Lafayette Parish School Board

Regular Board Meeting

REVISION #2

(Wednesday, July 18, 2018)

Meeting called to order at 5:30 PM

Members present

Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

Members absent

Tommy Angelle

1. MEETING OPENINGS

Procedural: 1.1 Pledge of Allegiance to the Flag of the United States of America

Procedural: 1.2 Moment of Silence

Action: 1.3 Addition(s) to the Agenda

That the Board add to the agenda SRO Agreement Update.

Motion by Erick Knezek, second by Justin Centanni.

Final Resolution: Motion Carries

Yes: Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

Absent: Tommy Angelle

Procedural: 1.4 Opening Comments – Superintendent

Superintendent Aguillard stated that the beginning of the 2018-19 school year is rapidly approaching and students will be reporting to school in about 3 weeks; high school and middle school principals have officially reported to work, and elementary principals will report to school on July 19, 2018.

He informed the Board of the appointment of eight new principals being introduced later during the meeting; and that the Human Resources Department has hired over 130 new employees and facilitated the transfer of over 200 current employees to various positions. He also informed the Board that staff had been preparing for the upcoming school year and invited Board Members to attend the yearly Administrators Conference scheduled on July 23-24, 2018 at Southside High School. Eric Sheninger is the keynote speaker for the event.

The Superintendent congratulated the Comeaux High Speech and Debate Team and their sponsor Mr. Jacob Simon for making it to finals and placing: Rashon Leday and Jacob Foster (sophomores) - 4th Place in Duo Interpretation; Emily Guidry (junior)-3rd Place in Program Oral Interpretation and Paige Allbright (senior)-2nd Place in Prose Reading.

In closing, The Superintendent reminded everyone that the monthly Making the Grade Newsletter will resume and scheduled for release in August.

2. INFORMATION ITEMS

Information: 2.1 FACILITIES: Billeaud Elementary School Change Order for Additional Classrooms - Aguillard/Bordelon

Kyle Bordelon, Director of Planning and Facilities, provided the Board with information regarding the change order for additional classrooms at Billeaud Elementary School. He also stated that during the design of the new Billeaud Elementary School, the number of classrooms was reduced in order to keep the construction cost within the budgeted funding. After the bids were received, the construction cost for the low bid was significantly lower than the anticipated cost of the project.

Information: 2.2 FINANCE: List of Bids Approved to be Advertised by the Superintendent - Aguillard/Craig/Guidry/Francis

As per Administrative Guidelines for Board Meetings effective January 12, 2017, Dr. Aguillard approved advertisement of the following bids during the time frame of June 11, 2018 - July 13, 2018: Bid# 35-19 Used SPED Buses (Diesel, 30 seated + 3 wheelchair); Bid# 36-19 New SPED Buses (Gasoline, 30 seated + 3 wheelchair).

