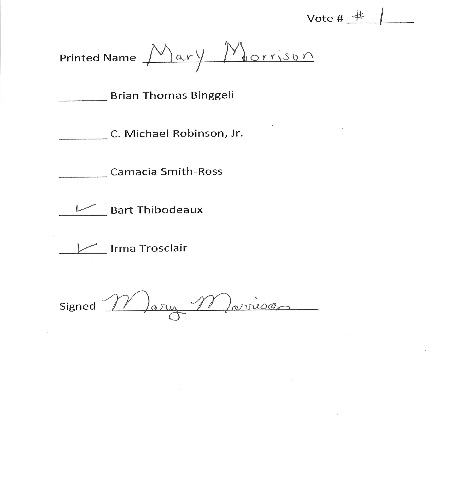

The Board selected, by ballot voting, 2 candidates to interview for Interim Superintendent: Irma Trosclair received 8 votes and Bart Thibodeaux received 7 votes. The Board Member ballot sheets are attached and the votes were as follows:

Tommy Angelle voted for Irma Trosclair and Bart Thibodeaux

Elroy Broussard voted for Irma Trosclair and Bart Thibodeaux

Justin Centanni voted for Irma Trosclair and Bart Thibodeaux

Tehmi Chassion voted for Irma Trosclair

Jeremy Hidalgo voted for Irma Trosclair and Bart Thibodeaux

Britt Latiolais voted for Irma Trosclair and Bart Thibodeaux

Dawn Morris voted for Irma Trosclair and Bart Thibodeaux

Mary Morrison voted for Irma Trosclair and Bart Thibodeaux

Erick Knezek was absent.

Action (Consent): 4.5 FACILITIES: Approval of Quotes for Evangeline Elementary School Playground Equipment-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board authorize staff to award the low quote to Kincade Recreation for $99,829.33 for new playground equipment in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.6 FACILITIES: Approval of Quotes for Ossun Elementary School Playground Equipment-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board authorize staff to award the low quote to Kincade Recreation for $96,040.33 for new playground equipment in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.7 FACILITIES: Approval of Quotes for Ridge Elementary School Playground Equipment-Bordelon/Frances/Guidry/Aguillard

Resolution: That the Board authorize the staff to award the low quote to Kincade Recreation for $99,910.33 for new playground equipment in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.8 FACILITIES: Rescind Contract Award for Garbage & Recycling Collection and Electronics Waste Disposal-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board rescind the contract award approved at the March 13, 2019 for Garbage & Recycling Collection and Electronics Waste Disposal in accordance with Articles 1.8 and 1.22 of the RFP #50-19, reject all proposals, and re-issue a new RFP with corrections.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.9 FACILITIES: Approval of Bids for Drexel Elementary School Roof Replacement-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board authorize staff to award the low bid to Morcore Roofing, LLC for the base bid only of $710,000 for the Drexel Elementary School Roof Replacement in accordance with Louisiana Public Bid Law and purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.10 FACILITIES: Approval of Bids for Lafayette High School Roof Replacement-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board authorize staff to award the low bid to Rycars Construction for $1,501,601 for the Lafayette High School Roof Replacement in accordance with Louisiana Public Bid Law and purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.11 FACILITIES: Approval of Guaranteed Maximum Price for Ridge Elementary Classroom Wing Addition-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board approve the Guaranteed Maximum Price (GMP) of $5,656,444.00 from J.B.Mouton, Inc. for the Ridge Elementary Classroom Wing Addition to be constructed under the Construction Manager At Risk (CMAR) project delivery method.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.12 FACILITIES: Approval of Quotes for Baranco Elementary Electrical Service Replacement-Bordelon/Francis/Guidry/Aguillard

Resolution: That the Board authorize staff to award the low quote to Magnon Electric, Inc. for $29,892.50 for the Baranco Elementary Electrical Service Replacement project in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.13 FACILITIES: Approval of HVAC Maintenance Contract Change Order for FY2019-2020-Bordelon/Guidry/Aguillard

Resolution: That the Board approve a change order to the HVAC Maintenance Contract with Bernhard MCC for the addition of new HVAC equipment at Comeaux High Performing Arts Academy, Career Center Robotics Area, Billeaud Elementary, N.P. Moss Central Office Annex Bldg., full maintenance on 18 air conditioned gymnasiums and deleting the downtown Sales Tax Office Bldg. in the amount of $120,126 for FY19-20.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.14 FACILITIES: Release Right of Use, St. Antoine Property-Craig/Guidry/Aguillard

Resolution: That the Board release its right of use on the St. Antoine Property to the Lafayette Parish Sheriff's Office.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.15 FINANCE: Sales Tax Collection Report for February 2019-Guidry/Ashy

Resolution: That the Board approves the Sales Tax Collection report for the month of February 2019

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.16 FINANCE: Approve Bid Award-Science Supplies Bid# 62-19-Aguillard/Trosclair/Guidry/Francis

Resolution: That the Board authorize staff's recommendation and award Bid# 62-19 as follows: Items number: 2-5, 7-10, 12, 13, 15-18, and 22-39 to Fisher Scientific

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

Action (Consent): 4.17 FINANCE: Approve Bid Award-SPED Equipment and Supplies Bid# 65-19-Aguillard/Trosclair/Guidry/Francis

Resolution: That the Board authorize staff's recommendation and award Bid# 65-19 as follows: Item numbers: 10, 13, 27 and 30 to Bill Fritz Sports Item numbers: 1-4, 7-9, 11, 12, 14-26, 28, 29, and 31-37 to School Specialty

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Jeremy Hidalgo, second by Tommy Angelle.

Final Resolution: Motion Carries

Yes: Tommy Angelle, Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Britt Latiolais, Dawn Morris