Information: 2.3 HUMAN RESOURCES: Personnel Changes for July 18, 2018

New Employees

|

Name |

Location |

Position |

Eff. Date |

Fund |

Note |

Req. # |

|

Abraham, Lea |

Live Oak ES |

Teacher - 4th |

08/01/18 |

01 |

New Position |

#5086 |

|

Alexander, Larry |

Career and Technical Education |

Director |

07/02/18 |

01 |

Replacing Robin Olivier |

#5343 |

|

Aulds, Kourtney |

Evangeline ES |

Teacher - 2nd |

08/01/18 |

01 |

Replacing Paige Vincent |

#5351 |

|

Barbier, Kourtney |

David Thibodeaux HS |

Teacher - HS ELA |

08/01/18 |

01 |

Replacing Courtney Robert |

#5406 |

|

Bell, Shequita |

Lafayette MS |

Teacher - Math |

08/01/18 |

01 |

Replacing Joan Ledet |

#5281 |

|

Benoit, Brittney |

Northside HS |

Teacher - ELA |

08/01/18 |

01 |

Replacing Marisha Batiste |

#5335 |

|

Berrio, Manuel |

Maintenance |

Electrician I |

07/02/18 |

01 |

Replacing Joshua Norris |

#4868 |

|

Blanchard, Lacey |

GT Lindon ES |

SPED Para |

08/01/18 |

01 |

Replacing Miriam Davis |

#5040 |

|

Boagni, Alyshia |

Evangeline ES |

Counselor |

07/30/18 |

01 |

Replacing Deirdra Batiste |

#4980 |

|

Bourque, Eva |

Ernest Gallet ES |

SPED Para |

08/01/18 |

01 |

Replacing Erin Richard |

#5452 |

|

Bowen, Connie |

Alice Boucher ES |

Teacher - 2nd |

08/01/18 |

01 |

Replacing Lainie Laughlin |

#5052 |

|

Boxie, Gabrielle |

Northside HS |

Teacher - Business |

08/01/18 |

01 |

Replacing Jason Herbstler |

#5334 |

|

Breaux, Faith |

Magnet Academies |

Clerical Assistant |

07/16/18 |

01 |

Replacing Amy Mouton |

#4865 |

|

Breland, Brandy |

Live Oak ES |

Teacher - 2nd |

08/01/18 |

01 |

Replacing Myra Johnson |

#5213 |

|

Broussard, Alexis |

Live Oak ES |

Speech Therapist |

09/01/18 |

01 |

Replacing Lynette Peterson |

#4964 |

|

Broussard, Havana |

Lafayette MS |

Teacher - Alt. ELA |

08/01/18 |

01 |

Replacing Mindy Chiasson |

#5374 |

|

Brown, Eboni |

Live Oak ES |

Teacher - 5th |

08/01/18 |

01 |

Replacing Cassie Semmes |

#5215 |

|

Caudill, Tiffany |

Westside ES |

Teacher -1st |

08/01/18 |

01 |

Replacing Rachel Hymel |

#5439 |

|

Chapman, Claire |

E. A. Martin MS |

Teacher - 5th |

08/01/18 |

01 |

Replacing Amy Muller |

#5391 |

|

Comeaux, David |

Comeaux HS |

Teacher - JTC |

08/01/18 |

01 |

Replacing Andrew Blaize |

#4975 |

|

Courville, Michael |

Carencro HS |

Teacher - Career Foundations |

08/01/18 |

01 |

Replacing Larry Breaux |

#5184 |

|

Credeur, Kallie |

Paul Breaux MS |

Teacher - Social Studies |

08/01/18 |

01 |

Replacing Karen Latiolais |

#5322 |

|

David, Alyson |

Youngsville MS |

Teacher - Math |

08/01/18 |

01 |

Replacing Erin Wooten |

#5036 |

|

Delahoussaye, Claire |

Ridge ES |

Speech Therapist |

08/01/18 |

01 |

Replacing Kate Darnall |

#5091 |

|

Derbel, Fathi |

David Thibodaux STEM |

Teacher - Math |

08/01/18 |

01 |

Replacing Shawandlyn Johnson |

#4267 |

|

Derouen, Bonnie |

Northside HS |

Instructional Leader |

7/27/18 |

01 |

Replacing Kaydra Ellis |

#5129 |

|

Doucet, Leslie |

LJ Alleman MS |

Teacher - ELA |

08/01/18 |

01 |

Replacing Alysa Broussard |

#5480 |

|

Dupre, Venturah |

Youngsville MS |

Teacher - Math |

08/01/18 |

01 |

New Position |

#5244 |

|

Endsley, Shannon |

Special ED |

Augmentative Communication Speech Language Pathologist |

08/01/18 |

40 |

Replacing Barbara Hendee |

#5023 |

|

Enlund, Sandie |

Carencro Hghts. ES |

Teacher - 4th |

08/01/18 |

01 |

Replacing Mary Rosser-Cornell |

#5066 |

|

Fabacher, Peter |

Northside HS |

Teacher - SS |

08/01/18 |

01 |

New Position |

#5336 |

|

Frederick, Paula |

Alice Boucher ES |

Secretary I |

08/01/18 |

01 |

Replacing Natasha Dartez |

#5277 |

|

Fontenot, Chasity |

Lafayette HS |

Teacher - Gifted/Math |

08/01/18 |

01 |

Replacing Christopher Guillott |

#4967 |

|

Flournoy, Misty |

J. W. Faulk ES |

Teacher - 4th |

08/01/18 |

01 |

Replacing Valerie Williams |

#5148 |

|

Guidroz, Danielle |

Acadiana HS |

Teacher - ELA |

08/01/18 |

01 |

Replacing Courtney Tatman |

#5332 |

|

Guidry, Jessica |

Live Oak ES |

Teacher - 2nd |

08/01/18 |

01 |

Replacing Kalyn Benoit |

#5214 |

|

Guidry, Lindsey |

L Leo Judice ES |

Counselor |

07/30/18 |

01 |

Replacing Renee Bourque |

#5072 |

|

Guynn, Allison |

Acadiana HS |

Teacher - Agri. |

07/03/18 |

01 |

Replacing Marie Trahan |

#4917 |

|

Hebert, Kristy |

Acadian MS |

Secretary I |

08/01/18 |

01 |

Replacing Shintale Paddio |

#4992 |

|

Hebert, Marissa |

Youngsville MS |

Teacher - ELA |

08/01/18 |

01 |

Replacing Marcus Guillory |

#5242 |

|

Hill, Terry |

Ossun ES |

Teacher - 2nd |

08/01/18 |

01 |

Replacing Megan Guidry |

#5298 |

|

Hollier, Flora |

Carencro MS |

Teacher - Math |

08/01/18 |

01 |

Replacing Mary Cockerham |

#4982 |

|

Hukins, Cynthia |

J. W. Faulk ES |

Teacher - 4th |

08/01//18 |

01 |

Replacing Lorena Alderson |

#5320 |

|

Kidd, Katherine |

Northside HS |

Teacher - Science |

08/01/18 |

01 |

Replacing Yolanda Charles-Jones |

#5292 |

|

Kilchrist, Pamela |

Lafayette MS |

Teacher - PE |

08/01/18 |

01 |

Replacing Lindsey Heatherly |

#5141 |

|

Kisor, Fallon |

Live Oak ES |

Teacher - 3rd |

08/01/18 |

01 |

New Position |

#5323 |

|

Kristicevich, Marla |

LeRosen Campus |

Teacher - Visual Arts |

08/01/18 |

01 |

Replacing CAtherine Cole |

#5024 |

|

LaFleur, April |

Live Oak ES |

Teacher - 3rd |

08/01/18 |

01 |

Replacing Emily LeBlanc |

#5085 |

|

Landreth, Maria |

Broadmoor ES |

Teacher - 1st |

08/01/18 |

01 |

Replacing Natalie Dugas |

#5180 |

|

Landry, Laura |

Truman EC |

Teacher - Pre-K |

08/01/18 |

01 |

Replacing Vickie Watkins |

#4951 |

|

Landry, Robert |

P. Breaux MS |

Teacher - ELA |

08/01/18 |

01 |

Replacing Julia Reed |

#5401 |

|

LaRive, Victoria |

Carencro HS |

ISS Facilitator |

08/01/18 |

01 |

Replacing Stephen Barrett |

#5195 |

|

LeBlanc, Carolyn |

Carencro HS |

Teacher - ELA |

08/01/18 |

01 |

New Position |

#4960 |

|

Ledoux, Elizabeth |

Live Oak ES |

Teacher - 2nd |

08/001/18 |

01 |

New Position |

#5083 |

|

Lee, Erica |

Alice Boucher ES |

Speech Therapist |

08/01/18 |

01 |

Replacing Kimberly Muirhead |

#4831 |

|

Leger, Gina |

Judice MS |

Teacher - Alt Math |

08/01/18 |

01 |

Replacing Monica Trahan |

#5095 |

|

Leonards, Amber |

GT Lindon ES |

SPED Pre-K Para |

08/01/18 |

01 |

Replacing Dusty Fitch |

#5065 |

|

Levine, Caffery |

Lafayette HS |

Custodian |

07/01/18 |

01 |

Replacing Joseph Francis |

#5049 |

|

McCauley, Caroline |

JW Faulk ES |

Teacher - 1st |

08/01/18 |

01 |

Replacing Rachel Hebert |

#5415 |

|

McDaniel, Cheryl |

Carencro HS/Carencro MS |

Speech Therapist |

08/01/18 |

01 |

Replacing Merritt Longman |

#4963 |

|

Meaux, Denise |

Lafayette HS |

Custodian |

08/01/18 |

01 |

Replacing Terrence Mulmore |

#5048 |

|

Meche, Kelly |

Acadiana HS |

Teacher - Social Studies |

08/01/18 |

01 |

Replacing Gavin Peters |

#5354 |

|

Mesa-Socas, Carmen |

SJ Montgomery ES |

ESL Para |

08/01/18 |

01 |

Replacing Madeline Omana-Hernandez |

#5291 |

|

Methvin, Ian |

Acadiana HS |

Teacher - Business |

08/01/18 |

01 |

New Position |

#5353 |

|

Monroe-Moore, Mary |

Evangeline ES |

Teacher - 2nd |

08/01/18 |

01 |

Replacing Katina Duhon |

#5348 |

|

Navarre, Brandy |

Acadiana HS |

Teacher - Math/Combo |

08/01/18 |

01 |

New Position |

#5309 |

|

Ourston, Emma |

Acadiana HS/L.J. Alleman MS |

Speech Therapist |

08/01/18 |

01 |

Replacing Gail Abshire |

#4973 |

|

Page, Lindsay |

Alice Boucher ES |

Teacher - 3rd |

08/01/18 |

01 |

Replacing Nancy Meyers |

#4989 |

|

Perry, Camille |

Charles Burke ES |

Counselor |

07/30/18 |

01 |

Replacing Susan Merritt |

#4981 |

|

Peterson, Beverly |

Plantation ES |

Teacher - Inclusion |

08/01/18 |

01 |

Replacing Sandra Hendershot |

#5132 |

|

Quibodeaux, Brigitte |

L. J. Alleman MS |

Teacher - Autism |

08/01/18 |

01 |

New Position |

#5150 |

|

Quinn, Julie |

E. A. Martin MS |

Teacher - ESL/Math |

08/01/18 |

01 |

Replacing Monica Landry |

#5315 |

|

Ray, Ashley |

Southside HS |

Teacher - PE |

08/01/18 |

01 |

New Position |

#5009 |

|

Richard, Lisa |

Woodvale ES |

Teacher - 1st |

08/01/18 |

01 |

New Position |

#4762 |

|

Richard, Kelli |

Lerosen Campus |

Teacher - Visual Arts |

08/01/18 |

01 |

Replacing David Fox |

#5025 |

|

Richard, Mandy |

Edgar Martin MS |

Secretary I |

08/01/18 |

01 |

Replacing Bridget Huval |

#5130 |

|

Roberts, Nicolette |

Lafayette HS |

Teacher - RTI |

08/01/18 |

01 |

Replacing Stacy Hargrove |

#5050 |

|

Romero, Allison |

SJ Montgomery ES |

SPED Para-Educator |

08/01/18 |

01 |

Replacing Laynie Leblanc |

#5365 |

|

Rummel, Jacob |

Acadian MS |

Teacher - ELA |

08/01/18 |

01 |

Replacing Candi Caesar |

#5289 |

|

Sassau, Tonya |

Acadian MS |

Teacher - Math |

08/01/18 |

01 |

Replacing Elliot Khan |

#5288 |

|

Schexnayder, Shannan |

SJ Montgomery ES |

Teacher - 1st |

08/01/18 |

01 |

Replacing Ericka Cornay |

#5413 |

|

Shiel, Courtney |

Acadian MS |

Teacher - SS |

08/01/18 |

01 |

Replacing Jocelyn Lawrence |

#4908 |

|

Siner, Joseph |

Broussard MS |

Custodian |

07/01/18 |

01 |

Replacing Kendall Celestine |

#5370 |

|

Siracusa, Steven |

Lafayette HS |

Teacher - Health Occupations |

08/01/18 |

01 |

Replacing Brandon Billeaud |

#5047 |

|

Tavera, Shari |

Alice Boucher ES |

Teacher-3rd/5th ELA Spanish Immersion |

08/01/18 |

01 |

Replacing Karen Cagle |

#5280 |

|

Thibodeaux, Ralph |

Career Center |

Principal |

07/16/18 |

01 |

Vacancy |

#4808 |

|

Trotter, Haley |

Scott MS |

Teacher - 7th/ELA |

08/01/18 |

01 |

Replacing Amie Knott |

#4925 |

|

Tyler, Anthony |

Carencro Heights ES |

Head Custodian I |

|

01 |

Replacing Paul Amos |

#4916 |

|

Vu, Jennifer |

Ossun ES |

Teacher - 3rd |

08/01/18 |

01 |

Replacing Kayln Benoit |

#5412 |

|

Walker, Ariel |

Live Oak ES |

Teacher - 3rd |

08/01/18 |

01 |

Replacing Stephanie Reed |

#5084 |

|

Wilson, Melissa |

Ossun ES |

SPED Para-Educator |

08/01/18 |

01 |

Replacing Jamie Thibodeaux |

#5124 |

Employee Transfers,

|

Name |

From/To |

Eff. Date |

Fund |

Note |

Req. # |

|

Alcina, Carolyn |

LJ Alleman (Educational Interpreter) - |

08/01/18 |

01 |

Department Transfer |

#5264 |

|

Alderson, Lorena |

J. W. Faulk ES (Teacher-4th) to |

07/23/18 |

50 |

New Position |

#4931 |

|

Alexander, Sharon |

LJ Alleman (Educational Interpreter) - |

08/01/18 |

01 |

Department Transfer |

#5265 |

|

Alfred, Clarissa |

Ridge ES (SPED Para) - |

08/01/18 |

01 |

New Position |

#5222 |

|

Alvarado, Jada |

Acadiana HS (SPED Para) - |

08/01/18 |

40 |

Replacing Crystal Smith |

#5127 |

|

Andrus, Kayla |

Truman Early Childhood (Teacher - Pre-K) to |

08/01/18 |

01 |

New Position |

#5082 |

|

Ardoin, Kyla |

LJ Alleman (Instructional Leader) to |

08/01/18 |

01 |

New Position |

#4932 |

|

Ayers, Ola |

LJ Alleman (Educational Interpreter) - |

08/01/18 |

40 |

Department Transfer |

#5271 |

|

Ayria, Eshe |

JW James ES (CS - Para) to |

08/01/18 |

01 |

Replacing Mary Thibodeaux |

#5389 |

|

Besse, Christine |

Evangeline ES (Teacher-ELA Immersion) to |

08/01/18 |

01 |

Replacing Kirsten Shortridge |

#5350 |

|

Begnaud, Shelly |

LJ Alleman (Educational Interpreter) - |

08/01/18 |

40 |

Department Transfer |

#5269 |

|

Benoit, Jacob |

Broussard/Youngsville MS (PE Para) |

08/01/18 |

01 |

Reallocation from EAM |

#5372 |

|

Bernard, Nicole |

Lafayette HS (SPED Para) - |

08/01/18 |

01 |

New Position |

#5377 |

|

Bienvenu, Sharon |

O. Comeaux HS (SPED Para) - |

08/01/18 |

01 |

New Position |

#5455 |

|

Boatman, Charleese |

Lafayette HS (ESL Para) - |

08/01/18 |

40 |

New Position |

#5156 |

|

Bob, Virginia |

Truman Early Childhood (Teacher-Pre-K) to |

08/01/18 |

01 |

Replacing Kathleen Vining |

#5241 |

|

Bonvillain, Frederic |

Evangeline ES (Teacher - PE) to |

08/01/18 |

01 |

Recruitment |

#4851 |

|

Booth, Myra |

Ernest Gallet ES (Teacher - 3rd) to |

08/01/18 |

01 |

Replacing Stephanie Dalfrey-Choate |

#5445 |

|

Bordlee, Jessica |

Evangeline ES (Teacher - 1st) to |

08/01/18 |

01 |

Replacing Rashell Hultquist |

#5523 |

|

Bourque, Jeanne |

Live Oak ES (Teacher - 2nd) to |

08/01/18 |

01 |

Replacing Kimberly Bratton |

#5218 |

|

Bradley, Tanisha |

O Comeaux HS (Clerical Assistant) to |

08/01/18 |

01 |

New Position |

#5369 |

|

Bratton, Kimberly |

Live Oak ES (Teacher - Kdgn.) to |

08/01/18 |

01 |

Replacing Christina Savoie |

#5088 |

|

Breaux, Ginger |

Acadian MS (SPED Para) - |

08/01/18 |

01 |

Replacing Alphia Thibodeaux |

#5219 |

|

Breaux, Larry |

Carencro HS (Teacher - Career Foundations) to |

08/01/18 |

01 |

Replacing Sheila Guillory |

#5031 |

|

Beebe, Jamie |

Lafayette HS (Clerical Assistant) to |

08/01/18 |

01 |

New Position |

#5061 |

|

Blanchard, Robin |

Acadiana HS (Clerical Assistant) to |

08/01/18 |

01 |

Replacing Jeniece Gerard |

#5319 |

|

Brew, Andrea |

Broadmoor ES (Librarian) to |

08/01/18 |

01 |

Replacing Theresa Singleton |

#5001 |

|

Broussard, Kandice |

Milton ES/MS (Assistant Principal) to |

07/16/18 |

01 |

Replacing Kimberly Etie |

#5029 |

|

Brown, Paul |

Warehouse (Warehouse Worker I) to |

07/02/18 |

01 |

Replacing Brady Thibodeaux |

#5017 |

|

Cambre, Lori |

Northside HS (Teacher - SPED) to |

08/01/18 |

01 |

Replacing Marie Ford |

#5004 |

|

Campbell, Jennifer |

David Thibodaux (SPED Para) to |

08/01/18 |

01 |

Replacing Lisa Ancona |

#5454 |

|

Causey, Leon |

Alice Boucher ES (PT Custodian) to |

07/01/18 |

01 |

Replacing Ernest Williams |

#5498 |

|

Chachere, Tara |

Broadmoor ES (Teacher - 4th) to |

08/01/18 |

01 |

New Position |

#5019 |

|

Cheramie, Lisa |

E. A. Martin MS (Teacher - Science) to |

08/01/18 |

01 |

Replacing Matthew Leger |

#5252 |

|

Chiasson, Phyllis |

Carencro HS (Teacher - ELA) to |

08/01/18 |

01 |

Replacing Traci Credeur |

#5118 |

|

Chaisson, Tyra |

GT Lindon ES (SPED Para) - |

08/01/18 |

60 |

Replacing Rudell Jones |

#5367 |

|

Chiasson, Mindy |

Lafayette MS (Teacher - Alt./ELA to |

08/01/18 |

01 |

Replacing David Flores |

#5427 |

|

Comeaux, Leslie |

Lafayette HS (SPED Para) - |

08/01/18 |

01 |

Replacing Melanie Johnson |

#5240 |

|

Comeaux, Jeanne |

Acadiana HS (SPED Para) - |

08/01/18 |

01 |

Reallocation from LMS |

#5337 |

|

Cormier, David |

Duson ES (Custodian) - |

06/01/2018 |

01 |

New Position |

#5205 |

|

Credeur, Traci |

Carencro HS (Teacher - ELA) to |

08/01/18 |

01 |

Replacing Daniel Kisamore |

#5045 |

|

Cullen, Monica |

S. J. Montgomery ES (Teacher - 4th) to |

08/01/18 |

01 |

Replacing Chelsie Thomas |

#5173 |

|

Delcambre, Katherine |

J. W. Faulk ES (Teacher - Pre-K) to |

08/01/18 |

01 |

Replacing Brandi Randol |

#5416 |

|

Denais, Shane |

Comeaux HS (SPED Para) - |

08/01/18 |

01 |

New Position |

#5379 |

|

Denton, Karen |

L Leo Judice ES (Custodian) - |

06/01/18 |

01 |

Replacing Dirrick Batiste |

#5191 |

|

Disotell, Nicole |

P. Breaux MS (Teacher - Math) to |

07/27/18 |

01 |

New Position |

#5034 |

|

Drake, Mary Alice |

Prairie ES (Pre-K Para) to |

08/01/18 |

01 |

New Position |

#5521 |

|

Domingue, Kylee |

Westside ES (Teacher-3rd) to |

08/01/18 |

01 |

Replacing Jannie Doan |

#5427 |

|

Douglas Smith, Kathryn |

Milton ES (Teacher - K) to |

08/01/18 |

01 |

Replacing Pamela Samsonov |

#5432 |

|

Dugas, Natalie |

Broadmoor ES (Teacher - 1st) to |

07/27/18 |

01 |

Replacing Scarlett Pettit |

#4869 |

|

Duhon, Katina |

Evangeline ES (Teacher - 2nd) to |

08/01/18 |

01 |

Replacing Terri Melton |

#4959 |

|

Edgar, Kacey |

David Thibodeaux (HS English) - |

08/01/18 |

01 |

Replacing Danielle Carpenter |

#5400 |

|

Elliott, Georgia |

Comeaux HS (Teacher - ELA) to |

08/01/18 |

01 |

New Position |

#5030 |

|

Evans, Sarah |

S. J. Montgomery ES (Teacher-3rd) to |

08/01/18 |

01 |

New Position |

#5077 |

|

Ewing, Jennifer |

Live Oak ES (Instructional Leader) to |

07/23/18 |

|

Replacing Jennifer Coffee |

#5395 |

|

Fitzgerald, Tristan |

Prairie ES (Teacher - 2nd/French Immersion) to |

08/01/18 |

01 |

Replacing Georgia Caballero |

#5179 |

|

Faulk, Latoya |

Carencro MS (Custodian) |

06/01/18 |

01 |

Replacing Lou Anna Savoy |

#5296 |

|

Fitch, Dusty |

GT Lindon ES (SPED Pre-K Para) - |

08/01/18 |

40 |

Replacing Elzina Ewing |

#5064 |

|

Fontenot, Janet |

Evangeline ES (Pre-K Para) - |

08/01/18 |

01 |

Replacing Lena Hebert |

#5314 |

|

Fontenot, L. Michelle |

L. Leo Judice ES (Teacher - French) to |

08/01/18 |

01 |

Replacing Martine Colar |

#4881 |

|

French, Verity |

Academics (ELA Instructional Content Coach) to |

07/27/18 |

01 |

New Position |

#5033 |

|

Frick, Jennifer |

David Thibodaux (Teacher) to |

07/19/18 |

01 |

New Position |

#4931 |

|

Galasso, Jodi |

LJ Alleman MS (Teacher - French) to |

08/01/18 |

01 |

New Position |

#4859 |

|

Gannard, Christina |

J. W. Faulk ES (Teacher - 1st) to |

08/01/18 |

01 |

Replacing Katherine Delcambre |

#5417 |

|

Gautreaux, Mallory |

Ridge ES (Teacher-3rd) to |

08/01/18 |

01 |

Replacing Brooke Landry |

#5193 |

|

Gerard, Jeniece |

On Track by 5 (Secretary I) - |

07/02/18 |

01 |

Replacing Aritha Lewis |

#5035 |

|

Graves, Tasha |

LJ Alleman MS (CS - Para) to |

08/01/18 |

01 |

New Position |

#5151 |

|

Gregory, Molly |

Carencro HS (Teacher - Speech/ELA) to |

08/01/18 |

01 |

Replacing Camille Sahuc |

#4991 |

|

Guidry, Megan |

Ossun ES (Teacher - 2nd) to |

08/01/18 |

01 |

New Position |

#5448 |

|

Guillory, Dana |

Truman Early Childhood (Teacher - Pre-K) to |

08/01/18 |

60 |

Replacing Jessica Verret |

#4965 |

|

Guillory, Emma |

Ernest Gallet ES/L. J. Alleman MS (Librarian) to |

08/01/18 |

01 |

Replacing Keri Hebert |

#5053 |

|

Gunner, Ronald |

Comeaux HS (Teacher-) to |

08/01/18 |

01 |

Replacing Denise Faulk |

#5170 |

|

Hargrove, Stacey |

Lafayette HS (Teacher-RTI) to |

08/01/18 |

01 |

New Position |

#5449 |

|

Harris, Charlotte |

Carencro MS (Computer Proctor)- |

08/01/18 |

01 |

Replacing Angelle Hunter |

#5161 |

|

Harst, Leslie |

G. T. Lindon ES (Teacher - 3rd) to |

08/01/18 |

01 |

Replacing Tabitha Vincent |