Absent: Erick Knezek, Mary Morrison

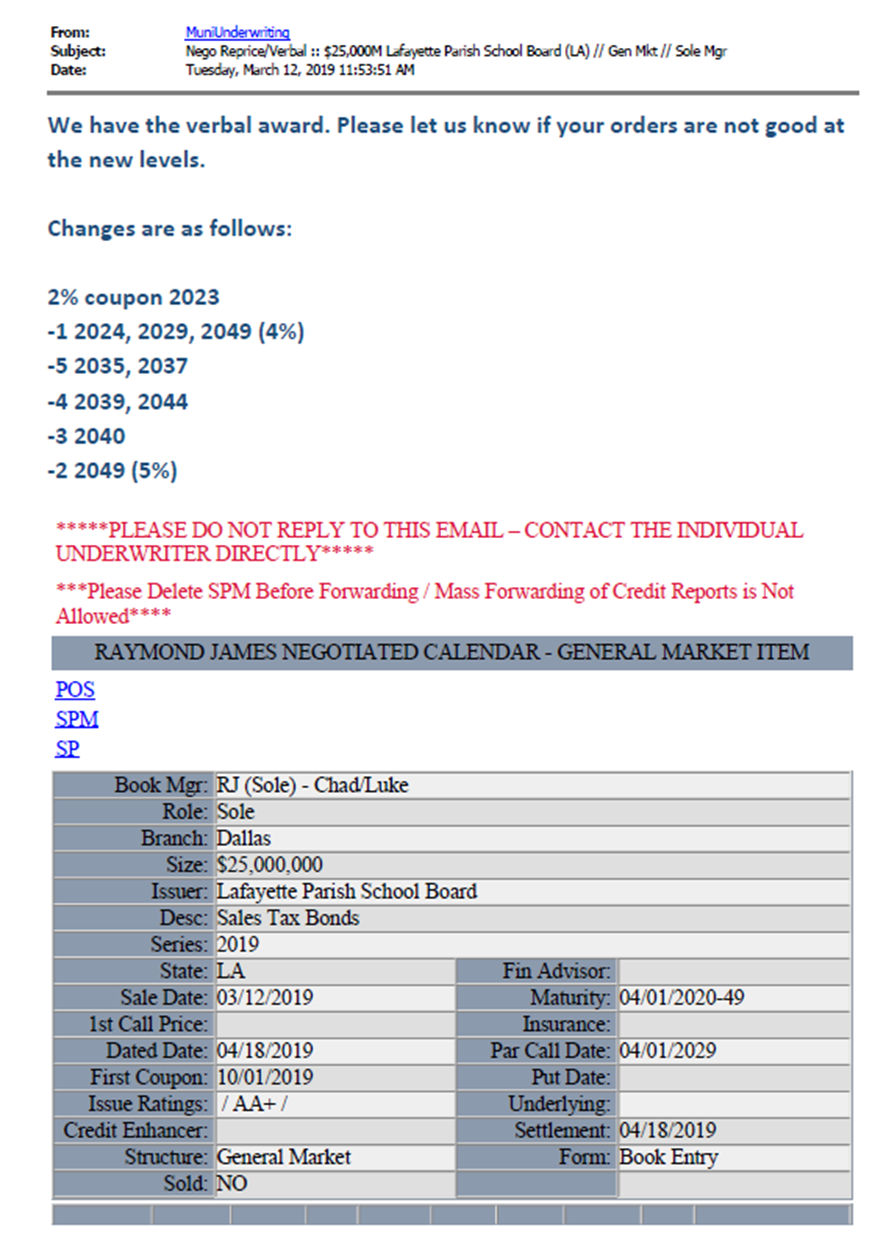

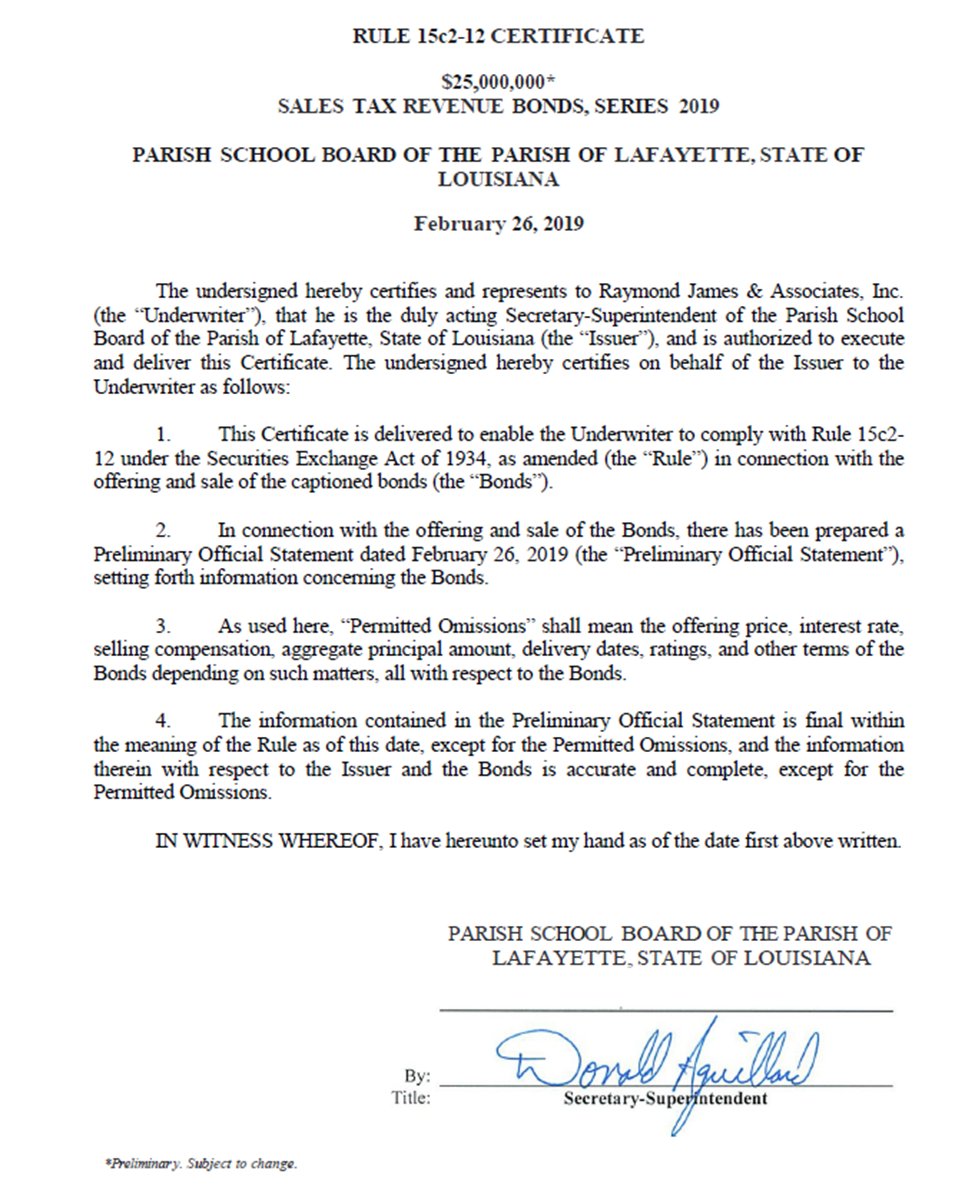

Action (Consent): 4.18 FINANCE: Resolution 04-19-1956 Ratification of Bond Sale-Aguillard/Guidry

Resolution: That the Board approve Resolution 04-19-1956 ratifying the sale of $25,000,000 Sales Tax Revenue Bonds that occurred on Tuesday, March 12, 2019.

The following resolution was offered by Jeremy Hidalgo and seconded by Tommy Angelle:

RESOLUTION 04-19-1956

RATIFICATION OF BOND PURCHASE AGREEMENT

A resolution recognizing and approving the execution of the Bond Purchase Agreement and Official Statement; amending the Prior Resolution to exclude acquiring land without prior approval of State Bond Commission regarding the issuance and sale of Sales Tax Revenue Bonds, Series 2019, of the Parish School Board of the Parish of Lafayette, State of Louisiana; and providing for other matters in connection therewith.