#5062 |

|

Haynes, Candice |

N. P. Moss Prep (Teacher - Resource) to |

08/01/18 |

01 |

Replacing Erica Laviolette |

#5279 |

|

Henry, Danielle |

Comeaux HS (Teacher - Spanish) to |

08/01/18 |

01 |

Replacing Mary Duarte |

#5286 |

|

Hidalgo, Natalie |

Milton ES/MS (Teacher - 2nd) to |

08/01/18 |

01 |

New Position |

#5181 |

|

Hill, Deborah |

Acadiana HS (Teacher - Math) to |

08/01/18 |

01 |

New Position |

#4811 |

|

Hulin, Camay |

Payroll (Account Clerk I) to |

08/01/18 |

01 |

New Position |

#5059 |

|

Hultquist, Rashell |

S. J. Montgomery ES (Teacher - 1st) to |

08/01/18 |

01 |

Replacing Kathleen McKinney |

#5125 |

|

Hunter, Angela |

Carencro MS (ISSF) - |

08/01/18 |

01 |

New Position |

#5160 |

|

Hymel, Rachel |

Westside ES (Teacher-1st) to |

08/01/18 |

01 |

Replacing Kaisha Williams |

#5438 |

|

Johnson, Dianne |

Carencro HS (Instructional Leader) to |

07/19/18 |

01 |

Replacing Vanessa Knott |

#5497 |

|

Johnson, Melanie |

Scott MS (SPED Para) - |

08/01/18 |

01 |

New Position |

#5013 |

|

Jones, Jade |

E. A. Martin MS (Teacher - 8th/Math) to |

08/01/18 |

01 |

Replacing Helen Keefe |

#5260 |

|

Jones, Jade |

E. A. Martin MS (Teacher-7th) to |

07/30/18 |

01 |

Replacing Monti Smith |

#5027 |

|

Jones, Rudell |

GT Lindon (Pre K Para) - |

08/01/18 |

01 |

Reallocation from Woodvale |

#5327 |

|

Kennerson, Erica |

Federal Programs (Secretary I) - |

08/01/18 |

01 |

Replacing Brenda Bergeron |

#4873 |

|

Knott, Amie |

Scott MS (Teacher - 5th) to |

08/01/18 |

01 |

New Position |

#5087 |

|

Knott, Vanessa |

Carencro HS (Instructional Leader) to |

07/19/18 |

01 |

New Position |

#4930 |

|

LaFleur, Shaina |

Ernest Gallet ES (Teacher - 2nd) to |

08/01/18 |

01 |

Replacing Jill LeBlanc |

#5444 |

|

Landers, Leah |

Westside ES (Librarian) - |

08/01/18 |

01 |

Replacing Sandra Lazare |

#5405 |

|

Landry, Delaine |

LJ Alleman (Educational Interpreter) - |

08/01/18 |

40 |

Department Transfer |

#5267 |

|

Landry, Elizabeth |

Broussard MS (Assistant Principal) to |

07/30/18 |

01 |

Replacing Christina Denais |

#5041 |

|

Latiolais, Karen |

P. Breaux MS (Teacher - 8th/SS) to |

08/01/18 |

01 |

Replacing Danielle Guidry |

#5098 |

|

Laviolette, Erica |

Alice Boucher ES (Teacher - 3rd) to |

08/01/18 |

01 |

Replacing Lanie Laughlin |

#5147 |

|

Leach, Genevieve |

Alice Boucher ES (Teacher - Kdgn.) to |

08/01/18 |

01 |

Replacing Susanna Patterson |

#5133 |

|

Leday, Elizabeth |

Lafayette MS (Counselor) to |

07/30/18 |

01 |

Replacing Julie Broussard |

#4978 |

|

Leger, Matthew |

Carencro MS (Teacher - Combo) to |

08/01/18 |

01 |

Replacing David Cazabut |

#5155 |

|

Lopez, Lindsay |

Judice MS (Teacher - Art) to |

08/01/18 |

01 |

New Position |

#5139 |

|

Lopinto, Shauntelle |

Acadiana HS (Librarian) to |

08/01/18 |

01 |

Replacing Courtney Tatman |

#5332 |

|

Mallet, Ariana |

Alice Boucher ES (Teacher - 3rd) to |

08/01/18 |

01 |

Replacing Alice Cawley |

#5093 |

|

Matthews, Tranavia |

Alice Boucher ES (ISS Facilitator) to |

08/01/18 |

01 |

Replacing Pauline Zehner |

#5471 |

|

Melancon, Rachel |

Lafayette HS (Teacher - Gifted/Science) to |

08/01/18 |

01 |

Replacing Kyle Lastrapes |

#4969 |

|

Moreau, Cali |

Ernest Gallet ES (Teacher - 5th) to |

08/01/18 |

01 |

Replacing Myra Booth |

#5446 |

|

Nabers, Tonya |

Lafayette HS (SPED Para) - |

08/01/18 |

01 |

Replacing Cecil Delaughter |

#5378 |

|

Nomey, Melissa |

Live Oak ES (Teacher - 1st) to |

08/01/18 |

01 |

Replacing Ashley Olivier |

#5217 |

|

Norbert, Amy |

Carencro Heights ES (Teacher - ESL) - |

08/01/18 |

01 |

Replacing Shaina LaFleur |

#5447 |

|

Olivier, Hanna |

David Thibodaux (Teacher -) to |

07/19/18 |

01 |

New Position |

#4933 |

|

Ortego, Julie |

Northside HS (Teacher - Biology) to |

08/01/18 |

01 |

Replacing Tresha White |

#5423 |

|

Paddio, Shintale |

Acadian MS (Secretary I) - |

05/24/18 |

01 |

Replacing Christine Guidry |

#4871 |

|

Padilla, Yngrid |

Alice Boucher ES (Teacher - 4th/Spanish Immersion) to |

08/01/18 |

01 |

New Position |

#5325 |

|

Patterson, Susanna |

Duson ES (Teacher - Pre-K) to |

08/01/18 |

01 |

Replacing Jasmine Pearson |

#5174 |

|

Paul, Drusilla |

JW Faulk ES (SPED Para) - |

08/01/18 |

01 |

Reallocation from LHS |

#5328 |

|

Pearson, Jasmine |

Duson ES (Teacher-Kdgn) to |

08/01/18 |

01 |

Replacing Elizabeth Harson |

#5175 |

|

Perkins, Noelle |

Alice Boucher ES (Teacher - Combo) to |

07/27/18 |

01 |

Replacing Lisa Anderson |

#4987 |

|

Pete, Lorena |

Lafayette HS (SPED Para) - |

08/01/18 |

01 |

Replacing Malcolm Stokes |

#5316 |

|

Peters, Gavin |

Acadiana HS (Teacher - SS/PE) to |

08/01/18 |

01 |

New Position |

#5236 |

|

Philen, Callie |

SJ Montgomery ES (Teacher-Combo) |

08/01/18 |

01 |

Replacing Rachel Aucoin |

#5420 |

|

Ray, Jillian |

GT Lindon ES (Reg. Ed Para)- |

08/01/18 |

01 |

Replacing Maria Derouen |

#5394 |

|

Reed, Julia |

P. Breaux MS (Teacher - ELA) to |

08/01/18 |

01 |

Replacing Shelley Young |

#5112 |

|

Pierce, Mary Jo |

Myrtle Place ES (Teacher - 3rd) to |

08/01/18 |

01 |

Replacing Lorraine Todd |

#5182 |

|

Rainey, Alana |

Northside HS (Teacher) to |

08/01/18 |

01 |

Replacing Elizabeth Leday |

#5357 |

|

Rice, Juliette |

Youngsville MS (Secretary I) |

08/01/18 |

01 |

New Position |

#5060 |

|

Richard, Erin |

Ernest Gallet ES (SPED Para) to |

08/01/18 |

01 |

Replacing Christopher Daigle |

#5451 |

|

Richard, Ginger |

G. T. Lindon ES (Assistant Principal) to |

07/19/18 |

01 |

Replacing Cheri Fontenot |

#5038 |

|

Richard, Shannon |

Edgar Martin MS (Clerical Assistant) - |

07/02/18 |

01 |

New Position |

#5056 |

|

Riedel, Christine |

LJ Alleman (Educational Interpreter)- |

08/01/18 |

40 |

Department Transfer |

#5268 |

|

Ritter, Emily |

LJ Alleman MS (SPED Para)- |

08/01/18 |

01 |

Replacing Tonya Nabers |

#5232 |

|

Robertson, Blair |

Evangeline ES (Teacher - 3rd) to |

08/01/18 |

01 |

In house from Class Size Reduction (New Position) |

#5330 |

|

Robicheaux, Danielle |

Plantation ES (Teacher - Kdgn.) to |

08/01/18 |

01 |

Replacing Teren Dupuis |

#5113 |

|

Romero, Amber |

Duson ES (Teacher - 3rd) to |

08/01/18 |

01 |

New Position |

#5176 |

|

Sahuc, Camille |

Carencro HS (Teacher - ELA) to |

08/01/18 |

01 |

Replacing Molly Gregory |

#4990 |

|

Samsonov, Pamela |

Milton ES/MS (Teacher - Pre-K) to |

08/01/18 |

01 |

Replacing Lori Taylor |

#4949 |

|

Seminerio, Kaitlyn |

K. Drexel ES (Teacher - 1st) to |

08/01/18 |

01 |

Replacing Brittni Domingue |

#5104 |

|

Semmes, Cassie |

Live Oak ES (Teacher-5th) to |

08/01/18 |

01 |

Replacing Phoebe Terry |

#5215 |

|

Senegal, Ashlin |

Live Oak ES (Teacher-3rd) to |

08/01/18 |

01 |

Replacing Melissa Nomey |

#5212 |

|

Senegal, Thracia |

Scott MS/Westside ES (Custodian) - |

06/01/18 |

01 |

Replacing David Cormier |

#5198 |

|

Shackleford, Amanda |

Judice MS (Teacher - ELA) to |

07/27/18 |

01 |

New Position |

#5033 |

|

Simon, Roberta |

Lafayette MS (Para-educator - SPED) to |

08/01/18 |

01 |

Replacing Aaron Esters |

#5297 |

|

Simon, Toby |

Prairie ES (Custodian) |

06/01/18 |

01 |

Replacing Melanie Davis |

#5081 |

|

Smith, Amanda |

Academics (ELA Coach) to |

08/01/18 |

01 |

Replacing Natalie Hidalgo |

#5183 |

|

Stone, Peggy |

LJ Alleman (Educational Interpreter)- |

08/01/18 |

40 |

Department Transfer |

#5270 |

|

Suire, Michelle |

Acadian MS (Teacher - Resource) to |

08/01/18 |

01 |

Replacing Callie Philen |

#5275 |

|

Terry, Phoebe |

Live Oak ES (Teacher-3rd) to |

08/01/18 |

01 |

Replacing Jeanne Bourque |

#5090 |

|

Thibodeaux, Lindsey |

Ossun ES (CS Para) - |

08/01/18 |

01 |

New Position |

#5122 |

|

Thibodeaux, Matthew |

N. P. Moss Prep (Teacher - Resource) to |

08/01/18 |

01 |

Replacing Robyn Pefferkorn |

#5166 |

|

Thomas, James |

Transportation (Board Driver) to |

07/05/18 |

01 |

Replacing Allison Chaisson |

#4561 |

|

Thomas-Ponce, Tekear |

Lafayette MS (SPED Para) - |

07/05/18 |

01 |

New Position |

#5057 |

|

Trahan, Beau |

Comeaux HS (Band) - |

08/01/18 |

01 |

Replacing Courtney Hover |

#5254 |

|

Trahan, Monica |

Judice MS (Teacher-Alt.SS) - |

08/01/18 |

01 |

Replacing Courtney Fangue |

#5094 |

|

Traxler, Chandra |

Charles Burke ES (Teacher-1st) to |

08/01/18 |

01 |

New Position |

#5203 |

|

Valentour, Katie |

Census and Attendance (Social Worker) to |

07/27/18 |

01 |

Replacing Cynthia Hebert |

#5026 |

|

Vallot, Kendra |

Lafayette HS (SPED Para) - |

08/01/18 |

01 |

New Position |

#5368 |

|

Vice, Randy |

GT Lindon ES (Custodian) - |

06/01/18 |

01 |

Replacing Karon Denton |

#5199 |

|

Vincent, Paige |

Evangeline ES (Teacher - 2nd) to |

08/01/18 |

01 |

Replacing Christine Besse |

#5351 |

|

Vincent, Tabitha |

G. T. Lindon ES (Teacher - 2nd) to |

08/01/18 |

01 |

Replacing Leslie Harst |

#5063 |

|

Washington, Carolyn |

David Thibodaux (SFS Tech )- |

06/11/18 |

01 |

New Position |

#5422 |

|

Watts, Alicia |

Charles Burke ES (Teacher-4th) to |

08/01/18 |

01 |

New Position |

#5200 |

|

Watts, Christine |

LJ Alleman (Educational Interpreter) - |

08/01/18 |

40 |

Department Transfer |

#5266 |

|

Weber, Denise |

Acadiana HS (Account Clerk I) - |

08/01/18 |

01 |

Replacing Laura Pouge |

#4916 |

|

White, Mary |

Insurance (Clerical Assistant) - |

08/01/18 |

01 |

Replacing Erica Kennerson |

#5128 |

|

Williams, Kaisha |

Westside ES (Teacher - 2nd) to |

08/01/18 |

01 |

Replacing Kylee Domingue |

#5437 |

|

Zehner, Pauline |

Alice Boucher ES (SPED Para-Educator) to |

08/01/18 |

01 |

Replacing Tranavia Matthews |

#5509 |

Other Action

|

Name |

Location |

Position |

Eff. Date |

Fund |

Note |

|

Baker, Shannon |

L. Leo Judice ES |

Teacher - 2nd |

08/01/18 |

01 |

Not Live Oak Elem. |

Exiting Employees

|

Name |

Location |

Position |

Eff. Date |

Fund |

Note |

|

Albarado, Dana |

Live Oak ES |

Para-Educator - Pre-School/SPED |

05/23/18 |

01 |

Service Retirement |

|

Alexis, Chereka |

Sales Tax |

Assistant Director |

07/27/18 |

88 |

Resignation |

|

Alford, Betty |

Acadiana HS |

SFS Technician |

06/11/18 |

70 |

Termination |

|

Ancona, Lisa |

Ernest Gallet ES |

Para-educator - SPED |

05/23/18 |

01 |

Service Retirement |

|

Angelle, Gwen |

Sales Tax |

Account Clerk II |

06/29/18 |

01 |

Resignation |

|

Armitage, Jamie |

Alice Boucher ES |

Teacher - Resource |

05/23/18 |

01 |

Resignation |

|

Austin, Angela |

Alice Boucher ES |

Speech Pathologist |

05/23/18 |

01 |

Resignation |

|

Baker, Elizabeth |

K. Drexel ES |

Teacher - 2nd |

05/23/18 |

01 |

Resignation |

|

Batiste, Dirrick |

Carencro HS |

Custodian |

06/11/18 |

01 |

Termination |

|

Benoit, Kalyn |

Ossun ES |

Teacher |

05/23/18 |

01 |

Resignation |

|

Brooks, Melinda |

Milton ES/MS |

Teacher - PE |

05/23/18 |

01 |

Service Retirement |

|

Brown, Melissa |

L. Leo Judice ES |

Teacher - Kdgn. |

05/23/18 |

01 |

Service Retirement |

|

Buis, Nikki |

Pupil Appraisal |

School Psychologist |

07/07/18 |

01 |

Service Retirement |

|

Burgess, Brittany |

Northside HS |

Teacher - Science |

05/23/18 |

01 |

Resignation |

|

Cantrell, Nicole |

K. Drexel ES |

Librarian |

05/23/18 |

01 |

Resignation |

|

Carmouche, Jasmine |

Alice Boucher ES |

Clerical Assistant |

05/24/18 |

01 |

Resignation |

|

Charles, Joshua |

Lafayette HS |

Para-Educator - SPED |

06/11/18 |

01 |

Resignation |

|

Coffee, Jennifer |

S. J. Montgomery ES |

Data Liaison |

06/05/18 |

01 |

Resignation |

|

Cooper, Nicole |

Southside HS |

Teacher - SPED |

05/23/18 |

01 |

Resignation |

|

Cornay, Ericka |

S.J. Montgomery ES |

Teacher - 1st |

05/23/18 |

01 |

Resignation |

|

Cormier, Debra |

Scott MS |

Cafeteria Manager II |

05/23/18 |

01 |

Service Retirement |

|

Dickerson, LaShona |

Instructional Technology |

Director |

07/06/18 |

01 |

Service Retirement |

|

Doan, Jannie |

Westside ES |

Teacher - 4th |

05/23/18 |

01 |

Resignation |

|

Dosser, Alice |

Carencro HS |

Teacher - Math |

05/23/18 |

01 |

Resignation |

|

Fangue, Courtney |

Judice MS |

Teacher |

05/23/18 |

01 |

Resignation |

|

Feist, Anita |

Lafayette MS |

Clerical Assistant |

05/23/18 |

01 |

Resignation |

|

Fredieu, Julia |

Evangeline ES |

Librarian |

05/23/18 |

01 |

Resignation |

|

Gerami, Leah |

LJ Alleman MS |

Teacher - Math |

05/23/18 |

70 |

Resignation |

|

Gerard, Marion |

Myrtle Place ES |

Para-Educator - Pre-K |

05/23/18 |

01 |

Resignation |

|

Gibson, Linda |

Carencro HS |

Teacher - Science |

05/23/18 |

01 |

Resignation |

|

Gilbert, Laura |

Carencro MS |

Librarian |

08/16/18 |

01 |

Service Retirement |

|

Gleason, Allison |

J. W. Faulk ES |

Teacher |

05/23/18 |

01 |

Resignation |

|

Goliday, Meaghan |

Northside HS |

Teacher - ELA |

05/23/18 |

01 |

Resignation |

|

Gradnigo, Mary |

Alice Boucher ES |

Para-educator - SPED |

05/23/18 |

01 |

Service Retirement |

|

Graeff, Leah |

Talented Education |

Teacher - Visual Arts |

05/23/18 |

01 |

Resignation |

|

Green, Brandi |

Lafayette MS |

Teacher - ED |

06/11/18 |

01 |

Resignation |

|

Hamblin, Alexandra |

Broadmoor ES |

Teacher - ESL |

06/26/18 |

01 |

Resignation |

|

Harness, Jamila |

J. W. Faulk ES |

Para-Educator - SPED |

05/23/18 |

01 |

Resignation |

|

Hebert, Melinda |

Transportation Dept. |

Bus Driver |

06/04/18 |

01 |

Deceased |

|

Hoffpauir, Marie |

Judice MS |

Secretary I |

05/23/18 |

01 |

Resignation |

|

Hoof, Samantha |

Youngsville MS |

Teacher - 5th |

05/23/18 |

01 |

Resignation |

|

Hoskins, LaTanya |

Alice Boucher ES |

Teacher - Resource |

05/23/18 |

01 |

Resignation |

|

James, Marisha |

Northside HS |

Teacher - ELA |

05/23/18 |

01 |

Resignation |

|

Lalonde, Marie |

K. Drexel ES |

Teacher - 1st |

05/23/18 |

01 |

Service Retirement |

|

Landry, Monica |

E. A. Martin MS |

Teacher - ESL/Math |

05/23/18 |

01 |

Resignation |

|

Lemaire, Grant |

LJ Alleman MS |

Teacher - Science |

05/23/18 |

01 |

Resignation |

|

Lewis, Geralyn |

Truman Early Childhood |

SFS Manager |

05/08/18 |

70 |

Service Retirement |

|

Love, Kellie |

David Thibodaux |

Teacher - ELA |

05/23/18 |

01 |

Resignation |

|

McIntyre, Dana |

Gear-Up |

College & Career Coach |

07/31/18 |

01 |

Resignation |

|

McGowan, Sheri |

Paul Breaux MS |

Counselor |

07/16/18 |

01 |

Resignation |

|

Meche, Sarah |

Lafayette HS |

Teacher - Resource |

05/23/18 |

01 |

Resignation |

|

Milligan, Carla |

Transportation Dept. |

Bus Driver - Board Owned |

08/31/18 |

01 |

Service Retirement |

|

Moore, Rollan |

Acadian MS |

Principal |

07/31/18 |

01 |

Resignation |

|

Mulderick, Megan |

Alice Boucher ES |

Teacher - 4th |

05/23/18 |

01 |

Resignation |

|

Pelsia, Kenneth |

Transportation Dept. |

Bus Driver - Board Owned |

05/23/18 |

01 |

Resignation |

|

Peterson, Sam |

Carencro MS |

Teacher - ELA |

05/23/18 |

01 |

Resignation |

|

Pry, Pamela |

Broussard MS |

Teacher - Art |

05/23/18 |

01 |

Resignation |

|

Richard, Cynthia |

Pupil Appraisal |

Speech Therapist |

05/23/18 |

01 |

Service Retirement |

|

Richard, Phillip |

Lafayette MS |

Speech Therapist |

05/23/18 |

01 |

Service Retirement |

|

Roy, Ginger |

Carencro MS |

Teacher - Science |

06/10/18 |

01 |

Resignation |

|

Samec, Annette |

Academics |

Chief Academic Officer |

07/31/18 |

01 |

Service Retirement |

|

Semmes, Cassie |

Live Oak ES |

Teacher - 3rd |

05/23/18 |

01 |

Resignation |

|

Stelly, Reeva |

Carencro HS |

Para-Educator - SPED |

05/23/18 |

01 |

Resignation |

|

Thibodeaux, Mary |

Woodvale ES |

Para-Educator - SPED |

05/23/18 |

01 |

Service Retirement |

|

Thomas. Shakondia, |

S. J. Montgomery ES |

Teacher - SPED |

07/19/18 |

01 |

Resignation |

|

Trahan, Korey |

Lafayette MS |

Teacher - PE |

05/23/18 |

01 |

Resignation |

|

Vallier, Devin |

P. Breaux MS |

Teacher - Science |

05/23/18 |

01 |

Resignation |

|

Walker-Taylor, Denise |

Prairie ES |

Counselor |

12/21/18 |

01 |

Service Retirement |

|

Waters, Kenneth |

Judice MS |

Teacher - Journey to Careers |

05/23/18 |

01 |

Resignation |

|

White, Tresha |

David Thibodaux |

Teacher - Biology |

05/23/18 |

01 |

Resignation |

|

Williams, Ernest |

|

Custodian |

06/29/18 |

01 |

Service Retirement |

|

Williams, Linda |

P. Breaux MS |

Custodian |

07/06/18 |

01 |

Resignation |

|

Wilridge, Kimberly |

Comeaux HS |

Teacher - Resource |

05/23/18 |

01 |

Resignation |

*Retiree Return to Work

|

Number of Full-Time, Active Employees by Funding Source as of: |

(07/16/18) |

Last Month (June 2018) |

One Year Ago (July 2017) |

|

General Fund (01) |

3,443.25 |

3,578.25 |

3,502.25 |

|

2002 Sales Tax (15) |

61 |

64 |

61 |

|

Special Revenues (20) |

6.5 |

6.5 |

5.5 |

|

Other Grants (25) |

0 |

0 |

0 |

|

Consolidated Adult Education (30) |

1 |

2 |

3 |

|

Consolidated Other Federal Programs (35) |

6 |

6 |

4 |

|

Special Education (40) |

84.5 |

86.5 |

86.5 |

|

Self-Funded Construction (45) |

2.5 |

2.5 |

2.5 |

|

IASA Title I (50) |

85.5 |

90 |

83.5 |

|

Consolidated Other State (55) |

4.75 |

4.75 |

5.75 |

|

GEARUP/Magnet Grant (57) |

7 |

7 |

6 |

|

Child Development & Head Start (60) |

67 |

69.75 |

68.75 |

|

IASA Titles II/III/IV/VI (65) |

12.75 |

12.25 |

14.25 |

|

Child Nutrition (70) |

213 |

230 |

229 |

|

Group Insurance Fund (85) |

4.5 |

4.5 |

4.5 |

|

Sales Tax Dept (88) |

16 |

17 |

17 |

|

TOTAL |

4,009 |

4,181 |

4,093.5 |

Information: 2.4 SRO Agreement Update – Knezek

Board President, Erick Knezek, gave the Board an update on the status of the SRO Agreements between LPSS and the City of Broussard, City of Youngsville, City of Scott, City of Carencro, and the Lafayette City-Parish Consolidated Government. He informed the Board that all agreements were signed and executed; with the exception of Lafayette City-Parish Consolidated Government. He stated that LPSS has requested from Lafayette City-Parish Consolidated Government a signed agreement be provided no later than July 26, 2018 for execution by July 27, 2018.