WHEREAS, this Parish School Board of the Parish of Lafayette, State of Louisiana (the "Issuer") adopted a resolution on January 17, 2019 (the "Prior Resolution"), providing for the issuance and sale of Sales Tax Revenue Bonds, Series 2019 (the "Bonds"); and

WHEREAS, the Secretary of the Issuer has executed the Bond Purchase Agreement as authorized by the Prior Resolution; and

WHEREAS, the Issuer now desires to amend the Prior Resolution, excluding the acquisition of land without prior approval from the State Bond Commission; and

WHEREAS, the form of Bond Purchase Agreement contained in the Prior Resolution was complete except for the amount, the maturities and interest rates born by the Bonds, date of the Bond Purchase Agreement, redemption provisions, date of the Preliminary Official Statement, date of delivery, conditions of rating from Standard & Poors Rating Services, signature page, Hold the Offering Price Provisions, Schedules I and II, its Exhibit A and its Schedule A; and

WHEREAS, a copy of the completed Bond Purchase Agreement is attached hereto as Exhibit A.

NOW, THEREFORE, BE IT RESOLVED by the Parish School Board of the Parish of Lafayette, State of Louisiana, that:

SECTION 1. Ratification of Bond Purchase Agreement. The Bond Purchase Agreement has met the parameters set forth in the Prior Resolution and accordingly, its execution and the redemption provisions provided for therein, are hereby ratified and approved.

SECTION 2. Amending the purpose of issuance. The Prior Resolution is hereby amended to preclude the use of Bond Proceeds to acquire real property without the prior approval of the State Bond Commission.

SECTION 3. Official Statement. The Issuer approves the form and content of the final Official Statement and hereby ratifies its execution by the Executive Officers of the Issuer and approves and authorizes delivery of such final Official Statement to the Purchaser (as defined in the Prior Resolution) for use in connection with the public offering of the Bonds.

SECTION 4. Any resolution in conflict herewith is hereby amended to the extent of such conflict.

This resolution having been submitted to a vote, the vote thereon was as follows:

YEAS: Angelle, Broussard, Centanni, Chassion, Hidalgo, Latiolais, Morris

NAYS: None

ABSENT: Knezek, Morrison

And the resolution was declared adopted on this 10th of April, 2019.

/s/ Donald Aguillard /s/ Justin Centanni

Secretary President

EXHIBIT A

BOND PURCHASE AGREEMENT

$25,000,000

SALES TAX REVENUE BONDS, SERIES 2019

OF THE

PARISH SCHOOL BOARD

OF THE

PARISH OF LAFAYETTE, STATE OF LOUISIANA

March 12, 2019

Hon. Parish School Board

Parish of Lafayette

113 Chaplin Drive

Lafayette, La 70502

The undersigned, Raymond James & Associates, Inc., of New Orleans, Louisiana (the "Underwriter"), offers to enter into this agreement with Parish School Board of the Parish of Lafayette, State of Louisiana (the "Issuer"), which, upon your acceptance of this offer, will be binding upon you and upon us.

This offer is made subject to your acceptance of this agreement on or before 11:59 p.m., New Orleans Time, on this date, which acceptance shall be evidenced by your execution of this Bond Purchase Agreement on behalf of the Issuer as a duly authorized official thereof.

Capitalized terms used, but not defined, herein shall have the meanings ascribed to them in the Bond Resolution (as defined below).

1. The Bonds. Upon the terms and conditions and the basis of the respective representations and covenants set forth herein, the Underwriter hereby agrees to purchase from the Issuer, and the Issuer hereby agrees to sell and deliver to the Underwriter, all (but not less than all) of the above‑captioned bonds of the Issuer (the "Bonds"). The purchase price of the Bonds is set forth in Schedule I hereto (the "Purchase Price"). Such Purchase Price shall be paid at the Closing (hereinafter defined) in accordance with Section 7 hereof. The Bonds are to be issued by the Issuer, acting through the Parish School Board of the Parish of Lafayette, State of Louisiana, its governing authority (the "Governing Authority"), under and pursuant to, and are to be secured, on a complete parity with the Outstanding Parity Bonds, (as defined in the resolution adopted by the Governing Authority on January 17, 2019 (the "Bond Resolution")) and payable as set forth in the Bond Resolution. The Bonds are issued pursuant to R.S. 47.338.86, as amended, and other constitutional and statutory authority (the "Act"). The Bonds shall mature on the dates and shall bear interest at the fixed rates, all as described in Schedule II attached hereto. Furthermore, the Bonds and the Outstanding Parity Bonds are entitled to the benefit of a common debt service reserve fund in accordance with the terms of the Bond Resolution, which common reserve fund is being initially funded with bond proceeds.

2. Establishment of Issue Price.

(a) The Underwriter agrees to assist the Issuer in establishing the issue price of the Bonds and shall execute and deliver to the Issuer at Closing a certificate substantially in the form attached hereto as Exhibit A, with such modifications and supporting pricing wires or equivalent communications as may be appropriate or necessary, in the reasonable judgment of the Underwriter, the Issuer and Bond Counsel, to accurately reflect, as applicable, the sales prices or the initial offering prices to the public of the Bonds. All actions to be taken by the Issuer under this section to establish the issue price of the Bonds may be taken on behalf of the Issuer by the Issuer’s municipal advisor, and any notice or report to be provided to the Issuer may be provided to the Issuer’s municipal advisor.

(b)Except as otherwise set forth in Schedule II attached hereto, the Issuer will treat the first price at which 10% of each maturity of the Bonds (the "10% test") is sold to the public as the issue price of that maturity (if different interest rates apply within a maturity, each separate CUSIP number within or bifurcated portion of that maturity will be subject to the 10% test). At or promptly after the execution of this Bond Purchase Agreement, the Underwriter shall report to the Issuer and Bond Counsel the price or prices at which it has sold to the public each maturity of Bonds. If at that time the 10% test has not been satisfied as to any maturity of the Bonds, the Underwriter agrees to promptly report to the Issuer the prices at which it sells the unsold Bonds of that maturity to the public. That reporting obligation shall continue, whether or not on April 18, 2019 (the "Closing Date") has occurred, until either (i) the Underwriter has sold all Bonds of that maturity or (ii) the 10% test has been satisfied as to the Bonds of that maturity, provided that the Underwriter’s reporting obligation after the Closing Date may be at reasonable period intervals or otherwise upon request of the Issuer or bond counsel.

(c) The Underwriter confirms that it has offered the Bonds to the public on or before the date of this Bond Purchase Agreement at the offering prices (the "initial offering price") set forth in Schedule II attached hereto, except as otherwise set forth therein. Schedule II also sets forth, as of the date of this Bond Purchase Agreement, the maturities, if any, of the Bonds for which the 10% test has not been satisfied and for which the Issuer and the Underwriter agree that the restrictions set forth in the next sentence shall apply, which will allow the Issuer to treat the initial offering price to the public of each such maturity as of the sale date as the issue price of that maturity (the "hold-the-offering-price rule"). So long as the hold-the-offering-price rule remains applicable to any maturity of the Bonds, the Underwriter will neither offer nor sell unsold Bonds of that maturity to any person at a price that is higher than the initial offering price to the public during the period starting on the sale date and ending on the earlier of the following:

(1) the close of the fifth (5th) business day after the sale date; or

(2) the date on which the Underwriter has sold at least 10% of that maturity of the Bonds to the public at a price that is no higher than the initial offering price to the public.

The Underwriter shall promptly advise the Issuer when it has sold 10% of that maturity of the Bonds to the public at a price that is no higher than the initial offering price to the public, if that occurs prior to the close of the fifth (5th) business day after the sale date.

(d) The Underwriter confirms that any selling group agreement and any retail distribution agreement relating to the initial sale of the Bonds to the public, together with the related pricing wires, contains or will contain language obligating each dealer who is a member of the selling group and each broker-dealer that is a party to such retail distribution agreement, as applicable, to (A) report the prices at which it sells to the public the unsold Bonds of each maturity allotted to it, whether or not the Closing Date has occurred, until either all Bonds of that maturity allotted to it have been sold or it is notified by the Underwriter that the 10% test has been satisfied as to the Bonds of that maturity, provided that the reporting obligation after the Closing Date may be at reasonable period intervals or otherwise upon request of the Underwriter and (B) comply with the hold-the-offering-price rule, if applicable, if and for so long as directed by the Underwriter. The Issuer acknowledges that, in making the representation set forth in this subsection, the Underwriter will rely on (i) in the event a selling group has been created in connection with the initial sale of the Bonds to the public, the agreement of each dealer who is a member of the selling group to comply with the hold-the-offering-price rule, if applicable, as set forth in a selling group agreement and the related pricing wires, and (ii) in the event that a retail distribution agreement was employed in connection with the initial sale of the Bonds to the public, the agreement of each broker-dealer that is a party to such agreement to comply with the hold-the-offering-price rule, if applicable, as set forth in the retail distribution agreement and the related pricing wires. The Issuer further acknowledges that the Underwriter shall not be liable for the failure of any dealer who is a member of a selling group, or of any broker-dealer that is a party to a retail distribution agreement, to comply with its corresponding agreement regarding the hold-the-offering-price rule as applicable to the Bonds.

(e) The Underwriter acknowledges that sales of any Bonds to any person that is a related party to the Underwriter shall not constitute sales to the public for purposes of this section. Further, for purposes of this section:

(i)"public" means any person other than an underwriter or a related party,

(ii)"underwriter" (when not referring to the Underwriter) means (A) any person that agrees pursuant to a written contract with the Issuer (or with the lead underwriter to form an underwriting syndicate) to participate in the initial sale of the Bonds to the public and (B) any person that agrees pursuant to a written contract directly or indirectly with a person described in clause (A) to participate in the initial sale of the Bonds to the public (including a member of a selling group or a party to a retail distribution agreement participating in the initial sale of the Bonds to the public),

(iii) a purchaser of any of the Bonds is a "related party" to an underwriter if the underwriter and the purchaser are subject, directly or indirectly, to (i) at least 50% common ownership of the voting power or the total value of their stock, if both entities are corporations (including direct ownership by one corporation of another), (ii) more than 50% common ownership of their capital interests or profits interests, if both entities are partnerships (including direct ownership by one partnership of another), or (iii) more than 50% common ownership of the value of the outstanding stock of the corporation or the capital interests or profit interests of the partnership, as applicable, if one entity is a corporation and the other entity is a partnership (including direct ownership of the applicable stock or interests by one entity of the other), and

(iv) "sale date" means the date of execution of this Bond Purchase Agreement by all parties.

3. Representative. The individual signing on behalf of the Underwriter below is duly authorized to execute this Bond Purchase Agreement on behalf of the Underwriter.

4. Preliminary Official Statement and Official Statement. The Issuer hereby ratifies and approves the lawful use of the Preliminary Official Statement, dated February 26, 2019, relating to the Bonds (the "Preliminary Official Statement") by the Underwriter prior to the date hereof and authorizes and approves the Official Statement and other pertinent documents referred to in Section 8 hereof to be lawfully used in connection with the offering and sale of the Bonds. The Issuer has previously provided the Underwriter with a copy of the Preliminary Official Statement. As of its date, the Preliminary Official Statement has been deemed final by the Issuer for purposes of SEC Rule 15c2-12 (the "Rule") under the Securities Exchange Act of 1934, as amended.

The Issuer has delivered a certificate to the Underwriter, dated April 18, 2019, to evidence compliance with the Rule to the date hereof, a copy of which is attached hereto as Exhibit B.

The Issuer, within seven (7) business days of the date hereof, shall deliver to the Underwriter sufficient copies of the Official Statement dated the date hereof relating to the Bonds, executed on behalf of the Issuer by the duly authorized officer(s) of the Governing Authority (the "Official Statement"), as the Underwriter may reasonably request as necessary to comply with paragraph (b)(4) of the Rule, with Rule G-32 and with all other applicable rules of the Municipal Securities Rulemaking Board (the "MSRB").

The Issuer hereby covenants that, if during the period ending on the 25th day after the "End of the Underwriting Period" (as defined in the Rule), or such other period as may be agreed to by the Issuer and the Underwriter, any event occurs of which the Issuer has actual knowledge and which would cause the Official Statement to contain an untrue statement of material fact or to omit to state a material fact necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading, the Issuer shall notify the Underwriter in writing, and if, in the reasonable opinion of the Underwriter, such event requires an amendment or supplement to the Official Statement, the Issuer promptly will amend or supplement, or cause to be amended or supplemented, the Official Statement in a form and in a manner approved by the Underwriter and consented to by the Issuer so that the Official Statement, under such caption, will not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in light of the circumstances existing at the time the Official Statement is delivered to a purchaser, not misleading. If such notification shall be given subsequent to the date of Closing, the Issuer also shall furnish, or cause to be furnished, such additional legal opinions, certificates, instruments and other documents as the Underwriter may reasonably deem necessary to evidence the truth and accuracy of any such supplement or amendment to the Official Statement.

5. Additional Requirements of the Issuer and Underwriter. The Underwriter agrees to promptly file a copy of the final Official Statement, including any supplements prepared by the Issuer as required herein, with the MSRB through the operation of the Electronic Municipal Market Access repository within one (1) business day after receipt from the Issuer, but by no later than the date of Closing, in such manner and accompanied by such forms as are required by the MSRB, in accordance with the applicable MSRB Rules, and shall maintain such books and records as required by MSRB Rules with respect to filing of the Official Statement. If an amended Official Statement is prepared in accordance with Section 4 during the "new issue disclosure period" (as defined in the Rule), and if required by applicable SEC or MSRB Rule, the Underwriter also shall make the required filings of the amended Official Statement.

The Issuer covenants and agrees to enter into a Continuing Disclosure Certificate to be dated the date of Closing (the "Continuing Disclosure Certificate") constituting an undertaking (an "Undertaking") to provide ongoing disclosure about the Issuer for the benefit of Bondholders as required by the Rule, in the form as set forth in the Preliminary Official Statement, with such changes as may be agreed to by the Underwriter.

The Issuer hereby further covenants and agrees to enter into the Tax Compliance Certificate in the form required by Bond Counsel (the "Tax Certificate") on the date of the Closing.