3. CONSENT AGENDA

Action (Consent): 3.1 ACADEMICS: Approval of N.P. Moss Becoming a K-5 Community School in the 2019-2020 School Year-Aguillard/Trosclair

Resolution: That the Board approve N.P. Moss becoming a K-5 community school in the 2019-2020 school year, with a capacity of 450 students serving students from Districts 3 and 4.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Britt Latiolais.

Final Resolution: Motion Carries

Yes: Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

Absent: Tommy Angelle

Action: 3.2 HUMAN RESOURCES: LPSS Reorganization of Staff-Aguillard/Craig/Thibodeaux

That the board approve the attached proposed plan of reorganization of staff and changes in job descriptions related to go into effect August 13, 2018 with the exception that the ESL Program Manager Position remain at Pay Grade 9.

Motion by Jeremy Hidalgo, second by Justin Centanni.

Final Resolution: Motion Carries

Yes: Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

Absent: Tommy Angelle

Action: 3.3 FINANCE: Budget Revisions-Safety Initiative: School Resource Officer Program, MFP Revenues and Other Offsets-Knezek/Agullard/Guidry/Dugas

That the Board approve the FY19 General Fund budget revisions totaling $1,392,521 to fund the enhancement of the School Resource Officer Program, Central Office Reorganization, reduction in MFP Revenues due to recalculation by the Louisiana Department of Education, and recognize the related offsets as provided in the attached listing.

Motion by Jeremy Hidalgo, second by Britt Latiolais.

Final Resolution: Motion Carries

Yes: Elroy Broussard, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

No: Justin Centanni

Absent: Tommy Angelle

Action: 3.4 ACADEMICS: Approval of the 2018-2019 Pupil Progression Plan-Aguillard/Trosclair

That the Board approve the proposed 2018-2019 Pupil Progression Plan.

Motion by Justin Centanni, second by Mary Morrison.

Final Resolution: Motion Carries

Yes: Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

No: Elroy Broussard

Absent: Tommy Angelle

Action (Consent): 3.5 FACILITIES: Approval of Quotes for Lafayette High Welding Shop Ventilation System-Aguillard/Bordelon/Francis/Guidry

Resolution: That the Board authorize staff to award the low quote to Bernhard MCC for $75,000 for the Lafayette High Welding Shop Ventilation System in accordance with purchasing procedures and guidelines.

That the Board approve all Action Consent Items with the exception of items pulled.

Motion by Justin Centanni, second by Britt Latiolais.

Final Resolution: Motion Carries

Yes: Elroy Broussard, Justin Centanni, Tehmi Chassion, Jeremy Hidalgo, Erick Knezek, Britt Latiolais, Dawn Morris, Mary Morrison

Absent: Tommy Angelle

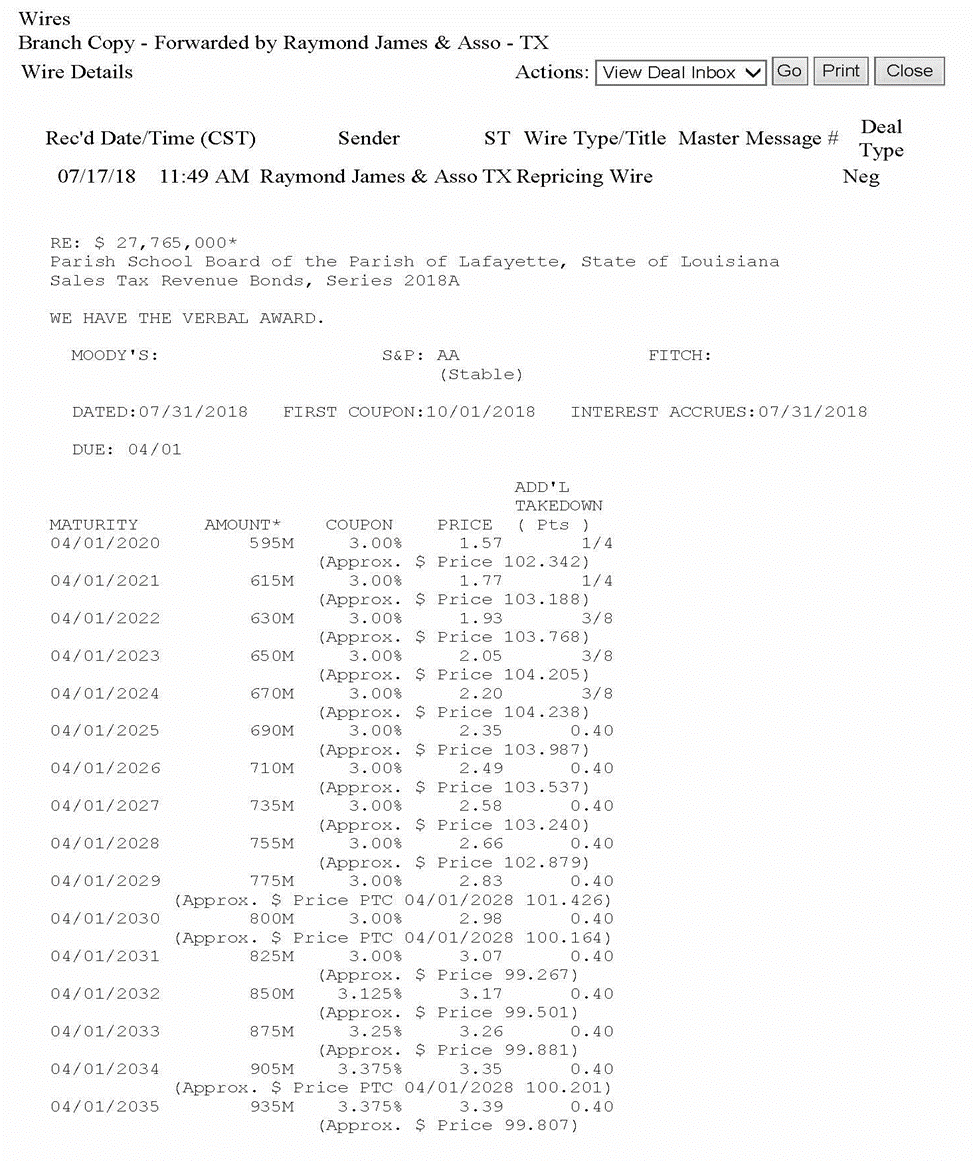

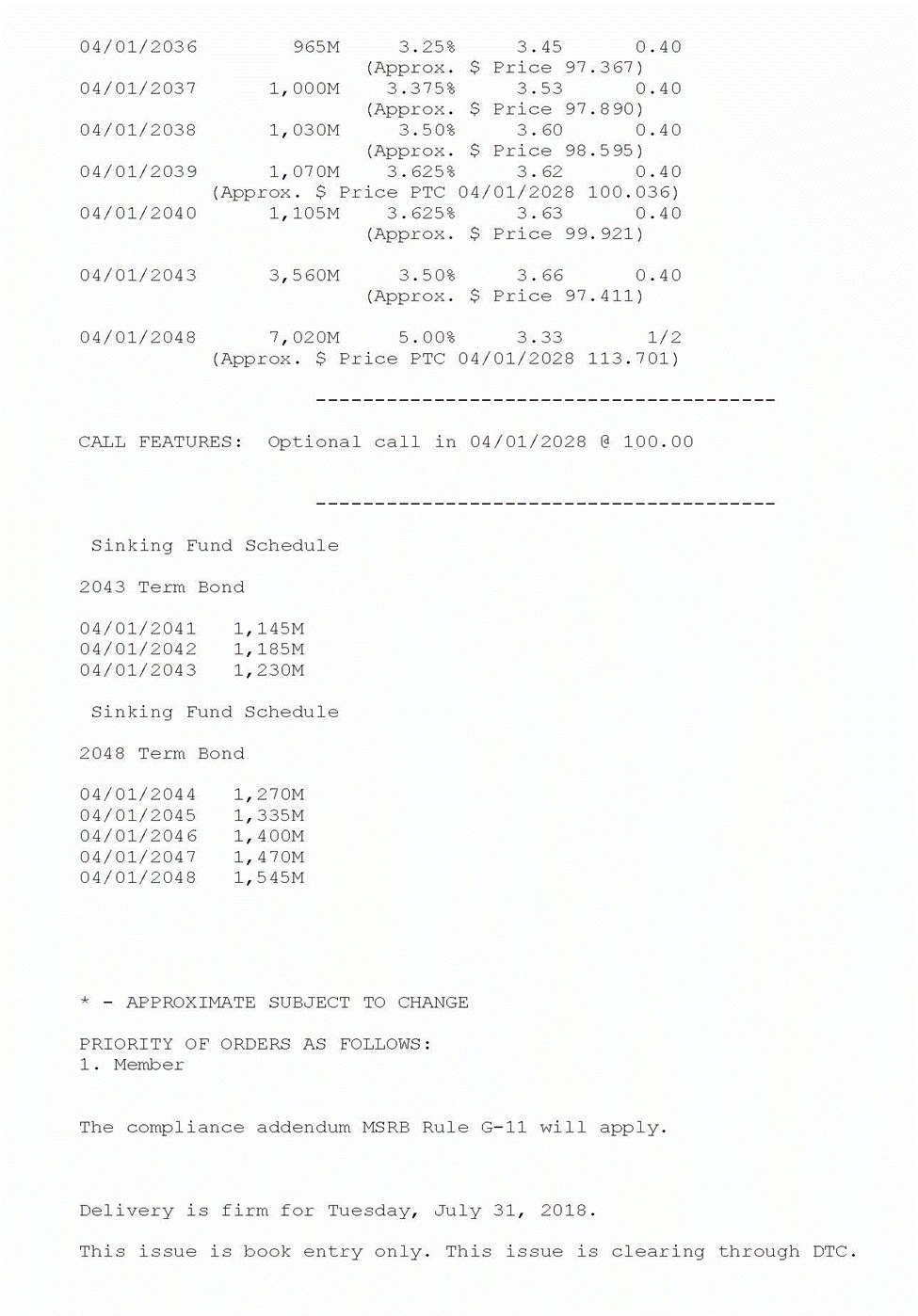

Action: 3.6 FINANCE: Resolution 07-18-1935-Ratification of Bond Sale-Aguillard/Guidry

That the Board approved Resolution 07-18-1935 ratifying the sale of $27,765,000 Sales Tax Revenue Bonds that occurred on Tuesday, July 17, 2018.