6. Representations of the Issuer. The Issuer hereby represents to the Underwriter as follows:

(a)The Issuer has duly authorized, or prior to the delivery of the Bonds the Issuer will duly authorize, all necessary action to be taken by it for (i) the sale of the Bonds upon the terms set forth herein and in the Official Statement; (ii) the approval and signing of the Official Statement by a duly authorized officer of the Issuer; and (iii) the execution, delivery and receipt of this Bond Purchase Agreement and any and all such other agreements and documents as may be required to be executed, delivered and received by the Issuer in order to carry out, give effect to, and consummate the transactions contemplated hereby, by the Bonds, the Official Statement, and the Bond Resolution;

(b) The information contained in the Preliminary Official Statement does not contain any untrue statement of material fact and does not omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they were made, not misleading; and the information to be contained in the Official Statement, as of its date and the date of Closing, will not contain any untrue statement of material fact and will not omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they are made, not misleading;

(c) To the knowledge of the Issuer there is no action, suit, proceeding, inquiry or investigation at law or in equity or before or by any court, public board or body pending against or affecting the Issuer or the Governing Authority or threatened against or affecting the Issuer or the Governing Authority (or, to the knowledge of the Issuer, any basis therefor) contesting the due organization and valid existence of the Issuer or the Governing Authority or the validity of the Act or wherein an unfavorable decision, ruling or finding would adversely affect the transactions contemplated hereby or by the Official Statement or the validity or due adoption of the Bond Resolution or the validity, due authorization and execution of the Bonds, this Bond Purchase Agreement or any agreement or instrument to which the Issuer is a party and which is used or contemplated for use in the consummation of the transaction contemplated hereby or by the Official Statement, except as disclosed in the Official Statement;

(d) The authorization, execution and delivery by the Issuer of the Official Statement, this Bond Purchase Agreement, and the other documents contemplated hereby and by the Official Statement, and compliance by the Issuer with the provisions of such instruments, do not and will not conflict with or constitute on the part of the Issuer a breach of or a default under any (i) statute, indenture, ordinance, resolution, mortgage or other agreement by which the Issuer is bound; (ii) provisions of the Louisiana Constitution of 1974, as amended; or (iii) existing law, court or administrative regulation, decree or order by which the Issuer or its properties are or, on the date of Closing, will be bound;

(e) All consents of and notices to or filings with governmental authorities necessary for the consummation by the Issuer of the transactions described in the Official Statement, the Bond Resolution, and this Bond Purchase Agreement (other than such consents, notices and filings, if any, as may be required under the securities or blue sky laws of any federal or state jurisdiction) required to be obtained or made have been obtained or made or will be obtained or made prior to delivery of the Bonds;

(f) The Issuer agrees to cooperate with the Underwriter and its counsel in any endeavor to qualify the Bonds for offering and sale under the securities or blue sky laws of such jurisdictions of the United States as the Underwriter may reasonably request; provided, however, that the Issuer shall not be required to register as a dealer or a broker in any such state or jurisdiction, qualify as a foreign corporation or file any general or specific consents to service of process under the laws of any state, or submit to the general jurisdiction of any state. The Issuer consents to the lawful use of the Preliminary Official Statement and the Official Statement by the Underwriter in obtaining such qualifications. No member of the Governing Authority, or any officer, employee or agent of the Issuer shall be individually liable for the breach of any representation or covenant made by the Issuer; and

(g) The Issuer acknowledges and agrees that (i) the purchase and sale of the Bonds pursuant to this Bond Purchase Agreement is an arm's-length commercial transaction between the Issuer and the Underwriter; (ii) in connection with such transaction, including the process leading thereto, the Underwriter's primary role, as an underwriter, is to purchase the Bonds for resale to investors, and the Underwriter is acting solely as a principal and not as an agent, municipal advisor, financial advisor or as a fiduciary of or to the Issuer; (iii) the Underwriter has neither assumed an advisory or fiduciary responsibility in favor of the Issuer with respect to the offering of the Bonds or the process leading thereto (whether or not the Underwriter, or any affiliate of the Underwriter, has advised or is currently advising the Issuer on other matters) nor has it assumed any other obligation to the Issuer except the obligations expressly set forth in this Bond Purchase Agreement; (iv) the Underwriter has financial and other interests that differ from those of the Issuer; and (v) the Issuer has consulted with its own legal, accounting, tax, financial and other advisors, as applicable, to the extent it has deemed appropriate in connection with the offering of the Bonds.

7. Delivery of, and Payment for, the Bonds. At 10:00 a.m., New Orleans Time, on April 18, 2019, or at such other time or date as shall have been mutually agreed upon by the Issuer and the Underwriter, the Issuer will deliver, or cause to be delivered, to the Underwriter, the Bonds, in definitive form as fully registered bonds bearing CUSIP numbers (provided neither the printing of a wrong CUSIP number on any Bond nor the failure to print a CUSIP number thereon shall constitute cause to refuse delivery of any Bond) registered in the name of Cede & Co., as nominee for The Depository Trust Company ("DTC"), duly executed and registered by Argent Trust Company, Ruston, Louisiana (the "Paying Agent"), together with the other documents hereinafter mentioned and the other moneys required by the Bond Resolution to be provided by the Issuer and, subject to the conditions contained herein, the Underwriter will accept such delivery and pay the purchase price of the Bonds in Federal Funds for the account of the Issuer.

Delivery of the Bonds as aforesaid shall be made at the offices of Foley & Judell, L.L.P., in New Orleans, Louisiana ("Bond Counsel"), or such other place as may be agreed upon by the Underwriter and the Issuer. Such delivery against payment of the Purchase Price therefor at the time listed above is herein called the "Closing." The Bonds will be delivered initially as fully registered bonds, one bond representing each CUSIP number of the Bonds, and registered in such names as the Underwriter may request not less than three business days prior to the Closing (or if no such instructions are received by the Paying Agent, in the name of the Underwriter).

8. Certain Conditions To Underwriter's Obligations. The obligations of the Underwriter hereunder shall be subject to the performance by the Issuer of its obligations to be performed hereunder, and to the following conditions:

(a) At the time of Closing, (i) the Bond Resolution shall have been adopted and shall be in full force and effect and shall not have been amended, modified or supplemented except as may have been agreed to by the Underwriter, (ii) the Bonds shall have been approved by the State Bond Commission and shall have been duly authorized, executed, authenticated and delivered, (iii) the Issuer shall perform or have performed all of its obligations under or specified in any instruments or documents related to the Bonds (collectively, the "Bond Documents") to be performed by it at or prior to the Closing and the Underwriter shall have received evidence thereof, and (iv) there shall have been duly adopted and there shall be in full force and effect such ordinances or resolutions as, in the opinion of Bond Counsel, shall be necessary in connection with the transactions contemplated hereby; and

(b)At or prior to the Closing, (i) the Underwriter shall have received each of the following:

(1) the approving opinion of Bond Counsel, dated the date of the Closing, in the form attached to the Official Statement;

(2) a supplemental opinion of Bond Counsel in substantially the form attached as Exhibit C hereto, dated the date of the Closing, addressed to the Issuer and the Underwriter, which supplemental opinion shall include, among other things, an opinion of Bond Counsel that the Bond Resolution and each of the Bond Documents constitute the valid and binding obligations of the Issuer, enforceable against the Issuer in accordance with their respective terms;

(3) certificates of the Issuer dated the date of the Closing, executed by authorized officers in form and substance reasonably satisfactory to the Underwriter, to the effect that (a) the representations of the Issuer herein and in the other Bond Documents are true and correct in all material respects as of the date of the Closing, (b) all obligations required under or specified in this Bond Purchase Agreement or in the other Bond Documents to be performed by the Issuer on or prior to the date of the Closing have been performed or waived, (c) the Issuer is in compliance in all respects with all the covenants, agreements, provisions and conditions contained in the Bond Documents to which the Issuer is a party which are to have been performed and complied with by the Issuer by the date of the Closing, and (d) the Issuer's execution of and compliance with the provisions of the Bond Documents will not conflict or constitute on the part of the Issuer a breach of or a default under any existing law, court or administrative regulation, decree or order or any other agreement, indenture, mortgage, loan or other instrument to which the Issuer is subject or by which it is bound;

(4) Evidence that Form 8038-G has been or shall be filed with the Internal Revenue Service with respect to the Bonds;

(5) the Tax Certificate containing provisions required by Bond Counsel under the Internal Revenue Code of 1986, as amended, signed by the duly authorized representative of the Issuer;

(6) the Official Statement, together with any supplements or amendments thereto in the event it has been supplemented or amended, executed on behalf of the Issuer by the duly authorized officer(s) thereof;

(7) a specimen of the Bonds;

(8) certified copies of the Bond Resolution and all other actions of the Issuer and the State Bond Commission relating to the issuance and/or sale of the Bonds, as applicable;

(9) a certificate of a duly authorized officer of the Issuer, reasonably satisfactory to the Underwriter, dated the date of Closing, stating that such officer is charged, either alone or with others, with the responsibility for issuing the Bonds; setting forth, in the manner required by Bond Counsel, the reasonable expectations of the Issuer as of such date as to the use of proceeds of the Bonds and of any other funds of the Issuer expected to be used to pay principal or interest on the Bonds and the facts and estimates on which such expectations are based; and stating that, to the best of the knowledge and belief of the certifying officer, the Issuer's expectations are reasonable;

(10) a certificate of the Paying Agent as to its corporate capacity to act as such, the incumbency and signatures of authorized officers, and its due registration of the Bonds delivered at the Closing by an authorized officer;

(11) a rating letter from S&P Global Ratings, acting through Standard & Poor’s Financial Services LLC, providing for the following rating(s) on the Bonds:

Underlying: "AA+"/stable outlook; and

(12) other certificates of the Issuer required in order for Bond Counsel to deliver the opinions referred to in Sections 8(b)(i)(1) and 8(b)(i)(2) of this Bond Purchase Agreement and such additional legal opinions, certificates, proceedings, instruments and other documents as Bond Counsel may reasonably request to evidence compliance by the Issuer with applicable legal requirements, the truth and accuracy, as of the time of Closing, of their respective representations contained herein, and the due performance or satisfaction by them at or prior to such time of all agreements then to be performed and all conditions then to be satisfied by each; and

(13) executed copies of each of the Bond Documents not listed above in this Section 8(b)(i).

(ii) All such opinions, certificates, letters, agreements and documents under Section 8(b)(i) will be in compliance with the provisions hereof only if they are reasonably satisfactory in form and substance to the Underwriter. The Issuer will furnish the Underwriter with such conformed copies or photocopies of such opinions, certificates, letters, agreements and documents relating to the Bonds as the Underwriter may reasonably request.

9. Effect of Termination. If the Issuer shall be unable to satisfy one or more of the conditions to the obligations of the Underwriter contained in this Bond Purchase Agreement and any such condition is not waived by the Underwriter, or if this Bond Purchase Agreement shall otherwise be terminated pursuant to Section 10 or Section 11 below, then the respective obligations hereunder of the Issuer and the Underwriter shall be cancelled and neither the Underwriter nor the Issuer shall be under further obligation hereunder, except that the Issuer and the Underwriter shall pay their respective expenses as provided in Section 13 hereof. Notwithstanding the foregoing, in order for either party to terminate or cancel its obligation to purchase or sell the Bonds as set forth herein, it must notify the other party in writing of its election to do so not less than 48 hours before the time for the Closing set forth in Section 7 hereof.

10. Termination by Underwriter. The Underwriter shall have the right to cancel its obligation to purchase the Bonds and terminate this Bond Purchase Agreement by written notice to the Issuer in accordance with Section 9 hereof, if, between the date hereof and the Closing, any of the following events shall occur: (i) legislation shall be enacted or favorably reported for passage to either House of the Congress by any committee of such House to which such legislation has been referred for consideration, or such legislation shall have been recommended to the Congress for passage by the President of the United States or a member of the President's Cabinet, a decision by a court of the United States or the United States Tax Court shall be rendered, or a ruling, regulation or statement by or on behalf of the Treasury Department of the United States, the Internal Revenue Service or other governmental agency shall be made or proposed to be made with respect to the federal taxation upon interest on obligations of the general character of the Bonds, or other action or events shall have transpired which may have the purpose or effect, directly or indirectly, of adversely changing the federal income tax consequences of any of the transactions contemplated in connection herewith, and, in the reasonable opinion of the Underwriter, materially adversely affects the market price of the Bonds, or the market price generally of obligations of the general character of the Bonds, except as may be described in the Official Statement, (ii) there shall exist any event which in the Underwriter's reasonable judgment either (a) makes untrue or incorrect in any material respect any statement or information contained in the Official Statement or (b) is not reflected in the Official Statement but should be reflected therein in order to make the statements and information contained therein not misleading in any material respect, (iii) there shall have occurred any outbreak of hostilities or any national or international calamity or crisis including financial crisis, or a default with respect to the debt obligations of, or the institution of proceedings under federal or state bankruptcy laws by or against the Issuer, the effect of which on the financial markets of the United States being such as, in the reasonable judgment of the Underwriter, would make it impracticable for the Underwriter to market the Bonds or to enforce contracts for the sale of the Bonds, (iv) there shall be in force a general suspension of trading on the New York Stock Exchange, (v) a general banking moratorium shall have been declared by either federal, Louisiana or New York state authorities, (vi) there shall have occurred since the date of this Bond Purchase Agreement any material adverse change in the affairs of the Issuer, except for changes which the Official Statement discloses have occurred or may occur, (vii) any rating on the Bonds, on any of the Outstanding Parity Bonds, or on the Insurer is reduced or withdrawn or placed on credit watch with negative outlook by any major credit rating agency, (viii) legislation shall be enacted or any action shall be taken by the Securities and Exchange Commission which, in the opinion of Bond Counsel, has the effect of requiring the contemplated distribution of the Bonds to be registered under the Securities Act of 1933, as amended, or the Bond Resolution, or any other document executed in connection with the transactions contemplated hereof to be qualified under the Trust Indenture Act of 1939, as amended, (ix) a stop order, ruling, regulation or official statement by or on behalf of the Securities and Exchange Commission shall be issued or made to the effect that the issuance, offering or sale of the Bonds, or of obligations of the general character of the Bonds as contemplated hereby, or the offering of any other obligation which may be represented by the Bonds is in violation of any provision of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, or the Trust Indenture Act of 1939, as amended, or (x) any state blue sky or securities commission shall have withheld registration, exemption or clearance of the offering, and in the reasonable judgment of the Underwriter the market for the Bonds is materially affected thereby.