The following resolution was offered by Justin Centanni and seconded by Mary Morrison:

RESOLUTION 07-18-1935

RATIFICATION OF BOND PURCHASE AGREEMENT

A resolution recognizing and approving the execution of the Bond Purchase Agreement and Official Statement regarding the issuance and sale of Sales Tax Revenue Bonds, Series 2018A, of the Parish School Board of the Parish of Lafayette, State of Louisiana; and providing for other matters in connection therewith.

WHEREAS, this Parish School Board of the Parish of Lafayette, State of Louisiana (the "Issuer") adopted a resolution on June 13, 2018 (the "Prior Resolution"), providing for the issuance and sale of Sales Tax Revenue Bonds, Series 2018A (the "Bonds"); and

WHEREAS, the Secretary of the Issuer has executed the Bond Purchase Agreement as authorized by the Prior Resolution; and

WHEREAS, the form of Bond Purchase Agreement contained in the Prior Resolution was complete except for the amount of the Bonds, date of the Bond Purchase Agreement,redemption provisions, date of the Preliminary Official Statement, date of delivery, conditions of rating from Standard & Poors Rating Services, signature page, Schedules I and II, Exhibit A and its Schedule A; and

WHEREAS, a copy of the completed Bond Purchase Agreement is attached hereto as Exhibit A.

NOW, THEREFORE, BE IT RESOLVED by the Parish School Board of the Parish of Lafayette, State of Louisiana, that:

SECTION 1. Ratification of Bond Purchase Agreement. The Bond Purchase Agreement contains the elements set forth in the third preamble hereto and otherwise has met the parameters set forth in the Prior Resolution and accordingly, its execution and the redemption provisions provided for therein, are hereby ratified and approved.

SECTION 2. Official Statement. The Issuer approves the form and content of the final Official Statement and hereby ratifies its execution by the Executive Officers of the Issuer and approves and authorizes delivery of such final Official Statement to the Purchaser (as defined in the Prior Resolution) for use in connection with the public offering of the Bonds.

SECTION 3. Any resolution in conflict herewith is hereby amended to the extent of such conflict.

This resolution having been submitted to a vote, the vote thereon was as follows:

YEAS: Broussard, Centanni, Chassion, Hidalgo, Knezek, Latiolais, Morris, Morrison

NAYS:

ABSENT: Angelle

And the resolution was declared adopted, on this, the 18th of July, 2018.

/s/ Donald Aguillard /s/ Erick Knezek .

Secretary President

Exhibit A

BOND PURCHASE AGREEMENT

$27,765,000

SALES TAX REVENUE BONDS, SERIES 2018A

OF THE

PARISH SCHOOL BOARD

OF THE

PARISH OF LAFAYETTE, STATE OF LOUISIANA

July 17, 2018

Hon. Parish School Board

Parish of Lafayette

113 Chaplin Drive

Lafayette, La 70502

The undersigned, Raymond James & Associates, Inc., of New Orleans, Louisiana (the “Underwriter”), offers to enter into this agreement with Parish School Board of the Parish of Lafayette, State of Louisiana (the “Issuer”), which, upon your acceptance of this offer, will be binding upon you and upon us.

This offer is made subject to your acceptance of this agreement on or before 11:59 p.m., New Orleans Time, on this date, which acceptance shall be evidenced by your execution of this Bond Purchase Agreement on behalf of the Issuer as a duly authorized official thereof.

Capitalized terms used, but not defined, herein shall have the meanings ascribed to them in the Bond Resolution (as defined below).

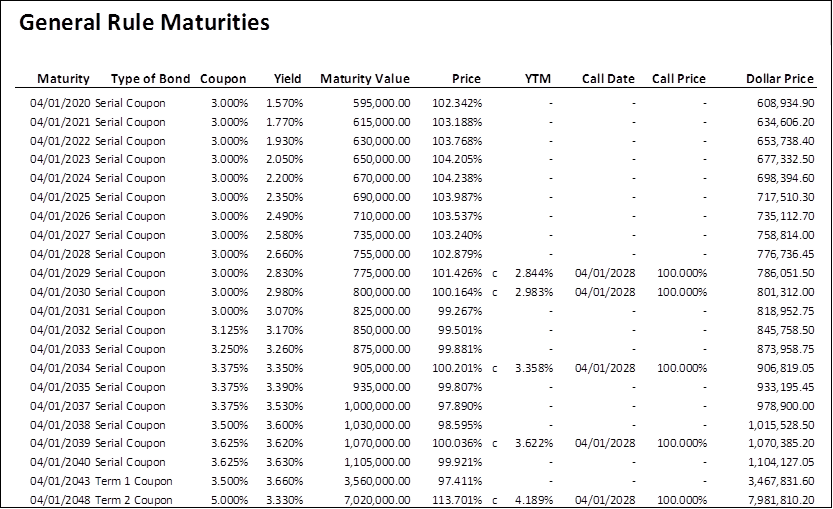

1) The Bonds. Upon the terms and conditions and the basis of the respective representations and covenants set forth herein, the Underwriter hereby agrees to purchase from the Issuer, and the Issuer hereby agrees to sell and deliver to the Underwriter, all (but not less than all) of the above‑captioned bonds of the Issuer (the “Bonds”). The purchase price of the Bonds is set forth in Schedule I hereto (the “Purchase Price”). Such Purchase Price shall be paid at the Closing (hereinafter defined) in accordance with Section 7 hereof. The Bonds are to be issued by the Issuer, acting through the Parish School Board of the Parish of Lafayette, State of Louisiana, its governing authority (the “Governing Authority”), under and pursuant to, and are to be secured, on a complete parity with the Outstanding Parity Bonds, and payable as set forth in a resolution adopted by the Governing Authority on June 13, 2018 (the “Bond Resolution”). The Bonds are issued pursuant to R.S. 47.338.86, as amended, and other constitutional and statutory authority (the “Act”). The Bonds shall mature on the dates and shall bear interest at the fixed rates, and be callable for redemption, all as described in Schedule II attached hereto. Furthermore, the Bonds and the Outstanding Parity Bonds are entitled to the benefit of a common debt service reserve fund in accordance with the terms of the Bond Resolution, which common reserve fund is being initially funded with bond proceeds.

2) Establishment of Issue Price.

(a) The Underwriter agrees to assist the Issuer in establishing the issue price of the Bonds and shall execute and deliver to the Issuer at Closing a certificate substantially in the form attached hereto as Exhibit A, with such modifications and supporting pricing wires or equivalent communications as may be appropriate or necessary, in the reasonable judgment of the Underwriter, the Issuer and Bond Counsel, to accurately reflect, as applicable, the sales prices or the initial offering prices to the public of the Bonds. All actions to be taken by the Issuer under this section to establish the issue price of the Bonds may be taken on behalf of the Issuer by the Issuer’s municipal advisor, and any notice or report to be provided to the Issuer may be provided to the Issuer’s municipal advisor.

(b) Except as otherwise set forth in Schedule II attached hereto, the Issuer will treat the first price at which 10% of each maturity of the Bonds (the “10% test”) is sold to the public as the issue price of that maturity (if different interest rates apply within a maturity, each separate CUSIP number within or bifurcated portion of that maturity will be subject to the 10% test). At or promptly after the execution of this Bond Purchase Agreement, the Underwriter shall report to the Issuer and Bond Counsel the price or prices at which it has sold to the public each maturity of Bonds. If at that time the 10% test has not been satisfied as to any maturity of the Bonds, the Underwriter agrees to promptly report to the Issuer the prices at which it sells the unsold Bonds of that maturity to the public. That reporting obligation shall continue, whether or not on July 31, 2018 (the “Closing Date”) has occurred, until either (i) the Underwriter has sold all Bonds of that maturity or (ii) the 10% test has been satisfied as to the Bonds of that maturity, provided that the Underwriter’s reporting obligation after the Closing Date may be at reasonable period intervals or otherwise upon request of the Issuer or bond counsel.

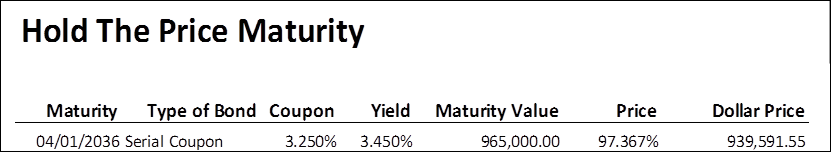

(c) The Underwriter confirms that it has offered the Bonds to the public on or before the date of this Bond Purchase Agreement at the offering prices (the “initial offering price”) set forth in Schedule II attached hereto, except as otherwise set forth therein. Schedule II also sets forth, as of the date of this Bond Purchase Agreement, the maturities, if any, of the Bonds for which the 10% test has not been satisfied and for which the Issuer and the Underwriter agree that the restrictions set forth in the next sentence shall apply, which will allow the Issuer to treat the initial offering price to the public of each such maturity as of the sale date as the issue price of that maturity (the “hold-the-offering-price rule”). So long as the hold-the-offering-price rule remains applicable to any maturity of the Bonds, the Underwriter will neither offer nor sell unsold Bonds of that maturity to any person at a price that is higher than the initial offering price to the public during the period starting on the sale date and ending on the earlier of the following:

(1) the close of the fifth (5th) business day after the sale date; or

(2) the date on which the Underwriter has sold at least 10% of that maturity of the Bonds to the public at a price that is no higher than the initial offering price to the public.