11. Termination by Issuer. Notwithstanding anything herein to the contrary, the Issuer shall have the right to cancel its obligation to sell the Bonds if, between the date hereof and the Closing, the Issuer determines that the Underwriter has failed to comply with its obligations contained in Section 2 hereof with respect to the establishment of the issue price of any maturity of the Bonds.

12. Survival of Representations. All representations and agreements of the Issuer and the Underwriter hereunder shall remain operative and in full force and effect, and shall survive the delivery of the Bonds and any termination of this Bond Purchase Agreement by the Underwriter pursuant to the terms hereof.

13. Payment of Expenses. (a) If the Bonds are sold to the Underwriter by the Issuer, the Issuer shall pay, from the proceeds of the Bonds, any reasonable expenses incidental to the performance of its obligations hereunder, including but not limited to: (i) State Bond Commission fees; (ii) the cost of the preparation, printing and distribution of the Preliminary Official Statement and the Official Statement; (iii) the cost of the preparation of the printed Bonds; (iv) any rating agency fees; (v) the fees and expenses of Bond Counsel, the Paying Agent, the Municipal Advisor, any other experts or consultants retained by the Issuer.

(b) The Underwriter shall pay (i) all advertising expenses in connection with the public offering of the Bonds; (ii) the cost of preparing and printing the blue sky and legal investment memoranda, if any; (iii) filing fees in connection with the aforesaid blue sky and legal investment memoranda; (iv) the cost of obtaining CUSIP numbers for the bonds; and (v) all other expenses incurred by the Underwriter (including the cost of any Federal Funds necessary to pay the purchase price of the Bonds) in connection with its public offering.

14. Indemnification and Contribution. (a) To the extent permitted by applicable laws, the Issuer shall indemnify, reimburse and hold harmless the Underwriter and each of its directors, trustees, partners, members, officers, affiliate agents and employees and each Person who controls the Underwriter within the meaning of Section 15 of the Securities Act of 1933, as amended, or Section 20(a) of the Securities Exchange Act of 1934, as amended, against any and all losses, claims, damages, liabilities or expenses, joint or several, to which such indemnified party may become subject under any statute or at law or in equity or otherwise, and shall reimburse any such indemnified party for any legal or other expenses incurred by it in connection with investigating any claims against it and defending any actions, insofar as such losses, claims, damages, liabilities or expenses arise out of or are based upon (i) a claim in connection with the public offering of the Bonds to the effect that the Bonds are required to be registered under the Securities Act of 1933, as amended, or that the Bond Resolution is required to be qualified under the Trust Indenture Act of 1939, as amended, or (ii) any untrue statement or alleged untrue statement of a material fact contained in the Preliminary Official Statement or in the Official Statement, including any amendment or supplement thereto, or the omission or alleged omission to state therein a material fact necessary to make such statements not misleading. The foregoing indemnity agreement shall be in addition to any liability that the Issuer otherwise may have.

(b) The Underwriter shall indemnify and hold harmless the Issuer and its officers and employees to the same extent as the foregoing indemnity from the Issuer to the Underwriter, but only with reference to written information relating to the Underwriter furnished by it specifically for inclusion in the Preliminary Official Statement and the Official Statement. This indemnity agreement will be in addition to any liability which the Underwriter may otherwise have. The Issuer acknowledges that the statements set forth under the heading "UNDERWRITING," in the Preliminary Official Statement and the Official Statement, constitute the only information furnished in writing by or on behalf of the Underwriter for inclusion in the Preliminary Official Statement or the Official Statement.

(c) In case any proceeding (including any governmental investigation) shall be instituted by or against an indemnified party pursuant to paragraphs (a) or (b) above, such party shall promptly notify the indemnifying party against whom such indemnity may be sought in writing, and the indemnifying party upon request of the indemnified party, shall retain counsel reasonably satisfactory to the indemnified party to represent the indemnified party and any others the indemnifying party may designate who are or may reasonably be foreseen to be a party in such proceeding and shall pay the fees and disbursements of such counsel to the extent allowed by appropriate law. Any separate counsel retained by such indemnified party shall be at the expense of such indemnified party unless (i) the indemnifying party and the indemnified party shall have mutually agreed to the retention of such counsel or (ii) representation of both parties by the same counsel would be inappropriate due to actual or potential differing interests between them. It is understood that the indemnifying party shall not, in connection with any proceeding or related proceedings in the same jurisdiction, be liable for the fees and expenses of more than one separate firm for each such indemnified party (to the extent clause (ii) of the preceding sentence is applicable), and that all such fees and expenses shall be reimbursed as they are incurred. The Underwriter in the case of parties indemnified pursuant to paragraph (b) shall discuss with the other indemnifying parties possible counsel and mutually satisfactory counsel shall be agreed upon. The indemnifying party shall not be liable for any settlement of any proceeding affected without its written consent, but if settled with such consent or if there be a final judgment for the plaintiff, the indemnifying party agrees to indemnify or reimburse the indemnified party from and against any loss or liability by reason of such settlement or judgment. No indemnifying party shall, without the prior written consent of the indemnified party, effect any settlement of any pending or threatened proceeding in respect of which any indemnified party is a party and indemnity could have been sought hereunder by such indemnified party, unless such settlement includes an unconditional release of such indemnified party from all liability on claims that are the subject matter of such proceeding.

15. Notices. Any notice or other communication to be given to the Issuer under this Bond Purchase Agreement may be given by delivering the same in writing at the address of the Issuer set forth above, and any notice or other communication to be given to the Underwriter under this Bond Purchase Agreement may be given by delivering the same in writing to Raymond James & Associates, Inc., 909 Poydras Street, Ste. 1300, New Orleans, LA 70112.

16. Parties. This Bond Purchase Agreement is made solely for the benefit of the Issuer and the Underwriter (including the successors or assigns of either) and no other person shall acquire or have any right hereunder or by virtue hereof.

17. Governing Law. This Bond Purchase Agreement shall be governed by and construed in accordance with the laws of the State of Louisiana.

18. General. This Bond Purchase Agreement may be executed in several counterparts, each of which shall be regarded as an original and all of which will constitute one and the same instrument. The section headings of this Bond Purchase Agreement are for convenience of reference only and shall not affect its interpretation. This Bond Purchase Agreement shall become effective upon your acceptance hereof.

By its execution hereof, the Underwriter agrees that no officer or employee of the Issuer or the Governing Authority shall be personally liable for the payment of any claim or the performance of any obligation of the Issuer.

Very truly yours,

RAYMOND JAMES & ASSOCIATES, INC.

By: _________________________________

Title: Managing Director

Accepted and agreed to as of

the date first above written:

PARISH SCHOOL BOARD OF THE PARISH

OF LAFAYETTE, STATE OF LOUISIANA

By: _____________________________________________

Secretary, Lafayette Parish School Board

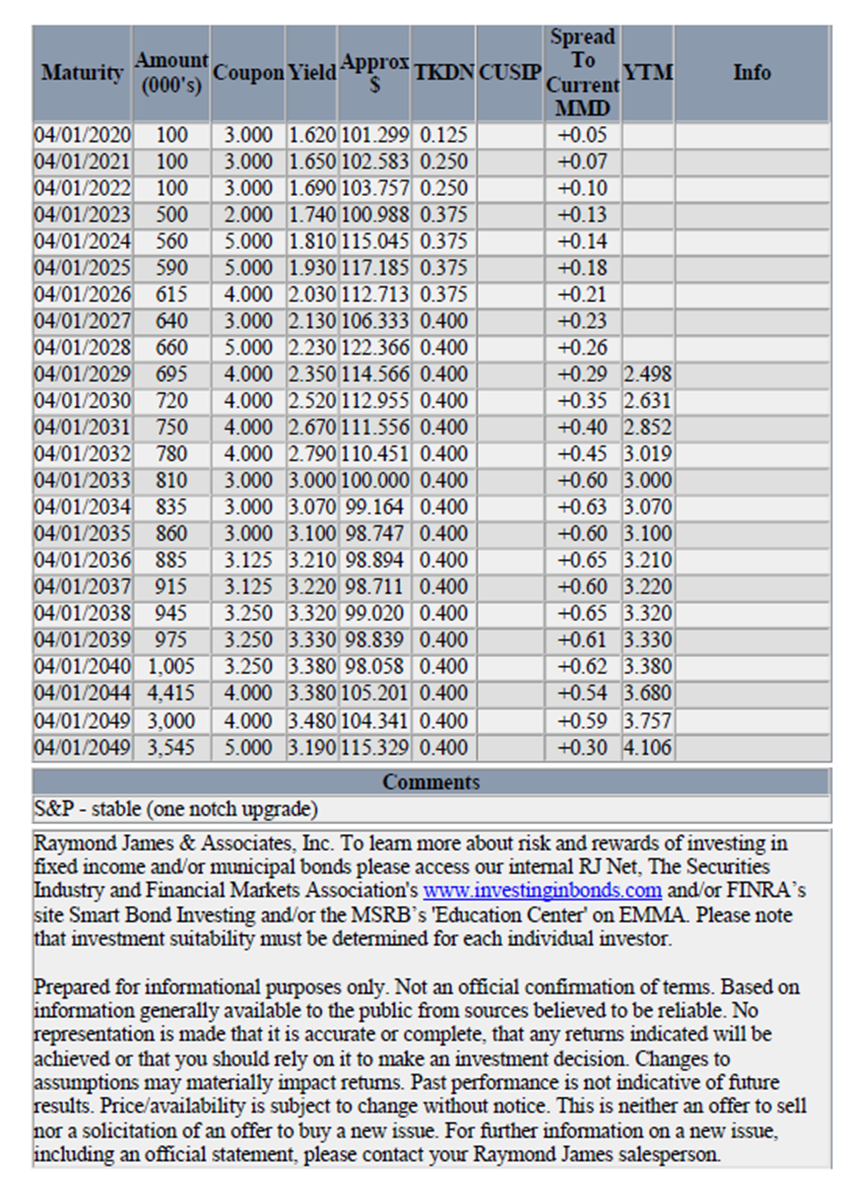

SCHEDULE I

To Bond Purchase Agreement

Purchase Price

Par Amount of Bonds $25,000,000

Less: Underwriter's Discount (0.650%) ($162,500)

Plus: Reoffering Premium $1,651,082.25

PURCHASE PRICE $26,488,582.25

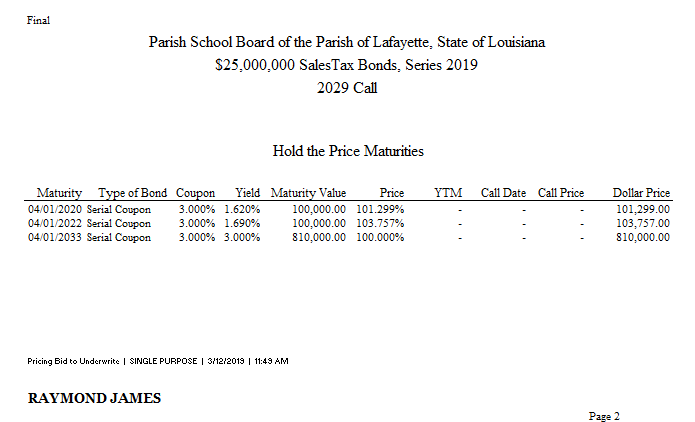

SCHEDULE II

To Bond Purchase Agreement

|

MATURITY (April 1) |

PRINCIPAL AMOUNT DUE |

INTEREST RATE |

REOFFERING PRICE |

|

2020** |

$100,000 |

3.000% |

101.299 |

|

2021 |

100,000 |

3.000 |

102.583 |

|

2022** |

100,000 |

3.000 |

103.757 |

|

2023 |

500,000 |

2.000 |

100.988 |

|

2024 |

560,000 |

5.000 |

115.045 |

|

2025 |

590,000 |

5.000 |

117.185 |

|

2026 |

615,000 |

4.000 |

112.713 |

|

2027 |

640,000 |

3.000 |

106.333 |

|

2028 |

660,000 |

5.000 |

122.366 |

|

2029 |

695,000 |

4.000 |

114.566 |

|

2030 |

720,000 |

4.000 |

112.955* |

|

2031 |

750,000 |

4.000 |

111.556* |

|

2032 |

780,000 |

4.000 |

110.451* |

|

2033** |

810,000 |

3.000 |

100.000 |

|

2034 |

835,000 |

3.000 |

99.164 |

|

2035 |

860,000 |

3.000 |

98.747 |

|

2036 |

885,000 |

3.125 |

98.894 |

|

2037 |

915,000 |

3.125 |

98.711 |

|

2038 |

945,000 |

3.250 |

99.020 |

|

2039 |

975,000 |

3.250 |

98.839 |

|

2040 |

1,005,000 |

3.250 |

98.058 |

|

2044 |

4,415,000 |

4.000 |

105.201* |

|

2049 |

3,545,000 |

5.000 |

115.329* |

|

2049 |

3,000,000 |

4.000 |

104.341* |

* Priced to call date.

** The 2020, 2022, and 2033 maturities are hold-the-offering-price rule maturities, all other maturities are 10% test or general rule maturities.

Optional Call Redemption Provisions. The Bonds maturing on or after April 1, 2030, and thereafter, shall be callable for redemption at the option of the Issuer in full or in part at any time on or after April 1, 2029 at the principal amount thereof of each Bond to be called for maturity, plus accrued interest from the most recent Interest Payment Date to which interest has been paid or duly provided for. Such Bonds are not required to be redeemed in inverse order of their maturities.