The Underwriter shall promptly advise the Issuer when it has sold 10% of that maturity of the Bonds to the public at a price that is no higher than the initial offering price to the public, if that occurs prior to the close of the fifth (5th) business day after the sale date.

(d) The Underwriter confirms that any selling group agreement and any retail distribution agreement relating to the initial sale of the Bonds to the public, together with the related pricing wires, contains or will contain language obligating each dealer who is a member of the selling group and each broker-dealer that is a party to such retail distribution agreement, as applicable, to (A) report the prices at which it sells to the public the unsold Bonds of each maturity allotted to it, whether or not the Closing Date has occurred, until either all Bonds of that maturity allotted to it have been sold or it is notified by the Underwriter that the 10% test has been satisfied as to the Bonds of that maturity, provided that the reporting obligation after the Closing Date may be at reasonable period intervals or otherwise upon request of the Underwriter and (B) comply with the hold-the-offering-price rule, if applicable, if and for so long as directed by the Underwriter. The Issuer acknowledges that, in making the representation set forth in this subsection, the Underwriter will rely on (i) in the event a selling group has been created in connection with the initial sale of the Bonds to the public, the agreement of each dealer who is a member of the selling group to comply with the hold-the-offering-price rule, if applicable, as set forth in a selling group agreement and the related pricing wires, and (ii) in the event that a retail distribution agreement was employed in connection with the initial sale of the Bonds to the public, the agreement of each broker-dealer that is a party to such agreement to comply with the hold-the-offering-price rule, if applicable, as set forth in the retail distribution agreement and the related pricing wires. The Issuer further acknowledges that the Underwriter shall not be liable for the failure of any dealer who is a member of a selling group, or of any broker-dealer that is a party to a retail distribution agreement, to comply with its corresponding agreement regarding the hold-the-offering-price rule as applicable to the Bonds.

(e) The Underwriter acknowledges that sales of any Bonds to any person that is a related party to the Underwriter shall not constitute sales to the public for purposes of this section. Further, for purposes of this section:

(i) “public” means any person other than an underwriter or a related party,

(ii) “underwriter” (when not referring to the Underwriter) means (A) any person that agrees pursuant to a written contract with the Issuer (or with the lead underwriter to form an underwriting syndicate) to participate in the initial sale of the Bonds to the public and (B) any person that agrees pursuant to a written contract directly or indirectly with a person described in clause (A) to participate in the initial sale of the Bonds to the public (including a member of a selling group or a party to a retail distribution agreement participating in the initial sale of the Bonds to the public),

(iii) their stock, if both entities are corporations (including direct ownership by one corporation of another), (ii) more than 50% common ownership of their capital interests or profits interests, if both entities are partnerships (including direct ownership by one partnership of another), or (iii) more than 50% common ownership of the value of the outstanding stock of the corporation or the capital interests or profit interests of the partnership, as applicable, if one entity is a corporation and the other entity is a partnership (including direct ownership of the applicable stock or interests by one entity of the other), and

(iv) “sale date” means the date of execution of this Bond Purchase Agreement by all parties.

3. Representative. The individual signing on behalf of the Underwriter below is duly authorized to execute this Bond Purchase Agreement on behalf of the Underwriter.

4. Preliminary Official Statement and Official Statement. The Issuer hereby ratifies and approves the lawful use of the Preliminary Official Statement, dated July 9, 2018, relating to the Bonds (the “Preliminary Official Statement”) by the Underwriter prior to the date hereof and authorizes and approves the Official Statement and other pertinent documents referred to in Section 8 hereof to be lawfully used in connection with the offering and sale of the Bonds. The Issuer has previously provided the Underwriter with a copy of the Preliminary Official Statement. As of its date, the Preliminary Official Statement has been deemed final by the Issuer for purposes of SEC Rule 15c2-12 (the “Rule”) under the Securities Exchange Act of 1934, as amended.

The Issuer has delivered a certificate to the Underwriter, dated July 17, 2018, to evidence compliance with the Rule to the date hereof, a copy of which is attached hereto as Exhibit A.

The Issuer, within seven (7) business days of the date hereof, shall deliver to the Underwriter sufficient copies of the Official Statement dated the date hereof relating to the Bonds, executed on behalf of the Issuer by the duly authorized officer(s) of the Governing Authority (the “Official Statement”), as the Underwriter may reasonably request as necessary to comply with paragraph (b)(4) of the Rule, with Rule G-32 and with all other applicable rules of the Municipal Securities Rulemaking Board (the “MSRB”).

The Issuer hereby covenants that, if during the period ending on the 25th day after the “End of the Underwriting Period” (as defined in the Rule), or such other period as may be agreed to by the Issuer and the Underwriter, any event occurs of which the Issuer has actual knowledge and which would cause the Official Statement to contain an untrue statement of material fact or to omit to state a material fact necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading, the Issuer shall notify the Underwriter in writing, and if, in the reasonable opinion of the Underwriter, such event requires an amendment or supplement to the Official Statement, the Issuer promptly will amend or supplement, or cause to be amended or supplemented, the Official Statement in a form and in a manner approved by the Underwriter and consented to by the Issuer so that the Official Statement, under such caption, will not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in light of the circumstances existing at the time the Official Statement is delivered to a purchaser, not misleading. If such notification shall be given subsequent to the date of Closing, the Issuer also shall furnish, or cause to be furnished, such additional legal opinions, certificates, instruments and other documents as the Underwriter may reasonably deem necessary to evidence the truth and accuracy of any such supplement or amendment to the Official Statement.

5. Additional Requirements of the Issuer and Underwriter. The Underwriter agrees to promptly file a copy of the final Official Statement, including any supplements prepared by the Issuer as required herein, with the MSRB through the operation of the Electronic Municipal Market Access repository within one (1) business day after receipt from the Issuer, but by no later than the date of Closing, in such manner and accompanied by such forms as are required by the MSRB, in accordance with the applicable MSRB Rules, and shall maintain such books and records as required by MSRB Rules with respect to filing of the Official Statement. If an amended Official Statement is prepared in accordance with Section 4 during the “new issue disclosure period” (as defined in the Rule), and if required by applicable SEC or MSRB Rule, the Underwriter also shall make the required filings of the amended Official Statement.

The Issuer covenants and agrees to enter into a Continuing Disclosure Certificate to be dated the date of Closing (the "Continuing Disclosure Certificate") constituting an undertaking (an "Undertaking") to provide ongoing disclosure about the Issuer for the benefit of Bondholders as required by the Rule, in the form as set forth in the Preliminary Official Statement, with such changes as may be agreed to by the Underwriter.

The Issuer hereby further covenants and agrees to enter into the Tax Compliance Certificate in the form required by Bond Counsel (the “Tax Certificate”) on the date of the Closing.

6. Representations of the Issuer. The Issuer hereby represents to the Underwriter as follows:

a. The Issuer has duly authorized, or prior to the delivery of the Bonds the Issuer will duly authorize, all necessary action to be taken by it for (i) the sale of the Bonds upon the terms set forth herein and in the Official Statement; (ii) the approval and signing of the Official Statement by a duly authorized officer of the Issuer; and (iii) the execution, delivery and receipt of this Bond Purchase Agreement and any and all such other agreements and documents as may be required to be executed, delivered and received by the Issuer in order to carry out, give effect to, and consummate the transactions contemplated hereby, by the Bonds, the Official Statement, and the Bond Resolution;

b. The information contained in the Preliminary Official Statement does not contain any untrue statement of material fact and does not omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they were made, not misleading; and the information to be contained in the Official Statement, as of its date and the date of Closing, will not contain any untrue statement of material fact and will not omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they are made, not misleading;

c. To the knowledge of the Issuer there is no action, suit, proceeding, inquiry or investigation at law or in equity or before or by any court, public board or body pending against or affecting the Issuer or the Governing Authority or threatened against or affecting the Issuer or the Governing Authority (or, to the knowledge of the Issuer, any basis therefor) contesting the due organization and valid existence of the Issuer or the Governing Authority or the validity of the Act or wherein an unfavorable decision, ruling or finding would adversely affect the transactions contemplated hereby or by the Official Statement or the validity or due adoption of the Bond Resolution or the validity, due authorization and execution of the Bonds, this Bond Purchase Agreement or any agreement or instrument to which the Issuer is a party and which is used or contemplated for use in the consummation of the transaction contemplated hereby or by the Official Statement, except as disclosed in the Official Statement;

d. The authorization, execution and delivery by the Issuer of the Official Statement, this Bond Purchase Agreement, and the other documents contemplated hereby and by the Official Statement, and compliance by the Issuer with the provisions of such instruments, do not and will not conflict with or constitute on the part of the Issuer a breach of or a default under any (i) statute, indenture, ordinance, resolution, mortgage or other agreement by which the Issuer is bound; (ii) provisions of the Louisiana Constitution of 1974, as amended; or (iii) existing law, court or administrative regulation, decree or order by which the Issuer or its properties are or, on the date of Closing, will be bound;

e. All consents of and notices to or filings with governmental authorities necessary for the consummation by the Issuer of the transactions described in the Official Statement, the Bond Resolution, and this Bond Purchase Agreement (other than such consents, notices and filings, if any, as may be required under the securities or blue sky laws of any federal or state jurisdiction) required to be obtained or made have been obtained or made or will be obtained or made prior to delivery of the Bonds;

f. The Issuer agrees to cooperate with the Underwriter and its counsel in any endeavor to qualify the Bonds for offering and sale under the securities or blue sky laws of such jurisdictions of the United States as the Underwriter may reasonably request; provided, however, that the Issuer shall not be required to register as a dealer or a broker in any such state or jurisdiction, qualify as a foreign corporation or file any general or specific consents to service of process under the laws of any state, or submit to the general jurisdiction of any state. The Issuer consents to the lawful use of the Preliminary Official Statement and the Official Statement by the Underwriter in obtaining such qualifications. No member of the Governing Authority, or any officer, employee or agent of the Issuer shall be individually liable for the breach of any representation or covenant made by the Issuer; and